Grantor Trusts ExplainedKnox McLaughlin Gornall & Sennett, P C Form

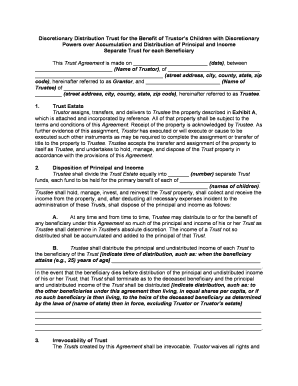

What is the Grantor Trust?

A grantor trust is a type of trust where the grantor retains control over the assets and income generated by the trust. This means that the grantor is responsible for reporting the income on their personal tax return, making it a popular choice for estate planning. The primary benefit of a grantor trust is that it allows the grantor to maintain flexibility and control over the assets while potentially avoiding probate. Additionally, the income generated by the trust is typically taxed at the grantor's personal tax rate, which can be advantageous in certain situations.

Steps to Complete the Grantor Trusts Explained

Completing the Grantor Trusts Explained form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary information about the trust, including the names of the grantor, trustee, and beneficiaries. Next, fill out the form with precise details regarding the trust's assets, income, and any specific provisions. It is essential to review the form for completeness and accuracy before submission. Once finalized, the form can be signed electronically, ensuring a secure and efficient process. Utilizing a reliable eSignature platform can enhance the validity of the completed form.

Legal Use of the Grantor Trusts Explained

The legal use of the Grantor Trusts Explained form is crucial for establishing the trust's validity. To be legally binding, the form must comply with state laws governing trusts and estates. This includes proper execution, which often requires signatures from the grantor and trustee. Additionally, it is important to adhere to any specific state requirements, as these can vary significantly. Ensuring that the trust is properly funded and that all relevant documentation is maintained will further solidify its legal standing.

IRS Guidelines for Grantor Trusts

The Internal Revenue Service (IRS) provides specific guidelines for grantor trusts, particularly concerning tax reporting. Grantors must report income generated by the trust on their personal tax returns, typically using Form 1040. It is essential to understand how the trust's income impacts the grantor's tax situation, including potential deductions and credits. Familiarity with IRS regulations can help avoid penalties and ensure compliance with federal tax laws.

State-Specific Rules for Grantor Trusts

State-specific rules play a significant role in the establishment and management of grantor trusts. Each state may have different regulations regarding the creation, funding, and taxation of trusts. It is important for grantors to consult with legal professionals familiar with their state's laws to ensure compliance. Understanding these rules can help prevent legal issues and ensure that the trust operates as intended.

Examples of Using the Grantor Trusts Explained

Grantor trusts can serve various purposes in estate planning. For instance, a grantor may use this type of trust to manage assets for minor children, ensuring that funds are available for education and other needs. Another example is using a grantor trust to hold real estate, allowing the grantor to retain control while potentially reducing estate taxes. These examples illustrate the versatility of grantor trusts in achieving specific financial and estate planning goals.

Required Documents for Grantor Trusts

When establishing a grantor trust, certain documents are required to ensure its validity and compliance with legal standards. Essential documents may include a trust agreement, which outlines the terms and conditions of the trust, and a certificate of trust, which provides proof of the trust's existence. Additionally, any documents related to the assets being transferred into the trust, such as deeds or account statements, should be prepared. Having these documents organized and accessible will facilitate a smoother process for both the grantor and the trustee.

Quick guide on how to complete grantor trusts explainedknox mclaughlin gornall ampamp sennett pc

Effortlessly Prepare Grantor Trusts ExplainedKnox McLaughlin Gornall & Sennett, P C on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any hold-ups. Manage Grantor Trusts ExplainedKnox McLaughlin Gornall & Sennett, P C on any device using airSlate SignNow’s Android or iOS applications and enhance any document-driven process today.

How to Modify and Electronically Sign Grantor Trusts ExplainedKnox McLaughlin Gornall & Sennett, P C with Ease

- Find Grantor Trusts ExplainedKnox McLaughlin Gornall & Sennett, P C and click Get Form to begin.

- Make use of the tools we offer to complete your form.

- Emphasize important parts of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose your preferred method for sending your form, such as email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid documents, time-consuming form hunts, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and electronically sign Grantor Trusts ExplainedKnox McLaughlin Gornall & Sennett, P C and ensure effective communication throughout your document preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the grantor trusts explainedknox mclaughlin gornall ampamp sennett pc

The way to create an e-signature for a PDF document online

The way to create an e-signature for a PDF document in Google Chrome

The best way to generate an e-signature for signing PDFs in Gmail

How to make an electronic signature straight from your smart phone

The best way to generate an e-signature for a PDF document on iOS

How to make an electronic signature for a PDF document on Android OS

People also ask

-

What are grantor trusts and how are they explained by Knox McLaughlin Gornall & Sennett, P C.?

Grantor trusts are legal arrangements where the grantor maintains control over the assets placed in the trust. Knox McLaughlin Gornall & Sennett, P C. explains that these trusts are often used for estate planning, providing flexibility and potential tax benefits to the grantor and beneficiaries.

-

What are the benefits of using grantor trusts according to Knox McLaughlin Gornall & Sennett, P C.?

According to Knox McLaughlin Gornall & Sennett, P C., the benefits of grantor trusts include maintaining control over the trust assets, potential estate tax savings, and protecting assets from creditors. They also provide a streamlined way to transfer wealth to beneficiaries while avoiding probate.

-

How much does it cost to set up a grantor trust through Knox McLaughlin Gornall & Sennett, P C.?

The cost of setting up a grantor trust with Knox McLaughlin Gornall & Sennett, P C. can vary based on individual circumstances and requirements. They offer competitive pricing and a personalized consultation to help you understand the best options for your needs.

-

What features do grantor trusts typically include as explained by Knox McLaughlin Gornall & Sennett, P C.?

Grantor trusts typically include features such as the ability to manage, amend, or revoke the trust during the grantor's lifetime. Knox McLaughlin Gornall & Sennett, P C. emphasizes that these features make grantor trusts a flexible estate planning tool.

-

What makes Knox McLaughlin Gornall & Sennett, P C. an expert in grantor trusts?

Knox McLaughlin Gornall & Sennett, P C. has extensive experience and knowledge in estate planning, particularly with grantor trusts. Their team of legal professionals understands the nuances of the law and can guide clients in making informed decisions.

-

Can grantor trusts integrate with other estate planning tools recommended by Knox McLaughlin Gornall & Sennett, P C.?

Yes, grantor trusts can integrate seamlessly with other estate planning tools such as wills, powers of attorney, and living trusts. Knox McLaughlin Gornall & Sennett, P C. works to create a comprehensive estate plan that encompasses all these tools for maximum effectiveness.

-

How does Knox McLaughlin Gornall & Sennett, P C. assist clients with grantor trusts throughout the process?

Knox McLaughlin Gornall & Sennett, P C. provides assistance at every stage of the grantor trust process, from initial consultation to drafting and managing the trust. Their expert legal team is dedicated to ensuring that your estate planning needs are fully met.

Get more for Grantor Trusts ExplainedKnox McLaughlin Gornall & Sennett, P C

- Vehicle abandonment form

- Affidavit of vehicle ownership form

- Defence statement template word 74877094 form

- Group consent form template

- Rs 6277 form nys retirement

- Portierungserklrung vodafone pdf form

- Bc 100 bc 100 indiana business tax closure request form

- Business tangible personal property assessment form

Find out other Grantor Trusts ExplainedKnox McLaughlin Gornall & Sennett, P C

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document