Vat Return Form Download

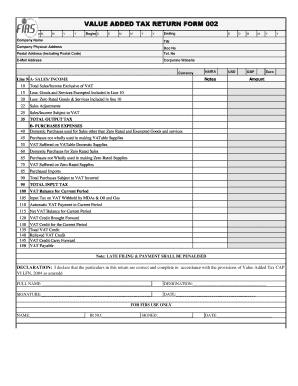

What is the value added tax return form?

The value added tax return form, often referred to as the VAT return form, is a crucial document used by businesses to report their VAT obligations to the Internal Revenue Service (IRS). This form allows businesses to declare the amount of VAT they have collected from customers and the VAT they have paid on purchases. The difference between these amounts determines whether a business owes VAT or is entitled to a refund. Understanding the purpose and requirements of this form is essential for compliance with tax regulations.

Steps to complete the value added tax return form

Completing the value added tax return form involves several important steps. First, gather all necessary financial records, including sales invoices and purchase receipts. Accurately calculate the total VAT collected on sales and the total VAT paid on purchases. Next, fill out the form by entering these amounts in the designated sections. Ensure that all calculations are correct to avoid discrepancies. Finally, review the completed form for accuracy before submission to the IRS, either online or via mail.

Filing deadlines and important dates

Filing deadlines for the value added tax return form vary based on the business's reporting period. Typically, businesses must submit their VAT returns quarterly or annually, depending on their sales volume. It is crucial to be aware of these deadlines to avoid penalties. Mark your calendar with these important dates to ensure timely filing and compliance with IRS regulations.

Required documents for filing

When filing the value added tax return form, several documents are necessary to support your claims. These include sales invoices, purchase receipts, and any relevant financial statements that detail your VAT transactions. Keeping organized records will facilitate the completion of the form and ensure that you have the necessary documentation in case of an audit.

Legal use of the value added tax return form

The value added tax return form must be completed and submitted in accordance with IRS regulations to be considered legally valid. This includes ensuring that all information is accurate and that the form is signed appropriately. Utilizing a reliable eSignature solution can enhance the legal standing of your submission, providing a digital certificate that verifies the authenticity of your signature and compliance with eSignature laws.

Form submission methods

The value added tax return form can be submitted through various methods, including online submission via the IRS website, mailing a physical copy, or delivering it in person to the appropriate IRS office. Each method has its own advantages, such as immediate confirmation of receipt for online submissions or the ability to maintain a physical copy when mailed. Choose the method that best suits your business needs and ensures compliance with filing requirements.

Quick guide on how to complete vat return form download

Complete Vat Return Form Download effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the resources you require to create, modify, and eSign your documents quickly without delays. Manage Vat Return Form Download on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

The easiest way to alter and eSign Vat Return Form Download seamlessly

- Locate Vat Return Form Download and click on Get Form to begin.

- Utilize the tools available to submit your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and eSign Vat Return Form Download and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a value added tax return?

A value added tax return is a document that businesses submit to tax authorities reporting the value added tax they have collected and paid during a specific period. This document is essential for ensuring compliance with tax regulations. An accurate value added tax return can help businesses recover any VAT they have overpaid, enhancing their cash flow.

-

How does airSlate SignNow help with filing a value added tax return?

airSlate SignNow streamlines the process of preparing and submitting a value added tax return by allowing businesses to electronically sign and send necessary documents. The platform ensures that all relevant data is organized and easily accessible, minimizing the risks of errors. This efficient approach can save businesses time and reduce the stress associated with tax submissions.

-

What are the pricing options for using airSlate SignNow for value added tax return processes?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses of all sizes. Pricing options are designed to be cost-effective, ensuring that companies can efficiently manage their value added tax return process without breaking the bank. Users can choose from monthly or annual subscriptions, providing flexibility based on budget and usage.

-

What features does airSlate SignNow offer for managing value added tax returns?

airSlate SignNow provides features such as template creation, document tracking, and secure e-signature capabilities that streamline the management of a value added tax return. Users can create custom templates for VAT forms, ensuring consistency and compliance. Additionally, real-time tracking allows businesses to monitor the status of their submissions.

-

Can airSlate SignNow integrate with accounting software for value added tax returns?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions to enhance the efficiency of preparing value added tax returns. This integration allows for the automatic transfer of financial data, reducing manual entry errors and saving time. Businesses can maintain accurate records, making the VAT return process smoother.

-

What are the benefits of using airSlate SignNow for value added tax return processes?

Using airSlate SignNow for value added tax return processes offers benefits such as increased accuracy, faster submission times, and improved compliance with tax regulations. The user-friendly platform ensures that businesses can easily navigate their VAT obligations. Overall, it can lead to better financial outcomes by optimizing cash flow and minimizing penalties.

-

Is airSlate SignNow suitable for small businesses needing to file value added tax returns?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it an excellent choice for small businesses that need to file value added tax returns. The platform helps simplify the documentation process, ensuring that small businesses can handle tax requirements without signNow time or resource investment. This scalability makes it suitable for companies of all sizes.

Get more for Vat Return Form Download

Find out other Vat Return Form Download

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy