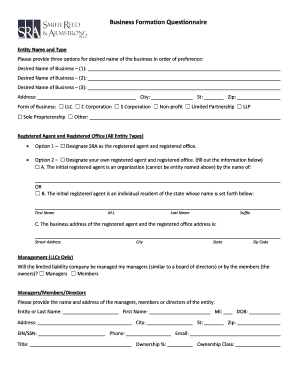

Entity Name and Type Form

What is the business formation questionnaire?

The business formation questionnaire is a vital document that helps entrepreneurs gather essential information required to establish a business entity. This questionnaire typically includes inquiries about the desired business name, type of business structure (such as LLC, corporation, or partnership), and the specific business activities intended. Completing this form accurately is crucial, as it lays the foundation for the legal formation of the business and ensures compliance with state regulations.

Key elements of the business formation questionnaire

Several key elements are typically included in a business formation questionnaire:

- Business Name: The proposed name of the business, which must comply with state naming regulations.

- Business Structure: The type of entity being formed, such as a limited liability company (LLC), corporation, or partnership.

- Business Address: The physical address where the business will operate.

- Owner Information: Details about the business owners, including names, addresses, and contact information.

- Purpose of the Business: A description of the business activities and objectives.

Steps to complete the business formation questionnaire

Completing the business formation questionnaire involves several steps to ensure all necessary information is accurately provided:

- Gather necessary information about the business and its owners.

- Fill out the questionnaire, ensuring all fields are completed accurately.

- Review the completed questionnaire for any errors or omissions.

- Submit the questionnaire to the appropriate state agency or use it to prepare the necessary formation documents.

Legal use of the business formation questionnaire

The business formation questionnaire serves a legal purpose by providing the information needed to create a business entity. When submitted, the information becomes part of the official records maintained by the state. This legal recognition is essential for establishing the business's existence and protecting the owners' personal assets from business liabilities.

Required documents

In addition to the business formation questionnaire, several documents may be required to complete the business formation process:

- Articles of Incorporation or Organization: The official document that establishes the business entity.

- Operating Agreement: A document outlining the management structure and operating procedures for LLCs.

- Employer Identification Number (EIN): A federal tax identification number required for tax purposes.

- Business Licenses and Permits: Any local or state licenses necessary to operate legally.

State-specific rules for the business formation questionnaire

Each state has its own regulations regarding business formation. It is essential to understand the specific requirements for the state in which the business will be formed. This includes naming conventions, filing fees, and additional documentation that may be required. Consulting the state’s business formation guidelines can help ensure compliance and streamline the formation process.

Quick guide on how to complete entity name and type

Complete Entity Name And Type effortlessly on any device

Digital document management has become widespread among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents since you can access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without any hold-ups. Manage Entity Name And Type on any device using airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Entity Name And Type seamlessly

- Find Entity Name And Type and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and eSign Entity Name And Type and guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a business formation questionnaire?

A business formation questionnaire is a tool designed to help entrepreneurs gather essential information needed for creating a new business entity. This questionnaire typically covers questions about the type of business, ownership structure, and operational details. Using a structured business formation questionnaire can streamline the process of registering your business.

-

How does airSlate SignNow streamline the business formation questionnaire process?

airSlate SignNow simplifies the business formation questionnaire process by allowing users to create, send, and eSign documents seamlessly. With its user-friendly interface, you can design tailored questionnaires that individuals can fill out easily. Additionally, the platform ensures that your data remains secure and organized.

-

What features does the airSlate SignNow business formation questionnaire offer?

The airSlate SignNow business formation questionnaire comes with features like customizable templates, automated workflows, and eSignature capabilities. These features not only save time but also increase accuracy when collecting critical information from clients or partners. This ensures a smooth and efficient business formation process.

-

Are there any costs associated with using the business formation questionnaire?

AirSlate SignNow offers various pricing plans that cater to different business needs. While there might be costs involved depending on the plan you choose, the value provided through the business formation questionnaire functionality can signNowly outweigh these expenses. It’s a cost-effective solution for forming a business.

-

Can I integrate the business formation questionnaire with other tools?

Yes, airSlate SignNow supports integrations with various third-party applications, allowing you to connect your business formation questionnaire with tools you already use. This can enhance your productivity by automating tasks and ensuring seamless data flow between systems. The integration options make it a versatile choice for businesses.

-

How can a business formation questionnaire benefit my startup?

A well-designed business formation questionnaire can help your startup establish a clear foundation quickly. It helps clarify your business structure, responsibilities, and operational procedures essential for growth. Utilizing a business formation questionnaire ensures that you gather all necessary information to comply with legal requirements.

-

Is the business formation questionnaire customizable?

Absolutely! The business formation questionnaire in airSlate SignNow is highly customizable. You can tailor the questions to fit your specific industry needs and business requirements, ensuring you gather all the relevant information necessary for a successful formation.

Get more for Entity Name And Type

Find out other Entity Name And Type

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online