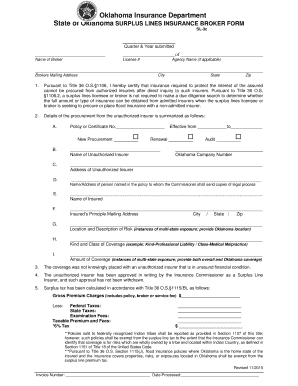

Oklahoma Insurance Department State of Oklahoma SURPLUS LINES INSURANCE BROKER FORM SL3c Quarter &amp Ok

What is the Oklahoma surplus lines tax filing service?

The Oklahoma surplus lines tax filing service is a crucial process for insurance brokers dealing with surplus lines insurance. This service allows brokers to report and pay the surplus lines tax to the Oklahoma Insurance Department. Surplus lines insurance refers to coverage provided by non-admitted insurers, which are not licensed in Oklahoma but are legally allowed to offer insurance products under specific conditions. Understanding this tax is essential for compliance and ensuring that all necessary obligations are met when conducting business in the state.

Steps to complete the Oklahoma surplus lines tax filing

Completing the Oklahoma surplus lines tax filing involves several key steps. First, brokers must gather all relevant information regarding the policies issued, including the premium amounts and the details of the insured parties. Next, they need to fill out the required forms accurately, ensuring that all information is complete and correct. Once the forms are completed, brokers can submit them electronically through the Oklahoma Insurance Department's online portal or by mail. It is vital to keep records of submissions for future reference and compliance verification.

Legal use of the Oklahoma surplus lines tax filing service

The legal use of the Oklahoma surplus lines tax filing service ensures that insurance brokers comply with state regulations. This filing service is governed by the Oklahoma Insurance Code, which outlines the requirements for surplus lines insurance and the associated tax obligations. By utilizing this service, brokers can maintain their legal standing and avoid potential penalties for non-compliance. It is essential for brokers to stay informed about any changes in legislation that may affect their filing responsibilities.

Filing deadlines and important dates

Staying aware of filing deadlines is crucial for compliance with the Oklahoma surplus lines tax. Typically, the tax is due on a quarterly basis, with specific deadlines set by the Oklahoma Insurance Department. Missing these deadlines can result in penalties and interest charges. Brokers should mark their calendars with these important dates and ensure that they complete their filings in a timely manner to avoid any complications.

Required documents for filing

When filing the Oklahoma surplus lines tax, brokers must provide certain documents to support their submission. This includes the completed surplus lines tax form, documentation of the insurance policies issued, and any additional information required by the Oklahoma Insurance Department. Having all necessary documents ready can streamline the filing process and help ensure that submissions are accepted without delays.

Penalties for non-compliance

Non-compliance with the Oklahoma surplus lines tax filing can lead to significant penalties. These may include fines, interest on unpaid taxes, and potential legal action against the broker. It is essential for brokers to understand the consequences of failing to file or pay the surplus lines tax on time. Maintaining compliance not only protects brokers from penalties but also upholds their professional reputation within the industry.

Quick guide on how to complete oklahoma insurance department state of oklahoma surplus lines insurance broker form sl3c quarter ampamp ok

Manage Oklahoma Insurance Department State Of Oklahoma SURPLUS LINES INSURANCE BROKER FORM SL3c Quarter & Ok effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Access Oklahoma Insurance Department State Of Oklahoma SURPLUS LINES INSURANCE BROKER FORM SL3c Quarter & Ok on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign Oklahoma Insurance Department State Of Oklahoma SURPLUS LINES INSURANCE BROKER FORM SL3c Quarter & Ok with ease

- Locate Oklahoma Insurance Department State Of Oklahoma SURPLUS LINES INSURANCE BROKER FORM SL3c Quarter & Ok and click Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Mark signNow parts of the documents or obscure sensitive details with features that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device. Modify and eSign Oklahoma Insurance Department State Of Oklahoma SURPLUS LINES INSURANCE BROKER FORM SL3c Quarter & Ok while ensuring smooth communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Oklahoma surplus lines tax?

The Oklahoma surplus lines tax is a tax imposed on surplus lines insurance premiums in Oklahoma. This tax is essential for ensuring compliance with state regulations, and understanding it can help businesses effectively manage their insurance costs. When utilizing services like airSlate SignNow, you can streamline the documentation process related to this tax.

-

How does airSlate SignNow assist with Oklahoma surplus lines tax documentation?

AirSlate SignNow offers an efficient platform for eSigning and managing documents related to the Oklahoma surplus lines tax. With its user-friendly interface, businesses can quickly prepare, send, and sign documents, ensuring that tax submissions are timely and accurate. This reduces administrative burden and enhances compliance.

-

Are there any fees associated with using airSlate SignNow for Oklahoma surplus lines tax forms?

Yes, airSlate SignNow has competitive pricing plans that cater to different business needs. While there may be transaction fees for eSignature services, the cost savings and efficiency gained in managing Oklahoma surplus lines tax documentation often outweigh these expenses. Explore the pricing options to find the best fit for your organization.

-

Can I integrate airSlate SignNow with my existing accounting software for Oklahoma surplus lines tax?

Absolutely! AirSlate SignNow integrates seamlessly with a variety of accounting software. This integration simplifies your workflow and allows for easy management of Oklahoma surplus lines tax documents alongside your financial records, enhancing your overall tax compliance process.

-

What are the benefits of using airSlate SignNow for eSigning Oklahoma surplus lines tax documents?

Using airSlate SignNow for eSigning Oklahoma surplus lines tax documents offers several advantages. It accelerates the signing process, reduces paper waste, and provides a secure way to manage sensitive tax information. Additionally, the platform ensures that all signatures are legally binding and compliant with state regulations.

-

Is airSlate SignNow compliant with Oklahoma regulations regarding surplus lines tax?

Yes, airSlate SignNow complies with all relevant state regulations, including those related to the Oklahoma surplus lines tax. The platform ensures that all documentation processed through its system meets legal standards, allowing you to conduct your business with confidence and peace of mind.

-

How can I track the status of my Oklahoma surplus lines tax document using airSlate SignNow?

AirSlate SignNow provides real-time tracking features that allow users to monitor the status of their Oklahoma surplus lines tax documents. You can receive updates on when documents are viewed, signed, or completed, ensuring transparency in the process and allowing you to manage timelines effectively.

Get more for Oklahoma Insurance Department State Of Oklahoma SURPLUS LINES INSURANCE BROKER FORM SL3c Quarter &amp Ok

Find out other Oklahoma Insurance Department State Of Oklahoma SURPLUS LINES INSURANCE BROKER FORM SL3c Quarter &amp Ok

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free