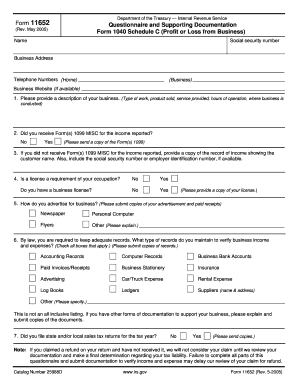

Form 1040 Schedule C

What is the Form 1040 Schedule C

The Form 1040 Schedule C is a tax document used by sole proprietors to report income and expenses related to their business. This form is essential for individuals who are self-employed or operate a business as a single owner. It allows taxpayers to calculate their net profit or loss from their business activities, which is then reported on their individual income tax return, Form 1040. Understanding this form is crucial for accurate tax reporting and compliance with IRS regulations.

Steps to complete the Form 1040 Schedule C

Completing the Form 1040 Schedule C involves several key steps to ensure accuracy and compliance. Here is a brief overview:

- Gather financial records: Collect all relevant income and expense records for the tax year.

- Fill out basic information: Enter your name, business name, and address at the top of the form.

- Report income: List all income received from your business activities in the designated section.

- Detail expenses: Categorize and enter your business expenses, such as supplies, utilities, and wages.

- Calculate net profit or loss: Subtract total expenses from total income to determine your net profit or loss.

- Sign and date: Ensure that you sign and date the form before submitting it.

Legal use of the Form 1040 Schedule C

The legal use of the Form 1040 Schedule C is governed by IRS regulations, which require accurate reporting of business income and expenses. This form must be filed annually by individuals who earn income from self-employment. Failure to report income correctly can lead to penalties, including fines and interest on unpaid taxes. It is important to maintain thorough records and ensure that all information provided on the form is truthful and complete to comply with tax laws.

IRS Guidelines

The IRS provides specific guidelines for filling out the Form 1040 Schedule C. This includes instructions on what constitutes deductible business expenses, how to report income, and the importance of maintaining accurate records. Taxpayers should refer to the IRS instructions for Schedule C to understand the requirements fully. Familiarity with these guidelines helps ensure compliance and minimizes the risk of audits or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 Schedule C align with the individual income tax return deadlines. Typically, the deadline for submitting your tax return, including Schedule C, is April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial to be aware of any changes in deadlines or extensions to avoid late filing penalties.

Required Documents

To complete the Form 1040 Schedule C, several documents are necessary. Taxpayers should gather:

- Income statements, such as invoices and sales records.

- Expense receipts, including bills and statements for business-related costs.

- Bank statements to verify income and expenses.

- Previous year's tax return for reference.

Having these documents organized and accessible can streamline the completion of the form and ensure accurate reporting.

Examples of using the Form 1040 Schedule C

The Form 1040 Schedule C is commonly used by various types of self-employed individuals. For instance, freelance graphic designers, independent consultants, and small business owners all utilize this form to report their income and expenses. Each example illustrates how the form captures the unique financial activities of different business types, allowing for accurate tax reporting and compliance with IRS regulations.

Quick guide on how to complete form 1040 schedule c

Effortlessly Prepare Form 1040 Schedule C on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without any delays. Handle Form 1040 Schedule C on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Edit and Electronically Sign Form 1040 Schedule C with Ease

- Find Form 1040 Schedule C and click Get Form to initiate the process.

- Use the tools we provide to fill out your document.

- Select important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method of sharing the form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 1040 Schedule C to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is form 1040 schedule c used for?

Form 1040 Schedule C is used to report income or loss from a business operated as a sole proprietorship. It provides a detailed overview of your business's revenues and expenses, which is essential for accurately calculating your taxable income. By filing this form, you can ensure compliance with IRS regulations while maximizing your potential deductions.

-

How can airSlate SignNow help with form 1040 schedule c?

airSlate SignNow streamlines the process of sending and eSigning documents, including form 1040 Schedule C. Our platform allows you to create, share, and securely sign your tax documents from anywhere, enhancing your productivity and ensuring timely filing. This convenience helps you focus more on your business rather than on paperwork.

-

Is there a cost associated with using airSlate SignNow for form 1040 schedule c?

Yes, airSlate SignNow offers various pricing plans to meet diverse business needs. While pricing can vary based on features, our solutions are designed to be cost-effective, especially when considering the time saved in document management, including for form 1040 Schedule C. We encourage prospective customers to explore our pricing options for more details.

-

What features does airSlate SignNow offer for managing form 1040 schedule c?

airSlate SignNow includes features such as document templates, customizable signing workflows, and cloud storage. These features enable users to easily prepare and manage form 1040 Schedule C, ensuring that all necessary details are included and reducing the risk of errors. Additionally, our platform supports real-time tracking and notifications, enhancing organization and efficiency.

-

Can I integrate airSlate SignNow with other software for form 1040 schedule c?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software applications, enhancing your workflow for form 1040 Schedule C. Whether you use accounting software, CRM systems, or document management tools, our platform can connect with them to simplify the process of handling your tax documents.

-

What are the benefits of using airSlate SignNow for form 1040 schedule c?

Using airSlate SignNow for form 1040 Schedule C provides numerous benefits, including increased efficiency in document handling, enhanced security for your sensitive information, and reduced turnaround times for eSigning. It allows you to securely send and receive documents while easily managing multiple tax-related tasks, making your filing process more straightforward.

-

Is it easy to eSign form 1040 schedule c with airSlate SignNow?

Yes, airSlate SignNow is designed to make eSigning forms like form 1040 Schedule C incredibly easy. Our user-friendly interface allows you to eSign documents in just a few clicks, whether you’re on your computer or mobile device. This simplifies the process of obtaining necessary signatures, allowing for quicker submissions to the IRS.

Get more for Form 1040 Schedule C

- Honored citizen application form

- Wheelchair skills test pdf form

- San mateo county encroachment permit form

- Maryland mva reinstatement application form

- Self employment income form

- Kentucky medicaid mco map 9 mco 012016 form

- Printable pool waiver form

- Form for requesting additional official copies of your eres

Find out other Form 1040 Schedule C

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract

- Sign Colorado General Power of Attorney Template Simple

- How Do I Sign Florida General Power of Attorney Template

- Sign South Dakota Sponsorship Proposal Template Safe

- Sign West Virginia Sponsorship Proposal Template Free

- Sign Tennessee Investment Contract Safe

- Sign Maryland Consulting Agreement Template Fast

- Sign California Distributor Agreement Template Myself

- How Do I Sign Louisiana Startup Business Plan Template

- Can I Sign Nevada Startup Business Plan Template

- Sign Rhode Island Startup Business Plan Template Now

- How Can I Sign Connecticut Business Letter Template

- Sign Georgia Business Letter Template Easy

- Sign Massachusetts Business Letter Template Fast

- Can I Sign Virginia Business Letter Template

- Can I Sign Ohio Startup Costs Budget Worksheet

- How Do I Sign Maryland 12 Month Sales Forecast

- How Do I Sign Maine Profit and Loss Statement

- How To Sign Wisconsin Operational Budget Template