Schedule B 2 Form 1065

What is the Schedule B 2 Form 1065

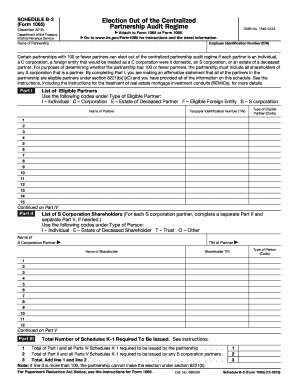

The Schedule B 2 Form 1065 is a supplementary document used by partnerships to report specific information to the IRS. This form is part of the overall Form 1065, which is the U.S. Return of Partnership Income. Schedule B 2 is particularly focused on providing details about the partnership's income, deductions, and credits, ensuring compliance with federal tax regulations. It is essential for partnerships to accurately complete this form to avoid potential penalties and ensure proper tax treatment.

How to use the Schedule B 2 Form 1065

Using the Schedule B 2 Form 1065 involves several key steps. First, partnerships must gather all relevant financial information, including income, deductions, and credits. Next, they should complete the form by entering the required data in the appropriate sections. It is important to ensure that the information aligns with the main Form 1065. Once completed, the form should be reviewed for accuracy before submission to the IRS, either electronically or via mail.

Steps to complete the Schedule B 2 Form 1065

Completing the Schedule B 2 Form 1065 requires careful attention to detail. Follow these steps:

- Gather all necessary financial documents, including income statements and expense records.

- Fill out the partnership's name, address, and identifying information at the top of the form.

- Provide details on income and deductions in the designated sections, ensuring accuracy.

- Review the completed form for any errors or omissions.

- Sign and date the form, if required, before submitting it to the IRS.

Legal use of the Schedule B 2 Form 1065

The legal use of the Schedule B 2 Form 1065 is crucial for partnerships to maintain compliance with IRS regulations. This form must be filled out accurately and submitted on time to avoid penalties. Electronic signatures are accepted, provided they meet the legal requirements outlined in the ESIGN Act and UETA. Utilizing a reliable eSignature solution can help ensure that the form is executed properly and securely.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule B 2 Form 1065. These guidelines detail the information required for each section of the form and the importance of accuracy in reporting. Partnerships should refer to the IRS instructions for Form 1065 and Schedule B 2 to ensure compliance with current tax laws and regulations. Staying informed about any changes in IRS requirements is essential for successful filing.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule B 2 Form 1065 are critical for partnerships to observe. Typically, the form must be submitted by March 15 for calendar-year partnerships. If additional time is needed, partnerships may file for an extension, which allows for an additional six months. It is important to keep track of these dates to avoid late fees and penalties.

Quick guide on how to complete schedule b 2 form 1065

Complete Schedule B 2 Form 1065 effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides you with all the resources required to create, alter, and electronically sign your documents quickly without delays. Handle Schedule B 2 Form 1065 on any platform using the airSlate SignNow applications for Android or iOS and simplify any document-related process today.

How to edit and eSign Schedule B 2 Form 1065 with ease

- Find Schedule B 2 Form 1065 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or obscure private information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, either via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your requirements in document management with just a few clicks from any device you choose. Edit and eSign Schedule B 2 Form 1065 and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 1065 schedule b 2 and why is it important?

The 1065 schedule b 2 is a form used by partnerships to report additional information regarding the partnership entity. It is crucial for ensuring compliance with IRS regulations and helps partnerships provide clarity on ownership and financial dealings.

-

How does airSlate SignNow assist with completing the 1065 schedule b 2?

airSlate SignNow simplifies the process of completing the 1065 schedule b 2 by offering easy-to-use templates and electronic signatures. This ensures that all necessary information can be filled out and submitted efficiently, streamlining tax preparation for partnerships.

-

Are there any costs associated with using airSlate SignNow for the 1065 schedule b 2?

airSlate SignNow offers a variety of pricing plans that cater to different business needs, with options for both individuals and large organizations. This ensures you can find a cost-effective solution for managing forms like the 1065 schedule b 2 without compromising on features.

-

What features does airSlate SignNow provide for the 1065 schedule b 2?

airSlate SignNow includes features such as customizable templates, secure electronic signatures, and integration with popular accounting software. These tools make it easier to manage the 1065 schedule b 2 accurately and efficiently.

-

Can I integrate airSlate SignNow with other software for tax filing?

Yes, airSlate SignNow integrates with various accounting and tax software to streamline the completion and filing of forms like the 1065 schedule b 2. This integration ensures that all your documents are easily accessible and can be managed in one cohesive system.

-

What are the benefits of using airSlate SignNow for the 1065 schedule b 2?

Using airSlate SignNow for the 1065 schedule b 2 offers several benefits, including reduced paperwork, improved accuracy through digital form management, and secure document storage. These advantages help partnerships save time and maintain compliance with tax regulations.

-

Is airSlate SignNow user-friendly for first-time users completing the 1065 schedule b 2?

Absolutely! airSlate SignNow is designed with user experience in mind, making it accessible for individuals unfamiliar with the 1065 schedule b 2. The platform provides guided prompts and tips, ensuring a smooth experience for all users.

Get more for Schedule B 2 Form 1065

- Divorce papers 100308874 form

- Change of trustees cac form

- Nashville number system chart pdf form

- Gcdf application form

- Ssf4337a apat certificate of wellness form

- Usar form 140 r 467226430

- Fillable online www2 erie affirmation of self quarantine form

- Fall risk checklist patient date fall risk factor form

Find out other Schedule B 2 Form 1065

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online