1040 Ez Form

What is the 1040 EZ Form

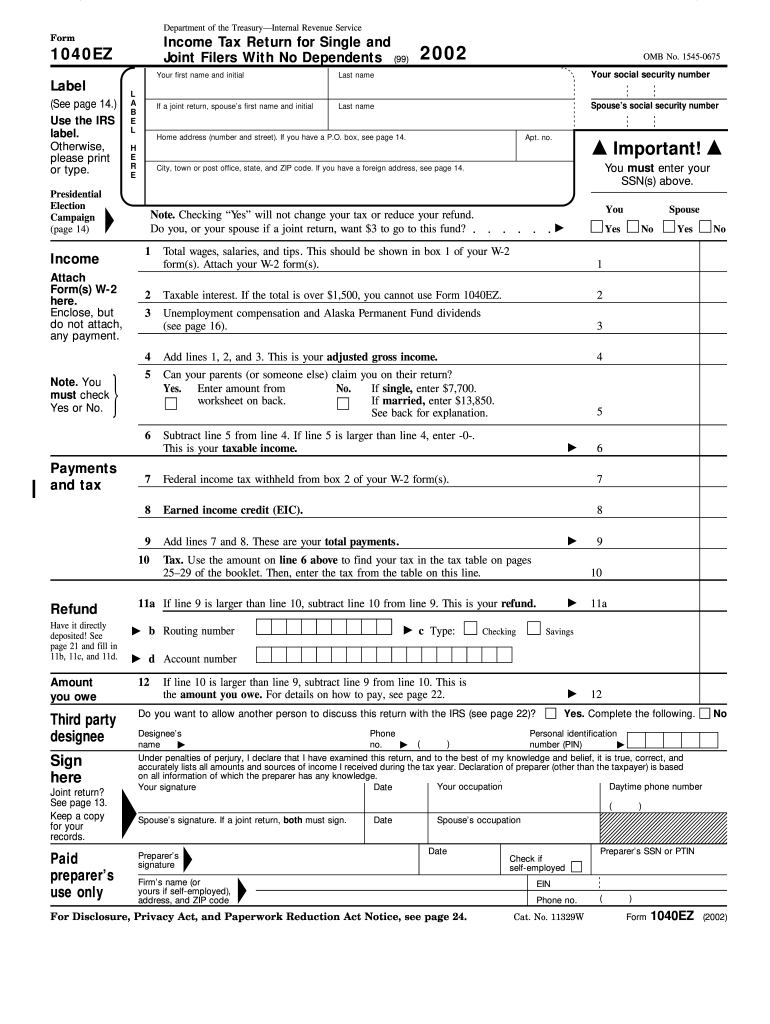

The 1040 EZ form is a simplified version of the standard Form 1040, designed for individuals who meet specific eligibility criteria. It is primarily used for filing federal income tax returns in the United States. This form is ideal for those with straightforward tax situations, such as single filers or married couples filing jointly, who do not have dependents and earn less than a certain income threshold. The 1040 EZ form allows taxpayers to report their income, claim the standard deduction, and calculate their tax liability in a streamlined manner.

How to use the 1040 EZ Form

Using the 1040 EZ form involves several straightforward steps. First, gather all necessary financial documents, such as W-2 forms from employers and any other income statements. Next, fill out the form by providing personal information, including your name, address, and Social Security number. Report your income and any applicable adjustments. After completing the form, calculate your tax liability and any refund or amount owed. Finally, sign and date the form before submitting it to the IRS either electronically or by mail.

Steps to complete the 1040 EZ Form

Completing the 1040 EZ form requires attention to detail. Follow these steps:

- Gather all necessary documents, including W-2s and other income records.

- Provide your personal information, including your filing status and Social Security number.

- Report your total income from all sources.

- Claim the standard deduction applicable to your filing status.

- Calculate your total tax liability based on the IRS tax tables.

- Determine if you are owed a refund or if you owe additional taxes.

- Sign and date the form before submission.

Legal use of the 1040 EZ Form

The 1040 EZ form is legally binding when completed accurately and submitted according to IRS guidelines. It is essential to ensure that all information provided is truthful and complete, as inaccuracies can lead to penalties or audits. The form must be filed by the designated deadline to avoid late fees. Additionally, using a reliable eSignature solution can enhance the legal standing of the submitted form, ensuring that it meets all electronic filing requirements.

Eligibility Criteria

To qualify for using the 1040 EZ form, taxpayers must meet specific criteria. Eligible individuals include those who:

- Have a taxable income of less than $100,000.

- Are single or married filing jointly.

- Do not claim dependents.

- Do not have income from sources such as self-employment, rental properties, or capital gains.

Meeting these criteria allows taxpayers to take advantage of the simplified filing process offered by the 1040 EZ form.

Filing Deadlines / Important Dates

Filing deadlines for the 1040 EZ form align with the standard deadlines for federal income tax returns. Typically, the deadline to file is April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers can also request an extension to file, but any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Quick guide on how to complete 1040 ez form

Accomplish 1040 Ez Form effortlessly on any device

Digital document management has become increasingly favored by corporations and individuals alike. It serves as an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage 1040 Ez Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

How to modify and eSign 1040 Ez Form seamlessly

- Obtain 1040 Ez Form and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Select key sections of your documents or obscure sensitive data with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your preference. Modify and eSign 1040 Ez Form to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

Why don't high schools teach students how to prepare a basic income tax return? Or at least, why don't they inform students about income taxes?

I see other answers here saying that they do teach their kids explicitly how to do taxes. I don’t.Why?Most kids don’t find it that interesting, and don’t retain much of what we teach.This is often the answer to “why don’t schools teach us stuff we can use?” Many well intentioned teachers try to instill real-world skills into their students, but students don’t usually find it engaging, and most forget it by the time it comes to use it.It’s because stuff doesn’t feel relevant… until it’s relevant. Once you realize you need the information, you suddenly become motivated, and you learn it fairly quickly (as long as you possess the prerequisite skills, more on this later.)It’s not that we shouldn’t try to teach relevant skills, but to actually add educational value, it needs to be skills that students are interested in picking up.Doing your taxes ISN’T THAT DAMN HARD.Seriously. It’s not.Time consuming? Yes. Frustrating, it can be. Annoying the other 364 days where you had to keep careful records? Sure.But actually doing taxes is not that bad unless you are a small business owner.You get your (sometimes free) tax software and answer all the questions and fill in appropriate boxes.It’s so easy that…Parents could teach their kids in an afternoon.We’re supposed to be teaching your kids the stuff that takes lots of time, or that you can’t.Teach your kids to cook.Teach your kids to fold laundry.Teach your kids to do their taxes.They’ll learn it better from you anyway. We don’t have time for that.Yes, I understand that not everyone comes from a good home, but we don’t have time to teach all life skills in the classroom.Teaching kids how to do taxes isn’t financial literacy.Oh, I definitely teach exponential growth, and the danger of high interest loans and credit cards. I try to instill numeracy. We talk a little about budgeting, saving, and investing.But teaching kids how to fill out a form is not preparing them to handle their finances.Tax law changes constantly. Anything we teach will be obsolete in 5 years.We teach students enough material that will be obsolete. No need to add to the list.And finally…We give students all the prerequisite skills to do their taxes.Math classes are constantly:asking students to take percentagestransferring numbers from here to thereoptimization problems (how can I get the biggest return)forcing students to follow specific directions for complicated processesMath is abstract. We don’t cover all possible applications. But we try to prepare students for anything by exposing students to lots of potential applications.We’ve got a lot to teach. We also provide specific financial math classes if students want to take them.Please just let me teach Algebra.

-

How do I fill out my FAFSA?

The FAFSA isn't as scary as it seems, but it's helpful to have the documents you'll need handy before you fill it out. It's available starting January 1 of the year you'll attend school, and it's best to complete it as early as possible so you get the most aid you'll qualify for. Be especially mindful of school and state deadlines that are earlier than the federal deadline of June 2017. Check out NerdWallet's 5 Hacks to Save Time on Your 2016 FAFSA. These are the basic steps: Gather the documents you'll need to complete the form by following this checklist.Log in to the FAFSA with your Federal Student Aid ID. You'll need an FSA ID to sign and submit the form electronically, and your parent will need one too if you're a dependent student. Create one here. Follow the prompts to fill out the FAFSA. This guide will help you fill it out according to your family situation. You'll be able to save time by importing income information from the IRS starting Feb. 7, 2016. Many families don't file their 2015 income taxes until closer to the deadline of April 18. But it's a good idea to fill out your FAFSA earlier than that. Use your parents' 2014 tax information to estimate their income, then go back in and update your FAFSA using the IRS Data Retrieval Tool once they've filed their taxes. More info here: Filling Out the FAFSA.

-

How do I fill out FAFSA without my kid seeing all my financial information?

You will have a FSA ID. Keep it somewhere secure and where you can find it when it is needed again over the time your kid is in college. Use this ID to “sign” the parent’s part of the FAFSA.Your student will have their own FSA ID. They need to keep it somewhere secure and where they can find it when it is needed again over the time they are in college. They will use the ID to “sign” their part of the FAFSA.There is no need to show your student your part of the FAFSA. I do suggest you just casually offer to help your student fill out their part of the form.The Parent’s Guide to Filling Out the FAFSA® Form - ED.gov BlogThe FAFSA for school year 2018–19 has been available since October 1. Some financial aid is first come-first served. I suggest you get on with this.How to Fill Out the FAFSA, Step by StepNotes:Reading the other answers brings up some other points:The student pin was replaced by the parent’s FSA ID and the student’s FSA ID in May, 2015. Never the twain need meet.Families each need to deal with three issues in their own way:AffordabilityIf you read my stuff you know I am a devotee of Frank Palmasani’s, Right College, Right Price. His book describes an “affordability” exercise with the parents and the student. The purpose is to determine what the family can afford to spend on post-secondary education and to SET EXPECTATIONS. He’s not talking about putting your 1040 on the dining room table, but sharing some of the basics of family finances.I get the impression that many families ignore this issue. I have a study that shows five out of eight students assume their families are going to pay for college regardless of cost. Most of these students are in for a big surprise.PrivacySome parents may want to hold their “financial cards” closer to their chest than others. In my opinion that’s OK. I suppose an 18 year old kid, theoretically, has the right to keeping his finances private. My approach to this would not be to make a big deal out of it but to offer to help them fill out their part of the FAFSA. The main objective should be to get the FAFSA filled out properly, in a timely fashion.FraudThis is absolutely not acceptable, and, hopefully, those who try it get caught and suffer the consequences. (I had a conversation with a father recently who was filling out the CSS Profile. He wasn’t intent on committing fraud. He thought he was being clever in defining assets. After our conversation he had to file a signNow revision. This revision was a good thing because two or three years from now his mistake was going to come to light. I’m not sure what the consequences of all that would have been, but, at a minimum, it would have been a big mess to unwind.)

-

How do I claim a tax refund? I just started a new job and I am paying taxes, but I don't meet the wage requirements needed to be taxed. I want to claim it back, how do I do this?

Without knowing what country you are in, there is no way to really know. Assuming you are in the U.S. there are two ways for you to do this. One is to fill out a 1040ez form, which is as easy and basic as it gets. Should not take you more than 10 minutes to fill out, and there are services on College Campuses that will help you fill them out for free.Another way is to fill out the W2 form and claim 20 or 30 exemptions. Do that and they will not withhold anything from the money you earn. I believe you will still have to fill out the 1040 ez, but it is now simple, and you will get nothing back because you paid nothing. Don’t forget to file with your state income tax office. There’s more money waiting for you there, too.

-

How do you fill out a 1040EZ tax form?

The instructions are available here 1040EZ (2014)

-

I am an F1 Visa student and received both W2 and 1099 MISC form. Can I sum both of these incomes and fill it in Line 3 of 1040 NR-EZ form?

Form 1040NR-EZ may be used by a nonresident alien if the person’s only U.S.-source income was from wages, salaries, tips, refunds of state and local income taxes, scholarship or fellowship grants, and nontaxable interest or dividends.If the person had income from another source, such as nonemployee compensation reported on box 7 of Form 1099-MISC, then Form 1040NR should be used instead.See the instructions to Form 1040NR-EZ for more information. See a tax professional for advice.https://www.irs.gov/pub/irs-pdf/...

-

What is Form 1040/A/EZ/NR/NR-EZ? Is it different from Form 1040NR?

Yes. Each form is different and should be filed based on your residency status. For more information, please do deep dive into IRS website. Each has its own significance.

-

Which forms do I fill out for taxes in California? I have a DBA/sole proprietorship company with less than $1000 in profit. How many forms do I fill out? This is really overwhelming. Do I need to fill the Form 1040-ES? Did the deadline pass?

You need to file two tax returns- one Federal Tax Form and another California State income law.My answer to your questions are for Tax Year 2018The limitation date for tax year 15.04.2018Federal Tax return for Individual is Form 1040 . Since you are carrying on proprietorship business, you will need to fill the Schedule C in Form 1040Form 1040 -ES , as the name suggests is for paying estimated tax for the current year. This is not the actual tax return form. Please note that while Form 1040, which is the return form for individuals, relates to the previous year, the estimated tax form (Form 1040-EZ ) calculates taxes for the current year.As far as , the tax return under tax laws of Californa State is concerned, the Schedule CA (540) Form is to be used for filing state income tax return . You use your federal information (forms 1040) to fill out your 540 FormPrashanthttp://irstaxapp.com

Create this form in 5 minutes!

How to create an eSignature for the 1040 ez form

How to create an eSignature for the 1040 Ez Form in the online mode

How to generate an eSignature for your 1040 Ez Form in Chrome

How to make an eSignature for putting it on the 1040 Ez Form in Gmail

How to make an eSignature for the 1040 Ez Form right from your smart phone

How to generate an electronic signature for the 1040 Ez Form on iOS

How to create an eSignature for the 1040 Ez Form on Android OS

People also ask

-

What is the 1040 Ez Form and who should use it?

The 1040 Ez Form is a simplified version of the standard IRS Form 1040, designed for individuals with straightforward tax situations. It is ideal for those who are single or married filing jointly, have no dependents, and meet specific income criteria. Using the 1040 Ez Form can streamline your tax preparation process, making it quicker and easier.

-

How can airSlate SignNow assist with filling out the 1040 Ez Form?

airSlate SignNow provides an intuitive platform that allows users to fill out and eSign the 1040 Ez Form effortlessly. Our solution simplifies document management by enabling you to complete tax forms online, ensuring that your data is secure and easily accessible. With airSlate SignNow, you can focus more on your finances and less on paperwork.

-

Is there a cost associated with using airSlate SignNow for the 1040 Ez Form?

Yes, airSlate SignNow offers various pricing plans that cater to different user needs when handling forms like the 1040 Ez Form. Our plans are competitively priced, providing a cost-effective solution for businesses and individuals who require efficient document management. You can choose a plan that best suits your requirements without breaking the bank.

-

What features does airSlate SignNow offer for the 1040 Ez Form?

airSlate SignNow includes features such as easy document editing, electronic signatures, and secure cloud storage, all tailored for forms like the 1040 Ez Form. Our platform allows you to collaborate with others in real-time, ensuring that all parties can review and sign the document quickly. Additionally, our user-friendly interface means you can complete your tax forms with minimal hassle.

-

Can I integrate airSlate SignNow with other tools for the 1040 Ez Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications to enhance your experience when working with the 1040 Ez Form. Whether you use accounting software or other document management tools, our integrations ensure that you can streamline your workflow and improve efficiency.

-

What are the benefits of using airSlate SignNow for the 1040 Ez Form?

Using airSlate SignNow for the 1040 Ez Form offers numerous benefits, including faster processing times, increased accuracy, and the convenience of eSigning. Our platform eliminates the need for printing and mailing forms, allowing you to submit your tax documents electronically. This not only saves time but also contributes to a more environmentally friendly approach to tax filing.

-

Is airSlate SignNow secure for handling my 1040 Ez Form?

Yes, airSlate SignNow prioritizes security, ensuring that your 1040 Ez Form and other documents are protected with advanced encryption and compliance measures. We implement strict security protocols to safeguard your sensitive information during the entire signing process. You can trust our platform to keep your tax documents safe and secure.

Get more for 1040 Ez Form

Find out other 1040 Ez Form

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney