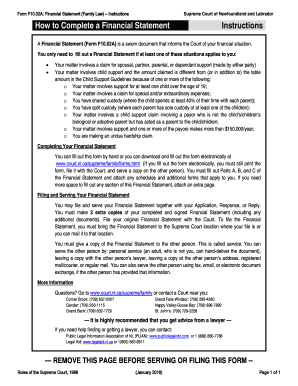

F10 02A Financial Statement the Law Courts of Newfoundland Form

Understanding the F10 02A Financial Statement

The F10 02A Financial Statement is a legal document used in the context of financial law within the jurisdiction of Newfoundland. This form is essential for individuals or entities involved in family law proceedings, particularly when disclosing financial information during disputes or negotiations. The statement captures a comprehensive overview of an individual's or family's financial situation, including income, expenses, assets, and liabilities. Understanding the components of this form is crucial for compliance and effective legal representation.

Steps to Complete the F10 02A Financial Statement

Completing the F10 02A Financial Statement requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents, including pay stubs, tax returns, bank statements, and records of debts.

- Begin filling out the form by entering personal information accurately, ensuring that names and addresses match official documents.

- Detail your income sources, including salaries, bonuses, and any additional earnings.

- List all monthly expenses, categorizing them into fixed and variable costs.

- Provide a thorough account of assets, such as real estate, vehicles, and investments, along with their current values.

- Document all liabilities, including mortgages, loans, and credit card debts.

- Review the completed form for accuracy and completeness before submission.

Legal Use of the F10 02A Financial Statement

The F10 02A Financial Statement serves a critical role in legal proceedings related to family law. It is often required by courts to assess financial circumstances during divorce or custody cases. The accuracy and completeness of this form can influence court decisions regarding asset division, alimony, and child support. Therefore, it is essential to ensure that all information is truthful and reflective of the current financial situation to avoid potential legal repercussions.

Key Elements of the F10 02A Financial Statement

The F10 02A Financial Statement consists of several key elements that must be accurately reported:

- Personal Information: Includes the names and contact details of the parties involved.

- Income: A detailed breakdown of all sources of income, including employment and investment income.

- Expenses: A comprehensive list of monthly expenses, categorized appropriately.

- Assets: A list of all owned assets, including their estimated values.

- Liabilities: Documentation of all debts and financial obligations.

Obtaining the F10 02A Financial Statement

The F10 02A Financial Statement can typically be obtained from the official website of the Law Courts of Newfoundland or through legal counsel. It is important to ensure that you are using the most current version of the form, as updates may occur. If you are unsure about the process, consulting with a legal professional can provide guidance and ensure compliance with all necessary legal standards.

Form Submission Methods for the F10 02A Financial Statement

Once the F10 02A Financial Statement is completed, it can be submitted through various methods:

- Online Submission: Many jurisdictions allow for electronic filing through designated portals.

- Mail: The form can be sent via postal service to the appropriate court address.

- In-Person: Individuals may also choose to submit the form directly at the courthouse.

Quick guide on how to complete f1002a financial statement the law courts of newfoundland

Complete F10 02A Financial Statement The Law Courts Of Newfoundland seamlessly on any gadget

Digital document management has become increasingly favored by organizations and individuals alike. It offers a superb eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly without delays. Handle F10 02A Financial Statement The Law Courts Of Newfoundland on any gadget with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign F10 02A Financial Statement The Law Courts Of Newfoundland with ease

- Find F10 02A Financial Statement The Law Courts Of Newfoundland and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Decide how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the stress of lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Modify and eSign F10 02A Financial Statement The Law Courts Of Newfoundland and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

How does airSlate SignNow comply with financial law?

airSlate SignNow is designed to ensure compliance with financial law by implementing robust security measures and encryption protocols. Our platform meets various legal requirements, ensuring that your electronically signed documents are both valid and enforceable. We continuously update our compliance framework to align with evolving financial laws and regulations.

-

What are the key features of airSlate SignNow for businesses in financial law?

AirSlate SignNow offers features such as secure eSigning, document templates, and integration with financial software solutions. These capabilities streamline workflows while ensuring adherence to financial law standards. With easy tracking and management of documents, businesses can focus on compliance and efficiency.

-

Is airSlate SignNow suitable for small businesses dealing with financial law?

Yes, airSlate SignNow provides a cost-effective solution that is ideal for small businesses navigating financial law. Our user-friendly interface and pricing plans are designed to accommodate diverse business needs. Small firms can leverage our platform to ensure compliance and enhance productivity without breaking the bank.

-

What types of integrations does airSlate SignNow offer for financial law professionals?

AirSlate SignNow integrates seamlessly with various financial tools and software, such as accounting and CRM systems. This allows professionals in the financial law sector to maintain interconnected workflows while adhering to regulatory requirements. Easy setup and compatibility mean you can focus on compliance and client needs.

-

How can airSlate SignNow help manage legal documents related to financial law?

Our platform enables users to create, send, and eSign legal documents efficiently, ensuring that all transactions comply with financial law. The ability to track document statuses and maintain an audit trail enhances accountability. This organization helps you manage your legal documents with confidence, knowing they meet legal standards.

-

What are the pricing options for airSlate SignNow's financial law services?

AirSlate SignNow offers a variety of pricing plans to cater to businesses in the financial law sector, ensuring flexibility and affordability. Our competitive rates allow companies to choose a plan that best fits their size and needs without compromising on compliance features. Users can benefit from a trial before committing to a subscription.

-

How does airSlate SignNow ensure document security while dealing with financial law?

Security is paramount in financial law, and airSlate SignNow employs high-level encryption and multi-factor authentication to protect sensitive information. Our platform ensures that documents are stored securely while providing authorized users easy access. This commitment to security helps businesses comply with regulatory requirements.

Get more for F10 02A Financial Statement The Law Courts Of Newfoundland

- Umastandi application form

- The legend of the cedar tree answer key form

- Signage agreement sample form

- Scao fillable forms

- Icivics answer key form

- Endocrine system worksheet sites jackson k12 ga form

- Donation pledge form for every dream capital campaign centralunionpreschool

- 14 lifeline theatre subscription order form

Find out other F10 02A Financial Statement The Law Courts Of Newfoundland

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document