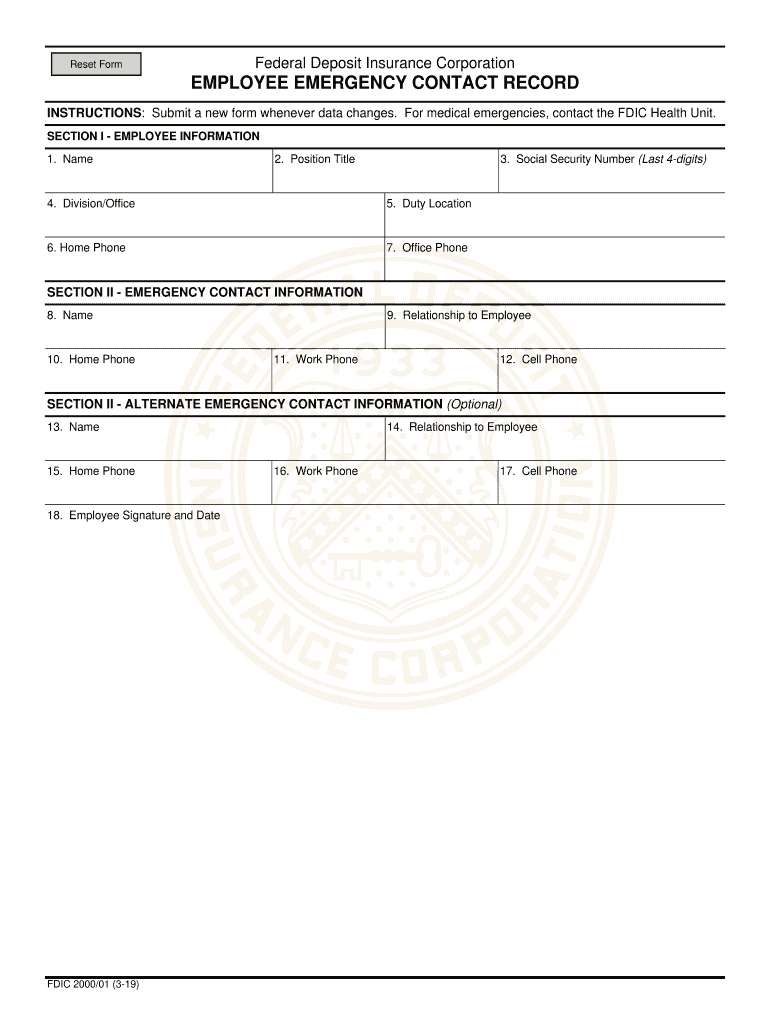

Federal Deposit Insurance Corporation Form

What is the Federal Deposit Insurance Corporation

The Federal Deposit Insurance Corporation (FDIC) is an independent agency of the United States government that was created in 1933. Its primary purpose is to maintain public confidence in the nation’s financial system by protecting depositors. The FDIC provides insurance coverage for deposits at member banks, ensuring that even if a bank fails, depositors will not lose their insured funds. The standard insurance amount is up to $250,000 per depositor, per insured bank, for each account ownership category.

How to use the Federal Deposit Insurance Corporation

Using the services of the Federal Deposit Insurance Corporation involves understanding the insurance coverage provided for your deposits. To ensure your funds are protected, it is essential to know which accounts are insured and the limits of that insurance. You can check if your bank is FDIC-insured by visiting the FDIC's official website. Additionally, the FDIC offers resources and tools to help consumers make informed decisions about their banking options, including calculators to assess insurance coverage based on account types.

Steps to complete the Federal Deposit Insurance Corporation

Completing the necessary steps to ensure your deposits are covered by the FDIC involves the following actions:

- Verify that your bank is FDIC-insured.

- Understand the different ownership categories, such as individual accounts, joint accounts, and retirement accounts.

- Determine the total amount of your deposits across different banks to ensure you remain within the insurance limits.

- Regularly review your accounts and banking relationships to maintain adequate coverage.

Legal use of the Federal Deposit Insurance Corporation

The legal use of the Federal Deposit Insurance Corporation is rooted in its mandate to protect depositors. The FDIC operates under the Federal Deposit Insurance Act, which outlines the insurance coverage it provides. It is important for consumers to understand their rights regarding deposit insurance, including how to file claims in the event of a bank failure. The FDIC also plays a role in regulating and supervising financial institutions to ensure compliance with banking laws and regulations.

Eligibility Criteria

Eligibility for FDIC insurance is generally straightforward. All deposits made at FDIC-insured banks are covered up to the insurance limit, provided they are in qualifying accounts. This includes checking accounts, savings accounts, money market accounts, and certificates of deposit (CDs). However, certain types of accounts, such as investment accounts or securities, are not insured by the FDIC. It is essential to review the specific terms of your accounts to confirm their eligibility for coverage.

Form Submission Methods (Online / Mail / In-Person)

While the Federal Deposit Insurance Corporation itself does not require specific forms for deposit insurance, it is important to know how to communicate with the FDIC or your bank regarding your accounts. Most inquiries can be handled online through the FDIC's official website or your bank's online banking platform. For more formal requests or claims, you may need to submit documentation via mail or in person at your bank's branch. Always ensure that you keep copies of any correspondence for your records.

Quick guide on how to complete federal deposit insurance corporation

Complete Federal Deposit Insurance Corporation effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly without interruptions. Manage Federal Deposit Insurance Corporation on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Federal Deposit Insurance Corporation with ease

- Locate Federal Deposit Insurance Corporation and click Obtain Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Finished button to save your changes.

- Choose your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, laborious form searches, or errors that necessitate reprinting documents. airSlate SignNow addresses all your requirements in document management in just a few clicks from a device of your preference. Adjust and electronically sign Federal Deposit Insurance Corporation to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the role of the federal deposit insurance corporation in banking?

The federal deposit insurance corporation (FDIC) is a government agency that protects depositors by insuring deposits in member banks. This insurance ensures that even if a bank fails, customers are not at risk of losing their money up to the insured limit, promoting trust and stability in the banking sector.

-

How does airSlate SignNow ensure compliance with federal deposit insurance corporation regulations?

airSlate SignNow complies with federal deposit insurance corporation regulations by implementing security measures to protect sensitive financial information. Our platform uses encryption and secure access protocols, ensuring that all documents handled meet industry standards for safety and compliance.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides a range of features for document management, including eSignature capabilities, templates for frequently used forms, and real-time tracking of document status. These tools streamline operations for businesses, ensuring that they remain compliant with the requirements set forth by the federal deposit insurance corporation.

-

Is airSlate SignNow cost-effective for small businesses covered by the federal deposit insurance corporation?

Yes, airSlate SignNow is a cost-effective solution for small businesses, particularly those whose banking operations are safeguarded by the federal deposit insurance corporation. Our pricing plans are designed to accommodate various budgets while providing essential features for secure document signing and management.

-

Can airSlate SignNow integrate with other financial software that adheres to federal deposit insurance corporation standards?

Absolutely! airSlate SignNow can integrate seamlessly with various financial software applications that comply with federal deposit insurance corporation standards. This makes it easier for businesses to manage their documents in conjunction with their existing systems, enhancing overall efficiency.

-

What benefits can businesses expect when using airSlate SignNow regarding federal deposit insurance corporation compliance?

Businesses using airSlate SignNow can benefit from streamlined document workflows that help maintain compliance with federal deposit insurance corporation standards. Our platform also minimizes the risk of errors, ensuring that all transactions are conducted securely and efficiently, protecting both the business and its clients.

-

How does airSlate SignNow help in protecting sensitive information related to the federal deposit insurance corporation?

airSlate SignNow employs advanced encryption technologies to protect sensitive information linked to the federal deposit insurance corporation. By securing data throughout the eSigning process, we help ensure that your documents remain confidential and protected from potential bsignNowes.

Get more for Federal Deposit Insurance Corporation

Find out other Federal Deposit Insurance Corporation

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself