Application for Michigan Net Operating Loss Refund MI 1045 Application for Michigan Net Operating Loss Refund MI 1045 Form

Understanding the Michigan Net Operating Loss Refund MI 1045

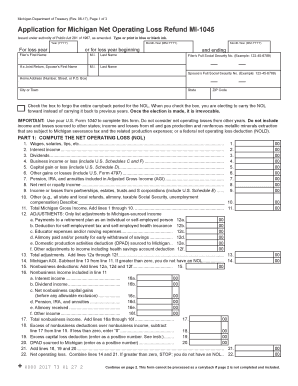

The Application for Michigan Net Operating Loss Refund MI 1045 is designed for businesses that have incurred net operating losses and wish to claim a refund. This application allows eligible taxpayers to recover taxes paid in prior years, providing financial relief during challenging times. It's essential to understand the specific criteria and processes involved in submitting this application to ensure compliance and maximize potential refunds.

Steps to Complete the Application for Michigan Net Operating Loss Refund MI 1045

Completing the Application for Michigan Net Operating Loss Refund MI 1045 involves several key steps:

- Gather Necessary Documentation: Collect all relevant financial records, including tax returns from previous years, to support your claim.

- Fill Out the Application: Carefully complete the MI 1045 form, ensuring all information is accurate and complete.

- Review for Accuracy: Double-check all entries for errors or omissions to avoid delays in processing.

- Submit the Application: Choose your preferred submission method, whether online, by mail, or in person, and ensure it is sent to the correct address.

Eligibility Criteria for the Michigan Net Operating Loss Refund MI 1045

To qualify for the Michigan Net Operating Loss Refund MI 1045, businesses must meet specific eligibility criteria. These include:

- The business must have incurred a net operating loss in the applicable tax year.

- Tax returns for the years being claimed must have been filed timely.

- The application must be submitted within the designated timeframe as outlined by the Michigan Department of Treasury.

Required Documents for the Application for Michigan Net Operating Loss Refund MI 1045

When submitting the Application for Michigan Net Operating Loss Refund MI 1045, certain documents are necessary to support your claim. These typically include:

- Copy of the tax returns for the years in which the losses occurred.

- Financial statements that detail the loss calculations.

- Any additional forms or schedules that pertain to the refund request.

Filing Deadlines for the Michigan Net Operating Loss Refund MI 1045

Awareness of filing deadlines is crucial for a successful application. The deadlines for submitting the Michigan Net Operating Loss Refund MI 1045 typically align with the state tax filing deadlines. Taxpayers should check the Michigan Department of Treasury's official website for the most current dates to ensure timely submission.

Legal Use of the Application for Michigan Net Operating Loss Refund MI 1045

The Application for Michigan Net Operating Loss Refund MI 1045 is legally binding when completed and submitted according to state regulations. It is essential to adhere to the guidelines set forth by the Michigan Department of Treasury to ensure that the application is valid and can be processed without issues. Compliance with all legal requirements helps protect against potential audits or penalties.

Quick guide on how to complete 2017 application for michigan net operating loss refund mi 1045 2017 application for michigan net operating loss refund mi 1045

Complete Application For Michigan Net Operating Loss Refund MI 1045 Application For Michigan Net Operating Loss Refund MI 1045 effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It presents an ideal green substitute for traditional printed and signed contracts, enabling you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents quickly without delays. Manage Application For Michigan Net Operating Loss Refund MI 1045 Application For Michigan Net Operating Loss Refund MI 1045 on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest way to alter and electronically sign Application For Michigan Net Operating Loss Refund MI 1045 Application For Michigan Net Operating Loss Refund MI 1045 with ease

- Find Application For Michigan Net Operating Loss Refund MI 1045 Application For Michigan Net Operating Loss Refund MI 1045 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to send your form, either via email, SMS, invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing additional copies. airSlate SignNow manages your document administration needs in just a few clicks from any device of your choosing. Edit and electronically sign Application For Michigan Net Operating Loss Refund MI 1045 Application For Michigan Net Operating Loss Refund MI 1045 and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for obtaining a refund MI 1045 Michigan?

To obtain a refund MI 1045 Michigan, taxpayers must first file their MI-1040 income tax form if they haven’t already. Once the form is processed by the Michigan Department of Treasury, any eligible refund will be issued based on the information provided. It is important to keep an eye on the status of your refund through the Michigan Treasury website for updates.

-

How does airSlate SignNow streamline the MI 1045 Michigan refund process?

airSlate SignNow helps streamline the MI 1045 Michigan refund process by enabling users to easily send and eSign necessary documents electronically. This eliminates the need for physical paperwork, reducing processing time. Additionally, our solution ensures security and compliance, allowing you to focus on your finances without the hassle.

-

Are there any fees associated with using airSlate SignNow for my refund MI 1045 Michigan?

airSlate SignNow operates on a cost-effective pricing model, offering various plans to suit different needs. Users can benefit from a free trial to determine if our service meets their requirements for handling documents related to the refund MI 1045 Michigan. Competitive pricing ensures you only pay for what you need.

-

What features does airSlate SignNow offer for managing documents related to refund MI 1045 Michigan?

AirSlate SignNow provides features like electronic signatures, document templates, and secure cloud storage to streamline the management of your refund MI 1045 Michigan documents. Users can collaborate in real-time and track document statuses easily, making the entire process more efficient and organized.

-

Can I integrate airSlate SignNow with other software for filing refund MI 1045 Michigan?

Yes, airSlate SignNow offers integrations with various accounting and tax software systems that can assist with filing a refund MI 1045 Michigan. These integrations simplify the process of managing and sharing documents, ensuring a seamless flow of information between your tools and systems.

-

How secure is my data when using airSlate SignNow for refund MI 1045 Michigan?

Security is a top priority at airSlate SignNow. We utilize advanced encryption technology and comply with industry standards to ensure that all data, including information related to your refund MI 1045 Michigan, is kept safe and secure. You can confidently manage your documents knowing they're protected.

-

What are the benefits of using airSlate SignNow for my tax-related documents?

Using airSlate SignNow for your tax-related documents provides several benefits, including increased efficiency and faster turnaround times for signing and sending forms like the refund MI 1045 Michigan. Our user-friendly platform enables you to reduce manual tasks and track the status of documents effortlessly.

Get more for Application For Michigan Net Operating Loss Refund MI 1045 Application For Michigan Net Operating Loss Refund MI 1045

- Employee behavior documentation template form

- Insurance research request form reimbursement solutions

- Parent empowerment and efficacy measure form

- Medical certificate template nsw form

- Marquette method pdf form

- Fis 0030 form michigan

- Fantastic lifestyle checklist form

- Steps to completing your community form

Find out other Application For Michigan Net Operating Loss Refund MI 1045 Application For Michigan Net Operating Loss Refund MI 1045

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile