Capital Gift Letter Form

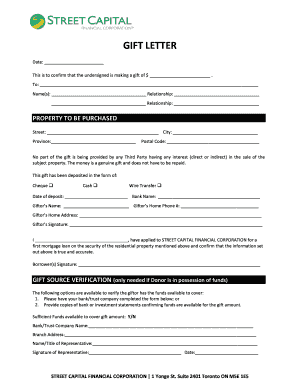

What is the street gift letter?

The street gift letter is a formal document that outlines the details of a financial gift made from one individual to another. This letter serves as a record of the transaction and is often used for tax purposes. It typically includes information such as the names of the giver and recipient, the amount of the gift, and the date it was given. Understanding the purpose and structure of this letter is crucial for both parties involved, as it can help clarify the intent behind the gift and ensure compliance with tax regulations.

How to use the street gift letter

Using the street gift letter involves several key steps. First, the giver should clearly state the intent to make a gift, ensuring that the recipient understands that the funds are a gift and not a loan. Next, both parties should sign the letter to acknowledge the transaction. It is advisable to keep a copy of the letter for personal records, as it may be required for tax filings or in case of future disputes. This letter can also be used to support any claims made on tax returns regarding gift exclusions or deductions.

Steps to complete the street gift letter

Completing a street gift letter requires careful attention to detail. Follow these steps to ensure accuracy:

- Begin with the date of the letter.

- Clearly identify the giver and recipient, including full names and addresses.

- State the amount of the gift and any specific conditions attached to it.

- Include a statement confirming that the gift is made voluntarily and without expectation of repayment.

- Sign and date the letter by both the giver and recipient.

By following these steps, you can create a comprehensive street gift letter that serves its intended purpose effectively.

Legal use of the street gift letter

The street gift letter has legal implications, particularly concerning taxation. In the United States, gifts exceeding a certain value may be subject to gift tax regulations. The IRS requires that gifts above the annual exclusion limit be reported. A properly executed street gift letter can serve as evidence that a gift was made, helping to establish the giver's intent and protect both parties in case of audits or disputes. It is essential to understand the legal framework surrounding gifts to ensure compliance with federal and state laws.

Key elements of the street gift letter

To ensure the street gift letter is effective, it should include several key elements:

- Giver's Information: Full name and address of the person giving the gift.

- Recipient's Information: Full name and address of the person receiving the gift.

- Gift Amount: Clearly state the monetary value of the gift.

- Date of Gift: The date on which the gift is made.

- Intent Statement: A declaration that the gift is made voluntarily and without conditions.

- Signatures: Signatures of both the giver and recipient to validate the transaction.

Incorporating these elements ensures that the street gift letter is comprehensive and legally sound.

IRS Guidelines

The IRS provides specific guidelines regarding the taxation of gifts, which are essential to understand when preparing a street gift letter. Gifts are generally not taxable to the recipient, but the giver may need to file a gift tax return if the gift exceeds the annual exclusion limit. For 2023, this limit is set at a specific amount, which can change annually. It is important to consult the IRS guidelines or a tax professional to ensure compliance and avoid potential penalties.

Quick guide on how to complete capital gift letter

Accomplish Capital Gift Letter seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly and without delays. Manage Capital Gift Letter on any device using airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to modify and eSign Capital Gift Letter effortlessly

- Obtain Capital Gift Letter and click on Acquire Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or mask sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just a few seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Finished button to save your changes.

- Choose your method for delivering your form, whether by email, SMS, or a link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Capital Gift Letter to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a street gift letter?

A street gift letter is a legal document that outlines a gift of property or assets made without any exchange of money or services. It is important for documenting the transfer for future reference and tax purposes. With airSlate SignNow, you can easily create, eSign, and manage your street gift letters in a secure environment.

-

How does airSlate SignNow facilitate the creation of a street gift letter?

airSlate SignNow provides customizable templates that allow you to quickly generate a street gift letter tailored to your specific needs. The platform's user-friendly interface ensures that anyone can create a professional document in minutes. This streamlined process helps save time and reduces the chance of errors.

-

Is there a cost associated with using airSlate SignNow for my street gift letter?

Yes, airSlate SignNow offers a range of pricing plans to fit various business needs and budgets. Whether you're a small business or a larger enterprise, you can find a suitable option that allows you to create and eSign street gift letters efficiently. Check out our pricing page for more details on the different plans available.

-

What benefits does airSlate SignNow offer for managing street gift letters?

Using airSlate SignNow for your street gift letter provides numerous benefits, including secure document storage, easy collaboration with multiple signees, and tracking of document statuses. The platform also ensures compliance with legal standards, giving you peace of mind when handling important legal documents. Moreover, eSigning eliminates the need for printing and mailing, making the process more efficient.

-

Can I integrate airSlate SignNow with other software for handling street gift letters?

Absolutely! airSlate SignNow offers robust integrations with various software, including CRM systems and cloud storage services. This allows you to seamlessly manage your street gift letters alongside your other business operations. Check our integrations page to see the full list of compatible applications.

-

What security features does airSlate SignNow have for my street gift letter?

airSlate SignNow prioritizes the security of your documents, including street gift letters, by employing bank-level encryption and secure servers. Additionally, the platform complies with all necessary regulations to keep your data safe. You can manage access controls and permissions to ensure that only authorized users can view or edit your documents.

-

How can I share my street gift letter after signing?

Once your street gift letter is signed on airSlate SignNow, you can easily share it via email or generate a secure link to distribute to others. The platform allows you to manage the sharing settings, ensuring only the intended recipients have access. This feature enhances collaboration while maintaining security and confidentiality.

Get more for Capital Gift Letter

Find out other Capital Gift Letter

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure