Determining Support Form

What is the Determining Support

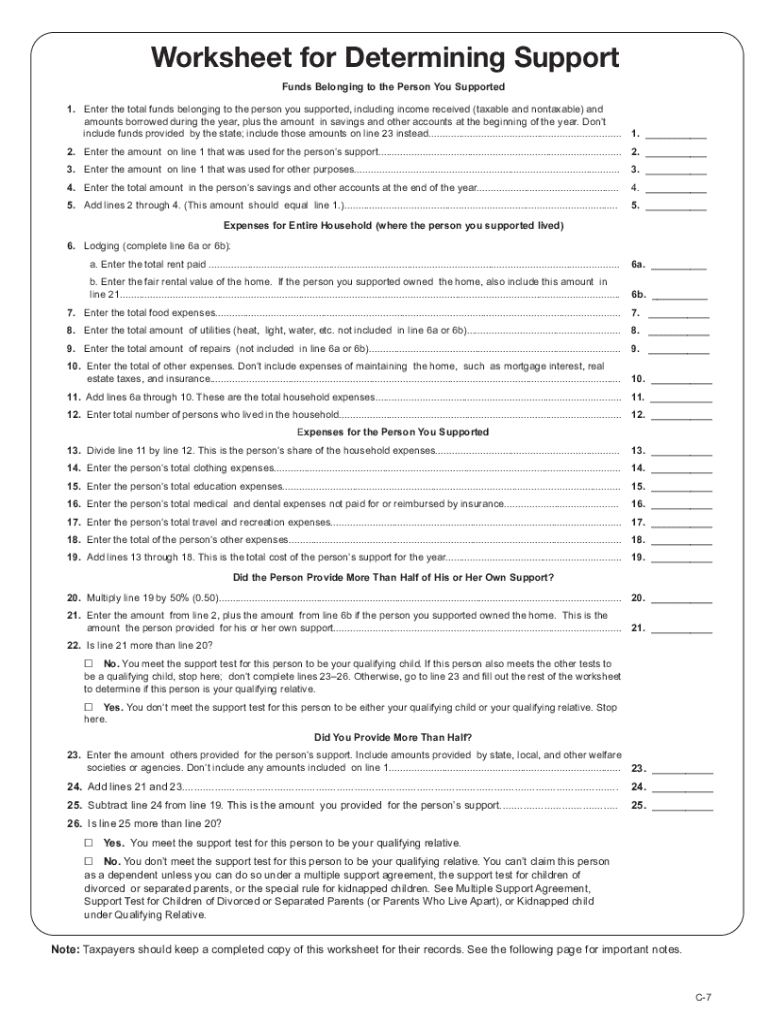

The Determining Support is a crucial document used by the Internal Revenue Service (IRS) to assess various tax obligations. It provides essential information that taxpayers must submit to ensure compliance with federal tax laws. This form is particularly important for individuals and businesses who need to clarify their tax status or report specific financial details to the IRS. Understanding what this support entails helps users navigate their tax responsibilities effectively.

How to Use the Determining Support

Using the Determining Support involves several steps. First, gather all necessary financial documents, such as income statements and expense records. Next, accurately fill out the form, ensuring that all information is complete and truthful. Once completed, review the form for any errors or omissions. It is advisable to consult with a tax professional if there are uncertainties regarding specific entries. Finally, submit the form to the IRS using the preferred method, which may include online submission or mailing a hard copy.

Steps to Complete the Determining Support

Completing the Determining Support requires careful attention to detail. Follow these steps:

- Gather relevant financial documents, including W-2s, 1099s, and receipts.

- Download the latest version of the Determining Support from the IRS website.

- Fill in personal information, including your name, address, and Social Security number.

- Provide detailed financial information as required by the form.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal Use of the Determining Support

The legal use of the Determining Support is governed by IRS regulations. To be considered valid, the form must be filled out accurately and submitted within the designated timeframes. Compliance with eSignature laws is also essential if the form is submitted electronically. This ensures that the submission is legally binding and recognized by the IRS. Understanding these legal requirements helps taxpayers avoid potential issues with their tax filings.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Determining Support. These guidelines include instructions on what information is required, how to fill out each section of the form, and the deadlines for submission. It is crucial for users to familiarize themselves with these guidelines to ensure their forms are processed without delays. The IRS website offers resources and FAQs that can assist in clarifying any uncertainties regarding the form.

Required Documents

When filling out the Determining Support, certain documents are required to substantiate the information provided. These may include:

- Proof of income (e.g., W-2 forms, 1099 forms).

- Expense documentation (e.g., receipts, invoices).

- Identification documents (e.g., Social Security card, driver's license).

Having these documents ready will facilitate a smoother completion process and help ensure compliance with IRS requirements.

Quick guide on how to complete determining support

Effortlessly Prepare Determining Support on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, enabling you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, modify, and electronically sign your documents without any delays. Handle Determining Support on any platform with airSlate SignNow's Android or iOS applications and streamline any document-based operation today.

The easiest method to modify and electronically sign Determining Support with ease

- Locate Determining Support and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important portions of your documents or redact sensitive information with tools specifically provided by airSlate SignNow.

- Generate your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Determining Support and guarantee excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the IRS support form and how does it work?

The IRS support form is a document that allows individuals and businesses to request assistance or clarification regarding tax-related issues. With airSlate SignNow, you can easily fill out and eSign the IRS support form online, streamlining the submission process and reducing the time spent on paperwork.

-

How can airSlate SignNow help me with the IRS support form?

airSlate SignNow provides a user-friendly platform that simplifies the creation and signing of the IRS support form. Our solution ensures that your documents are secure, easily accessible, and can be sent electronically, which is particularly useful for staying compliant with IRS requirements.

-

Are there any costs associated with using airSlate SignNow for the IRS support form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. We provide a cost-effective solution for handling the IRS support form and other documents, which helps businesses save both time and money while ensuring efficiency in document management.

-

What features does airSlate SignNow offer for the IRS support form?

airSlate SignNow includes features such as in-person signing, document templates, and the ability to track document status in real-time. These capabilities enhance the process of managing your IRS support form and ensure that you are always updated on its progress.

-

Can I integrate airSlate SignNow with my existing software for the IRS support form?

Absolutely! airSlate SignNow offers seamless integrations with various business software such as CRM systems, accounting platforms, and cloud storage services. This ensures that working on your IRS support form is more efficient and fits easily into your existing workflows.

-

Is it safe to eSign the IRS support form using airSlate SignNow?

Yes, security is a top priority for airSlate SignNow. We use advanced encryption methods to protect your documents and ensure that your IRS support form is handled with the utmost confidentiality and compliance with industry standards.

-

What benefits does using airSlate SignNow provide when dealing with the IRS support form?

Using airSlate SignNow for your IRS support form allows for faster processing and improved accuracy in filling out forms. It eliminates the traditional hassles of paper signing, resulting in a more efficient submission process that can save you time and help prevent errors.

Get more for Determining Support

- Contoh surat penutupan akaun tnb form

- Texas bill of sale vehicle form

- Massage and bodywork intake form studio g salon amp spa

- Lodgify rental agreement form

- Strawberry order form

- Civil rights complaint sample form

- Snipef certificate fill online printable fillable blank form

- Epionce skin peel consent form

Find out other Determining Support

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free