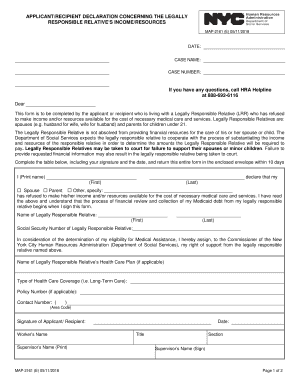

APPLICANTRECIPIENT DECLARATION CONCERNING the LEGALLY Form

What is the 2018 New York Income Form?

The 2018 New York Income Form, commonly referred to as the NY Form IT-201, is a crucial document for residents of New York State to report their income and calculate their state tax obligations. This form is specifically designed for individuals who are full-year residents of New York and need to report their income, deductions, and credits for the tax year. It includes sections for various types of income, such as wages, interest, dividends, and capital gains, as well as adjustments and credits that may apply to the taxpayer's situation.

Steps to Complete the 2018 New York Income Form

Completing the 2018 New York Income Form involves several key steps to ensure accurate reporting and compliance with state tax laws. Begin by gathering all necessary documentation, including W-2 forms, 1099 forms, and any other records of income received during the year. Next, follow these steps:

- Fill out personal information, including your name, address, and Social Security number.

- Report all sources of income on the form, ensuring to include wages, interest, and dividends.

- Calculate deductions and credits applicable to your situation, such as the standard deduction or itemized deductions.

- Complete the tax calculation section to determine your total tax liability.

- Sign and date the form before submission, ensuring all information is accurate and complete.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the 2018 New York Income Form to avoid penalties and interest. The deadline for filing your state income tax return is typically April fifteenth of the following year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, taxpayers may consider filing for an extension if they require more time, but it is crucial to pay any estimated taxes owed by the original deadline to avoid penalties.

Required Documents

To accurately complete the 2018 New York Income Form, you will need several key documents. These include:

- W-2 forms from employers reporting annual wages.

- 1099 forms for any freelance or contract work.

- Records of other income, such as rental income or interest statements.

- Documentation for deductions, such as mortgage interest statements or receipts for charitable contributions.

IRS Guidelines

While the 2018 New York Income Form is specific to state tax obligations, it is important to align your filing with IRS guidelines as well. Ensure that your reported income matches the information provided to the IRS on your federal tax return. This includes consistency in income reporting, deductions, and credits claimed. Discrepancies between state and federal filings can lead to audits or additional scrutiny from tax authorities.

Form Submission Methods

Taxpayers have several options for submitting the 2018 New York Income Form. You can file electronically using approved tax software, which often provides a streamlined process and faster refunds. Alternatively, you may choose to print and mail the completed form to the appropriate state tax office. If you opt for paper filing, ensure that you send it well before the deadline to allow for processing time.

Quick guide on how to complete applicantrecipient declaration concerning the legally

Prepare APPLICANTRECIPIENT DECLARATION CONCERNING THE LEGALLY effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage APPLICANTRECIPIENT DECLARATION CONCERNING THE LEGALLY on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign APPLICANTRECIPIENT DECLARATION CONCERNING THE LEGALLY effortlessly

- Obtain APPLICANTRECIPIENT DECLARATION CONCERNING THE LEGALLY and click Get Form to begin.

- Take advantage of the tools we provide to submit your form.

- Emphasize pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method to submit your form: via email, SMS, invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from your desired device. Edit and eSign APPLICANTRECIPIENT DECLARATION CONCERNING THE LEGALLY and ensure effective communication throughout the form preparation stages with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 2018 New York income form and why is it important?

The 2018 New York income form is a tax document that residents must complete to report their earnings and calculate their state taxes. It is important because it determines your tax liability and eligibility for credits or refunds. Filing this form accurately is crucial to ensure compliance with state tax regulations.

-

How can airSlate SignNow help with completing the 2018 New York income form?

airSlate SignNow offers an efficient way to fill out and eSign your 2018 New York income form digitally. Our platform allows you to easily upload, edit, and collaborate on documents, ensuring that your tax forms are completed accurately and submitted on time. Plus, our user-friendly interface makes it simple for anyone to navigate.

-

Is there a cost associated with using airSlate SignNow for the 2018 New York income form?

Yes, airSlate SignNow offers various pricing plans that cater to businesses and individuals looking to streamline their document processes, including the completion of the 2018 New York income form. Our cost-effective solutions ensure you get the best value for features like eSigning, form templates, and customer support.

-

What features does airSlate SignNow offer for managing tax forms like the 2018 New York income form?

airSlate SignNow provides features such as document editing, customizable templates, and secure eSigning to assist with managing tax forms like the 2018 New York income form. You can also track who has signed documents and when, ensuring a seamless process all around. These features enhance both accuracy and efficiency.

-

Can airSlate SignNow integrate with other software for filing the 2018 New York income form?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to file your 2018 New York income form directly from the platform. This integration helps you sync data and minimizes the chances of errors during the filing process, thereby saving time and resources.

-

What security measures does airSlate SignNow have for sensitive documents like the 2018 New York income form?

airSlate SignNow uses robust encryption and security protocols to protect sensitive documents, including the 2018 New York income form. We prioritize confidentiality and security, ensuring that your personal and financial information remains safe from unauthorized access during the signing and submission processes.

-

Does airSlate SignNow provide customer support for issues related to the 2018 New York income form?

Absolutely! airSlate SignNow offers comprehensive customer support to assist users with any issues they might encounter while completing the 2018 New York income form. Our knowledgeable support team is available via chat, email, or phone to provide guidance and resolve any concerns promptly.

Get more for APPLICANTRECIPIENT DECLARATION CONCERNING THE LEGALLY

Find out other APPLICANTRECIPIENT DECLARATION CONCERNING THE LEGALLY

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself