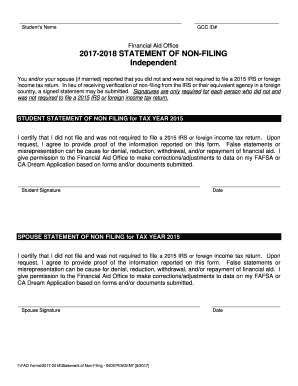

Financial Aid Office STATEMENT of NON FILING Form

IRS Guidelines

The IRS provides specific guidelines for tax filing federal, ensuring that taxpayers understand their obligations and the necessary steps to comply. These guidelines outline the required forms, deadlines, and eligibility criteria for various filing statuses. Taxpayers should familiarize themselves with the relevant IRS publications, which detail the rules for income reporting, deductions, and credits. Understanding these guidelines can help prevent errors and ensure that filings are accurate and complete.

Filing Deadlines / Important Dates

Filing deadlines are crucial for tax compliance. Typically, the deadline for filing federal income tax returns is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of deadlines for extensions, estimated tax payments, and other relevant dates. Keeping track of these important dates helps avoid penalties and ensures timely submission of tax documents.

Required Documents

When preparing for tax filing federal, specific documents are essential to ensure accuracy and compliance. Commonly required documents include W-2 forms from employers, 1099 forms for freelance income, and receipts for deductible expenses. Taxpayers may also need documentation related to investments, mortgage interest, and educational expenses. Gathering these documents in advance can streamline the filing process and reduce the likelihood of errors.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting their federal tax filings. They can file online using e-filing services, which offer convenience and faster processing times. Alternatively, taxpayers can choose to mail their completed forms to the appropriate IRS address or submit them in person at designated IRS offices. Each method has its advantages, and taxpayers should select the one that best fits their needs and preferences.

Penalties for Non-Compliance

Failing to comply with tax filing requirements can result in significant penalties. The IRS imposes fines for late filings, underpayment of taxes, and failure to pay taxes owed. Understanding these penalties is essential for taxpayers to avoid unexpected financial burdens. It is advisable to file returns on time and pay any taxes owed to minimize the risk of incurring penalties.

Eligibility Criteria

Eligibility criteria for tax filing federal can vary based on factors such as income level, filing status, and age. For example, certain income thresholds determine whether a taxpayer is required to file a return. Additionally, specific credits and deductions may only be available to individuals who meet certain criteria. Understanding these eligibility requirements is vital for ensuring compliance and maximizing potential tax benefits.

Quick guide on how to complete financial aid office 2017 2018 statement of non filing

Complete Financial Aid Office STATEMENT OF NON FILING effortlessly on any gadget

Digital document management has gained signNow popularity among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to obtain the correct form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your files promptly without delays. Manage Financial Aid Office STATEMENT OF NON FILING on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to edit and eSign Financial Aid Office STATEMENT OF NON FILING without any hassle

- Find Financial Aid Office STATEMENT OF NON FILING and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Select key sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements with just a few clicks from any device you prefer. Edit and eSign Financial Aid Office STATEMENT OF NON FILING and guarantee effective communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it help with tax filing federal?

airSlate SignNow is an intuitive eSignature solution that enables businesses to send and eSign documents quickly and efficiently. For tax filing federal, this tool simplifies the process by allowing users to securely sign and send tax-related documents online, ensuring compliance and speed.

-

Is airSlate SignNow suitable for individual tax filing federal needs?

Yes, airSlate SignNow caters to both individuals and businesses, making it ideal for those managing their own tax filing federal requirements. Its user-friendly interface allows individuals to easily navigate document signing and submission for their federal taxes.

-

What are the pricing options for airSlate SignNow when handling tax filing federal?

airSlate SignNow offers flexible pricing plans that accommodate various needs, making it cost-effective for tax filing federal. Whether you're an individual or a large organization, you can choose a plan that suits your budget while ensuring essential features for efficient document management.

-

What features does airSlate SignNow offer that benefit tax filing federal?

airSlate SignNow includes key features such as customizable templates, secure document storage, and tracking capabilities that enhance tax filing federal. These features help streamline workflows and ensure that all documents are properly signed and managed throughout the tax process.

-

Can airSlate SignNow integrate with accounting software for tax filing federal?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software, enhancing your tax filing federal experience. These integrations allow for smooth data transfer and more efficient document management, making tax season easier to navigate.

-

How secure is airSlate SignNow for handling tax filing federal documents?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive information like tax filing federal documents. The platform employs advanced encryption and complies with industry standards to ensure that your documents are safe and secure throughout the signing process.

-

Does airSlate SignNow provide support for tax filing federal-related queries?

Yes, airSlate SignNow offers comprehensive customer support to assist with any tax filing federal-related queries. Our support team is available to help you navigate the platform and answer any questions regarding the eSigning of federal tax documents.

Get more for Financial Aid Office STATEMENT OF NON FILING

Find out other Financial Aid Office STATEMENT OF NON FILING

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation