Oregon Business Change in Status Form

What is the Oregon Business Change In Status Form

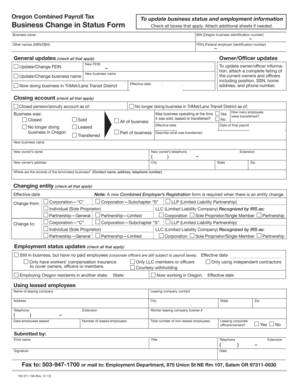

The Oregon Business Change In Status Form is a crucial document used by businesses to report significant changes in their operational status. This form is necessary for various reasons, such as altering the business structure, updating ownership details, or changing the business name. Filing this form ensures that the state has up-to-date information about the business, which is essential for compliance with state regulations.

How to use the Oregon Business Change In Status Form

Using the Oregon Business Change In Status Form involves several steps to ensure accurate completion. First, download the form from the appropriate state website or obtain a physical copy. Next, fill out the required fields, providing detailed information about the changes being made. It is important to review the form thoroughly for accuracy before submission. Finally, submit the completed form through the designated method, whether online, by mail, or in person.

Steps to complete the Oregon Business Change In Status Form

Completing the Oregon Business Change In Status Form requires careful attention to detail. Follow these steps for a smooth process:

- Download or request the form from the Oregon Secretary of State's office.

- Fill in the business identification information, including the business name and registration number.

- Specify the type of change being reported, such as a change in ownership or business structure.

- Provide any additional documentation that supports the changes, if required.

- Review the form for completeness and accuracy.

- Submit the form through the chosen submission method.

Legal use of the Oregon Business Change In Status Form

The Oregon Business Change In Status Form is legally binding when filled out and submitted correctly. It complies with state regulations governing business operations. To ensure its legal standing, businesses must adhere to all relevant laws, including providing accurate information and submitting the form within required timeframes. This compliance helps avoid potential penalties and ensures that the business remains in good standing with state authorities.

Key elements of the Oregon Business Change In Status Form

Several key elements must be included in the Oregon Business Change In Status Form for it to be valid:

- Business name and registration number

- Type of business entity

- Description of the changes being made

- Contact information for the business owner or authorized representative

- Signature of the person completing the form

Required Documents

When submitting the Oregon Business Change In Status Form, certain documents may be required to support the changes being reported. These may include:

- Proof of identity for the business owner or authorized signatory

- Supporting documents that validate the changes, such as amendments to operating agreements or partnership agreements

- Any applicable fees that accompany the submission

Quick guide on how to complete oregon business change in status form 100331588

Complete Oregon Business Change In Status Form effortlessly on any gadget

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly option to traditional printed and signed documents, as you can easily access the correct format and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your files quickly without delays. Manage Oregon Business Change In Status Form on any device with airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to edit and eSign Oregon Business Change In Status Form with ease

- Obtain Oregon Business Change In Status Form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark relevant sections of the documents or hide sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and has the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your selection. Edit and eSign Oregon Business Change In Status Form and ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Oregon business change in status form?

The Oregon business change in status form is a document required to notify the state about changes in your business's status, such as ownership changes, address updates, or business type modifications. Completing this form correctly ensures your business remains compliant with state regulations.

-

How can airSlate SignNow help with the Oregon business change in status form?

airSlate SignNow offers a streamlined way to complete, send, and eSign the Oregon business change in status form. Our platform simplifies the process, ensuring that your documents are legally binding and securely stored.

-

Is there a cost associated with using airSlate SignNow for the Oregon business change in status form?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. Our cost-effective solutions allow you to manage documents like the Oregon business change in status form easily without breaking the bank.

-

What features does airSlate SignNow provide for handling the Oregon business change in status form?

With airSlate SignNow, you can eSign documents, track changes, and send reminders. These features ensure that your Oregon business change in status form is processed quickly and efficiently, reducing the time needed for management.

-

Are there any integrations available with airSlate SignNow?

airSlate SignNow integrates with many popular applications, including Google Drive, Salesforce, and more. This allows for seamless document management and makes it easier to fill out the Oregon business change in status form in conjunction with other essential tools.

-

What are the benefits of using airSlate SignNow for document management?

Using airSlate SignNow for document management provides you with enhanced security, reduced turnaround times, and improved compliance. Specifically for the Oregon business change in status form, the platform ensures accuracy and efficiency in your submissions.

-

Can I complete the Oregon business change in status form on my mobile device?

Yes, airSlate SignNow is mobile-friendly, enabling you to complete the Oregon business change in status form on the go. Our intuitive mobile app makes eSigning and document management convenient from anywhere.

Get more for Oregon Business Change In Status Form

Find out other Oregon Business Change In Status Form

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe