Fillable FORM 720 V I

What is the Fillable FORM 720 V I

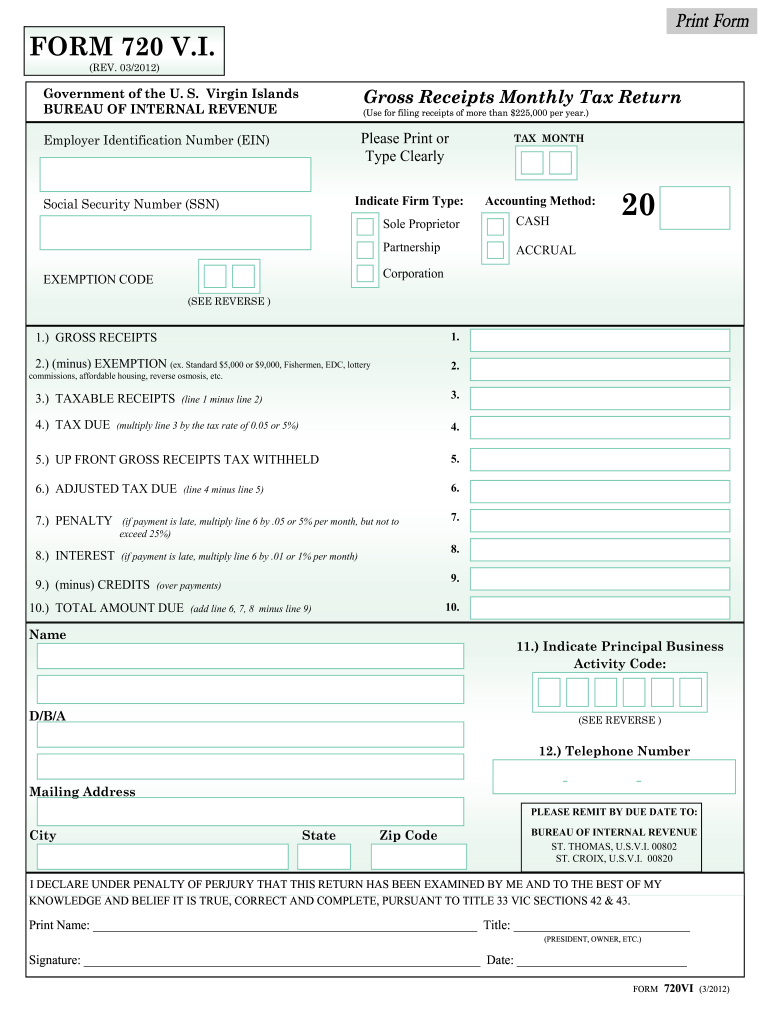

The Fillable FORM 720 V I is a specific document used for reporting and paying certain taxes in the United States. This form is primarily utilized by individuals and businesses to report various tax liabilities, including those related to specific transactions or activities. It is essential for ensuring compliance with IRS regulations and for maintaining accurate financial records.

How to use the Fillable FORM 720 V I

Using the Fillable FORM 720 V I involves several steps to ensure accurate completion and submission. First, gather all necessary information, such as your tax identification number and details related to the specific tax being reported. Next, fill out the form electronically, ensuring all fields are completed accurately. After completing the form, review it for any errors before submitting it to the appropriate tax authority.

Steps to complete the Fillable FORM 720 V I

Completing the Fillable FORM 720 V I requires careful attention to detail. Follow these steps for a smooth process:

- Download the fillable form from a reliable source.

- Open the form using compatible software that supports fillable PDFs.

- Enter your personal and financial information as required.

- Double-check all entries for accuracy.

- Save the completed form to your device.

- Submit the form according to the guidelines provided by the IRS.

Legal use of the Fillable FORM 720 V I

The Fillable FORM 720 V I is legally binding when filled out and submitted according to IRS regulations. It is crucial to ensure that all information provided is truthful and accurate to avoid potential legal issues. The form must be signed electronically or physically, depending on the submission method, to validate its contents. Compliance with all relevant tax laws is essential for the legal acceptance of this form.

Filing Deadlines / Important Dates

Filing deadlines for the Fillable FORM 720 V I vary based on the specific tax obligations it addresses. Typically, it is important to submit the form by the designated due date to avoid penalties. Taxpayers should be aware of any changes in deadlines that may occur annually and plan accordingly. Keeping a calendar of important tax dates can help ensure timely submissions.

Form Submission Methods (Online / Mail / In-Person)

The Fillable FORM 720 V I can be submitted through various methods, including online submission, mailing, or in-person delivery. Online submission is often the most efficient option, allowing for immediate processing. If choosing to mail the form, ensure it is sent to the correct address and consider using a trackable mailing option. In-person submission may be necessary in specific cases, depending on the requirements set by the IRS.

Quick guide on how to complete fillable form 720 vi

Effortlessly Prepare Fillable FORM 720 V I on Any Device

The management of online documents has gained traction among both companies and individuals. It offers an excellent environmentally-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly, without any delays. Handle Fillable FORM 720 V I on any platform using the airSlate SignNow applications for Android or iOS, and simplify any document-related task today.

How to Modify and Electronically Sign Fillable FORM 720 V I with Ease

- Find Fillable FORM 720 V I and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes just a few seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for submitting your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign Fillable FORM 720 V I to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Fillable FORM 720 V I?

The Fillable FORM 720 V I is a standardized document designed for various tax-related applications. It simplifies the process of filling out and submitting tax information, ensuring compliance with regulations. Utilizing a fillable format enhances user experience by allowing easy data entry and edits.

-

How can I access the Fillable FORM 720 V I?

You can easily access the Fillable FORM 720 V I directly on the airSlate SignNow platform. Simply navigate to the forms section and search for the document to begin filling it out. Registration is required to save and securely send your completed form.

-

Is there a cost associated with using the Fillable FORM 720 V I?

airSlate SignNow offers competitive pricing plans that include access to the Fillable FORM 720 V I. You can choose a subscription model that best fits your business needs, with options for monthly or annual billing. Check our pricing page for specific details on what is included.

-

What features does the Fillable FORM 720 V I offer?

The Fillable FORM 720 V I includes features such as auto-saving your progress, easy editing options, and the ability to add electronic signatures. It helps streamline document workflows by enabling users to fill out and send forms securely. These features enhance productivity and reduce errors.

-

Can I integrate the Fillable FORM 720 V I with other software?

Yes, airSlate SignNow allows you to integrate the Fillable FORM 720 V I with various applications and platforms. This functionality improves your document management processes by linking form submissions to your existing workflows. Popular integrations include CRM systems and accounting software.

-

How does the Fillable FORM 720 V I benefit my business?

Using the Fillable FORM 720 V I can signNowly streamline your tax filing process, saving time and reducing errors. This tool promotes compliance with tax regulations, ensuring your submissions are accurate and timely. Moreover, it creates an organized digital record of your essential documents.

-

Is the Fillable FORM 720 V I secure?

Absolutely, the Fillable FORM 720 V I on airSlate SignNow is designed with security in mind. Our platform utilizes advanced encryption protocols to protect your data, ensuring that all information remains confidential and secure. Compliance with industry standards further guarantees your peace of mind.

Get more for Fillable FORM 720 V I

Find out other Fillable FORM 720 V I

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself

- How Can I Electronic signature Texas Electronic Contract

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile