Montana Pte Form

What is the Montana Pte Form

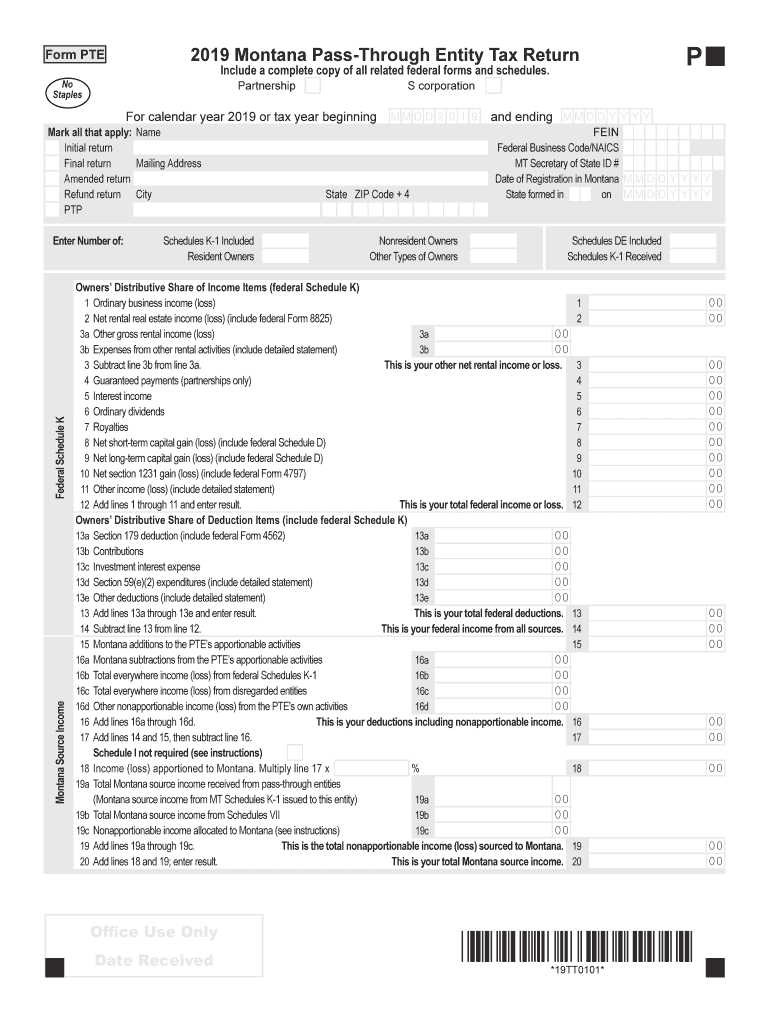

The Montana Pte Form is a tax document specifically designed for pass-through entities in Montana. This form is essential for entities such as partnerships, S corporations, and limited liability companies that choose to pass their income, deductions, and credits through to their owners. By using this form, these entities can report their income and ensure compliance with state tax regulations. Understanding the purpose and function of the Montana Pte Form is crucial for accurate tax filing and to avoid potential penalties.

Steps to complete the Montana Pte Form

Completing the Montana Pte Form involves several key steps that ensure accurate reporting of income and expenses. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form by providing details about the entity, such as its name, address, and federal identification number. Be sure to report all income earned and deductions claimed accurately. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the form by the designated deadline to avoid any penalties.

Legal use of the Montana Pte Form

The legal use of the Montana Pte Form requires compliance with state tax laws. This form must be filled out accurately to reflect the entity's financial activities. It serves as an official record for the state of Montana, ensuring that the entity pays the appropriate taxes based on its income. Additionally, the form must be signed by an authorized representative of the entity, affirming that the information provided is true and complete. Failure to comply with these legal requirements can result in penalties or audits.

Filing Deadlines / Important Dates

Filing deadlines for the Montana Pte Form are critical to ensure timely compliance with state tax regulations. Typically, the form is due on the 15th day of the fourth month after the end of the entity's tax year. For entities operating on a calendar year, this means the form is generally due by April 15. It is important to stay informed about any changes to these deadlines, as late submissions can incur penalties and interest on unpaid taxes.

Required Documents

To successfully complete the Montana Pte Form, certain documents are required. These typically include financial statements that detail the entity's income and expenses, previous tax returns, and any supporting documentation for deductions claimed. It is essential to have accurate and complete records to ensure the form is filled out correctly. Keeping organized documentation can help streamline the process and reduce the risk of errors.

Form Submission Methods (Online / Mail / In-Person)

The Montana Pte Form can be submitted through various methods, providing flexibility for entities. Submissions can be made online through the Montana Department of Revenue’s website, which offers a convenient and efficient way to file. Alternatively, entities can choose to mail the completed form to the appropriate state office. In-person submissions may also be possible at designated state tax offices. Each method has its own processing times and requirements, so it is advisable to choose the one that best fits the entity's needs.

Penalties for Non-Compliance

Non-compliance with the requirements of the Montana Pte Form can lead to significant penalties. Entities that fail to file the form by the deadline may incur late fees and interest on any taxes owed. Additionally, inaccuracies in the form can trigger audits and further penalties if discrepancies are found. It is essential for entities to understand these potential consequences and take proactive measures to ensure compliance with all filing requirements.

Quick guide on how to complete montana pte form

Effortlessly Prepare Montana Pte Form on Any Device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, enabling you to locate the right form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without any delays. Handle Montana Pte Form on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The Easiest Way to Modify and eSign Montana Pte Form with Ease

- Obtain Montana Pte Form and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for delivering your form, either via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and eSign Montana Pte Form and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the main features of airSlate SignNow for managing my tax return mt?

airSlate SignNow offers a user-friendly platform that enables you to send and eSign documents quickly and securely. For your tax return mt, you can easily track and manage your documents, ensuring compliance and reducing errors. Additionally, features like workflow automation can streamline the process, saving you time and hassle.

-

How does airSlate SignNow improve the tax return mt process?

With airSlate SignNow, the tax return mt process is simplified through digital document management and electronic signatures. This reduces the reliance on paper and manual processes, enhancing efficiency. You can prepare, sign, and send documents from anywhere, making it a convenient solution for busy professionals.

-

What pricing plans does airSlate SignNow offer for tax return mt services?

airSlate SignNow offers flexible pricing plans to cater to different business sizes and needs, starting with a free trial for new users. Each plan includes features tailored for tax return mt, like advanced eSigning options and document templates. It's a cost-effective solution, especially for small to medium-sized businesses.

-

Can I integrate airSlate SignNow with accounting software for tax return mt purposes?

Yes, airSlate SignNow integrates seamlessly with various accounting software solutions to simplify your tax return mt management. This integration allows for automatic data entry and document generation, saving you time and minimizing the risk of errors. Check our integration options to see the specific software we support.

-

Is airSlate SignNow secure for submitting my tax return mt documents?

Absolutely! airSlate SignNow employs industry-leading security measures to protect your tax return mt documents. With encryption, secure data storage, and authentication features, you can trust that your sensitive information remains confidential and secure throughout the signing process.

-

Can I access airSlate SignNow from multiple devices while working on my tax return mt?

Yes, airSlate SignNow is cloud-based, allowing you to access your account from any device with an internet connection. Whether you’re working on your tax return mt from your office computer, tablet, or smartphone, you can manage and sign documents efficiently. This flexibility enhances your ability to stay organized and productive.

-

What support options are available for airSlate SignNow users handling tax return mt?

airSlate SignNow provides comprehensive support for users dealing with their tax return mt, including live chat, email support, and a resourceful help center. Whether you have questions about features or need assistance with your account, our support team is here to help you every step of the way. Plus, you can find numerous tutorials and guides to navigate the platform easily.

Get more for Montana Pte Form

Find out other Montana Pte Form

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter