2 Brand New MA VA Form 40 DOC Luzernecounty

What is the 2 Brand New MA VA Form 40 doc Luzernecounty

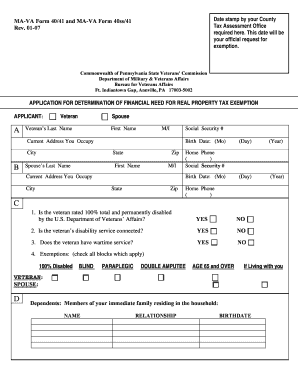

The 2 Brand New MA VA Form 40 doc Luzernecounty is a specific tax form used for various purposes, including reporting income and claiming deductions. This form is essential for individuals and businesses operating within Luzerne County, as it ensures compliance with local tax regulations. Understanding its purpose is crucial for accurate tax reporting and avoiding potential penalties.

Steps to complete the 2 Brand New MA VA Form 40 doc Luzernecounty

Completing the 2 Brand New MA VA Form 40 doc Luzernecounty involves several key steps:

- Gather all necessary personal and financial information, including income statements and deduction records.

- Carefully read the instructions provided with the form to understand each section's requirements.

- Fill out the form accurately, ensuring that all information is complete and truthful.

- Review the completed form for any errors or omissions before submission.

- Submit the form through the designated method, whether online, by mail, or in person.

Legal use of the 2 Brand New MA VA Form 40 doc Luzernecounty

The legal use of the 2 Brand New MA VA Form 40 doc Luzernecounty is governed by specific regulations that ensure its validity. For the form to be considered legally binding, it must be filled out correctly and submitted by the appropriate deadlines. Compliance with local tax laws is essential to avoid any legal repercussions, including fines or audits.

Filing Deadlines / Important Dates

Understanding filing deadlines for the 2 Brand New MA VA Form 40 doc Luzernecounty is crucial for timely submissions. Typically, forms must be filed by April 15 of each year, but specific dates may vary based on local regulations. It is important to stay informed about any changes to these deadlines to ensure compliance and avoid late fees.

Required Documents

To complete the 2 Brand New MA VA Form 40 doc Luzernecounty, several documents are required:

- Income statements, such as W-2s or 1099s.

- Records of any deductions you plan to claim, including receipts and invoices.

- Identification information, such as Social Security numbers.

Who Issues the Form

The 2 Brand New MA VA Form 40 doc Luzernecounty is issued by the local tax authority in Luzerne County. This authority is responsible for ensuring that all tax forms meet legal requirements and provide the necessary information for tax assessment and collection. Keeping up to date with any announcements from this office can help taxpayers stay informed about any changes to the form or its requirements.

Quick guide on how to complete 2 brand new ma va form 40doc luzernecounty

Complete 2 Brand New MA VA Form 40 doc Luzernecounty effortlessly on any device

Online document management has become a favorite among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents promptly without any delays. Manage 2 Brand New MA VA Form 40 doc Luzernecounty on any device using airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to alter and eSign 2 Brand New MA VA Form 40 doc Luzernecounty with ease

- Obtain 2 Brand New MA VA Form 40 doc Luzernecounty and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from any device of your preference. Modify and eSign 2 Brand New MA VA Form 40 doc Luzernecounty to ensure excellent communication at any phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how can it help with tax service?

airSlate SignNow is an easy-to-use platform that empowers businesses to send and eSign documents seamlessly. When it comes to tax service, our platform streamlines the process, ensuring that you can quickly manage and sign important tax documents, saving time and reducing errors.

-

How much does airSlate SignNow cost for tax service users?

Our pricing for airSlate SignNow is designed to be cost-effective, with various plans to suit your business needs. Depending on the features you require for your tax service, you can choose from flexible subscription options that provide great value for managing and signing all your tax-related documents.

-

What features does airSlate SignNow offer for tax service?

airSlate SignNow offers a range of features ideal for tax service, including document templates, eSigning, and secure storage. The easy-to-navigate interface allows users to prepare, send, and receive signed tax documents efficiently, ensuring compliance and ease of use.

-

Is airSlate SignNow compliant with tax regulations?

Yes, airSlate SignNow is designed to be compliant with various tax regulations, ensuring that your signed documents hold up in any legal context. Our commitment to security and compliance makes it a trustworthy solution for all your tax service needs.

-

Can airSlate SignNow integrate with other tools I use for tax service?

Absolutely! airSlate SignNow offers integration capabilities with various popular accounting and tax software. This allows you to streamline your workflow and efficiently manage your tax service processes without any hassle.

-

How does airSlate SignNow enhance the efficiency of my tax service?

By using airSlate SignNow, you can enhance the efficiency of your tax service through automated workflows and quick eSigning processes. This not only saves time but also minimizes the chances of errors associated with manual handling of tax documents.

-

What benefits does airSlate SignNow provide for businesses handling tax service?

With airSlate SignNow, businesses handling tax service will enjoy benefits such as improved document turnaround time and enhanced security for sensitive information. Our cost-effective solution enables companies to focus more on their core activities while we handle their eSigning needs.

Get more for 2 Brand New MA VA Form 40 doc Luzernecounty

- Blue cross blue shield away from home care guest membership application form

- Dc police clearance form

- Ngo intake form

- Audiology case history examples form

- Death certificate request letter in kannada form

- Vf 14 qol questionnaire form

- Dir2 form download

- School of computer engineering in singapore and developed by associate professor kwoh chee keong form

Find out other 2 Brand New MA VA Form 40 doc Luzernecounty

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter