Cleaning Business Expenses Spreadsheet Form

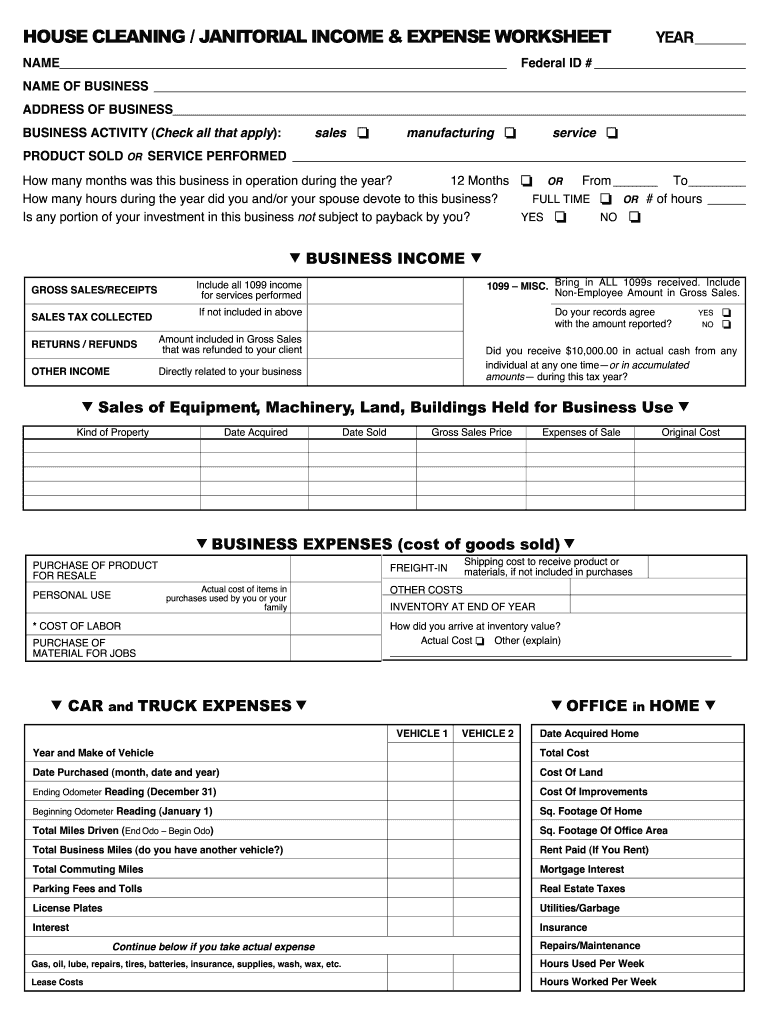

What is the janitorial worksheet?

The janitorial worksheet is a structured document designed to help cleaning businesses track their expenses and manage their financial records effectively. This worksheet typically includes various categories of expenses, such as supplies, labor, and equipment costs, allowing business owners to gain a clear overview of their financial situation. By utilizing a janitorial worksheet, cleaning service providers can streamline their accounting processes and ensure they maintain accurate records for tax purposes.

How to use the janitorial worksheet

Using the janitorial worksheet involves several straightforward steps. First, identify all relevant expense categories, such as cleaning supplies, maintenance costs, and employee wages. Next, input the amounts spent in each category on a monthly or weekly basis. Regularly updating the worksheet ensures that all expenses are documented and can be reviewed easily. This practice not only aids in budgeting but also prepares the business for any financial audits or tax filings.

Key elements of the janitorial worksheet

A comprehensive janitorial worksheet should include essential elements such as:

- Date: The date when the expense was incurred.

- Expense Category: Classification of the expense (e.g., supplies, labor).

- Description: A brief description of the item or service purchased.

- Amount: The total cost of the expense.

- Payment Method: How the expense was paid (e.g., cash, credit card).

Incorporating these elements ensures that the worksheet is both functional and informative, providing a clear financial picture of the cleaning business.

Steps to complete the janitorial worksheet

Completing the janitorial worksheet involves a systematic approach:

- Gather Receipts: Collect all receipts and invoices related to cleaning expenses.

- Input Data: Enter the relevant information into the worksheet, ensuring accuracy in amounts and categories.

- Review Entries: Double-check all entries for completeness and correctness.

- Calculate Totals: Sum up the expenses in each category to understand overall spending.

- Save and Backup: Regularly save the worksheet and consider backing it up to prevent data loss.

Following these steps will help maintain an organized financial record for the cleaning business.

Legal use of the janitorial worksheet

The janitorial worksheet serves as a valuable tool for maintaining compliance with financial regulations. It can be used to substantiate claims during tax filings, ensuring that all business expenses are documented and legitimate. By keeping accurate records, cleaning business owners can avoid potential legal issues related to misreporting income or expenses. Additionally, the worksheet can support claims for deductions, helping to reduce taxable income.

Examples of using the janitorial worksheet

Practical examples of utilizing the janitorial worksheet include:

- Tracking monthly cleaning supply expenses to identify trends and adjust budgets accordingly.

- Documenting labor costs to evaluate the profitability of different cleaning contracts.

- Analyzing equipment maintenance expenses to determine when to replace or upgrade tools.

These examples illustrate how the janitorial worksheet can enhance financial decision-making and operational efficiency within a cleaning business.

Quick guide on how to complete cleaning business expenses spreadsheet

Complete Cleaning Business Expenses Spreadsheet effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Cleaning Business Expenses Spreadsheet on any device using airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to alter and electronically sign Cleaning Business Expenses Spreadsheet with ease

- Obtain Cleaning Business Expenses Spreadsheet and click Get Form to begin.

- Take advantage of the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you wish to send your form, either by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in a few clicks from a device of your choosing. Edit and electronically sign Cleaning Business Expenses Spreadsheet and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a janitorial worksheet?

A janitorial worksheet is a vital tool that helps cleaning services track and manage their tasks efficiently. It outlines the responsibilities of janitorial staff and provides a comprehensive record of cleaning activities. With airSlate SignNow, you can create, send, and eSign your janitorial worksheet effortlessly.

-

How can a janitorial worksheet benefit my cleaning business?

Utilizing a janitorial worksheet streamlines the cleaning process by clearly outlining tasks and responsibilities. This organization improves accountability and can enhance service quality. By integrating airSlate SignNow, your team can ensure that each janitorial worksheet is signed by staff, confirming that tasks have been completed as required.

-

Can I customize my janitorial worksheet templates in airSlate SignNow?

Yes, airSlate SignNow allows you to easily customize your janitorial worksheet templates to suit your specific business needs. You can add fields, modify layouts, and tailor content to reflect your cleaning protocols. This flexibility ensures that your janitorial worksheet aligns with your operational requirements.

-

Is airSlate SignNow cost-effective for small cleaning businesses?

Absolutely! airSlate SignNow offers affordable pricing plans tailored for businesses of all sizes, including small cleaning companies. By choosing our service, you can optimize your janitorial worksheet management without exceeding your budget, enabling your business to grow sustainably.

-

What features does airSlate SignNow provide for managing janitorial worksheets?

airSlate SignNow boasts several features designed for effective management of janitorial worksheets, including eSigning, document tracking, and seamless sharing capabilities. These features simplify communication and monitoring for cleaning teams. Leveraging these tools can greatly enhance your operational efficiency.

-

How do I integrate airSlate SignNow with other software I use?

Integrating airSlate SignNow with your existing software systems is straightforward, thanks to its compatibility with various platforms. You can easily sync your janitorial worksheet data with project management tools and CRMs. This integration helps maintain a unified workflow across your business operations.

-

What is the process for eSigning a janitorial worksheet?

To eSign a janitorial worksheet using airSlate SignNow, simply upload the document, add the necessary fields for signatures, and send it to the relevant parties. Recipients can access the worksheet from any device to review and sign it online. This process simplifies approvals and enhances document security.

Get more for Cleaning Business Expenses Spreadsheet

- Replacement license plate indiana form

- Integrated chinese level 2 part 2 pdf form

- Formulario 0020 fundempresa pdf

- Missing receipt form

- Nutribody form

- Bill of rights worksheet answers form

- Clets001confidential information for law enforceme

- Wisconsin medicaid for the elderly blind or disabled application packet form

Find out other Cleaning Business Expenses Spreadsheet

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease