Form HS 122 Vermont Department of Taxes Vermont Gov

What is the Form HS 122 Vermont Department Of Taxes Vermont gov

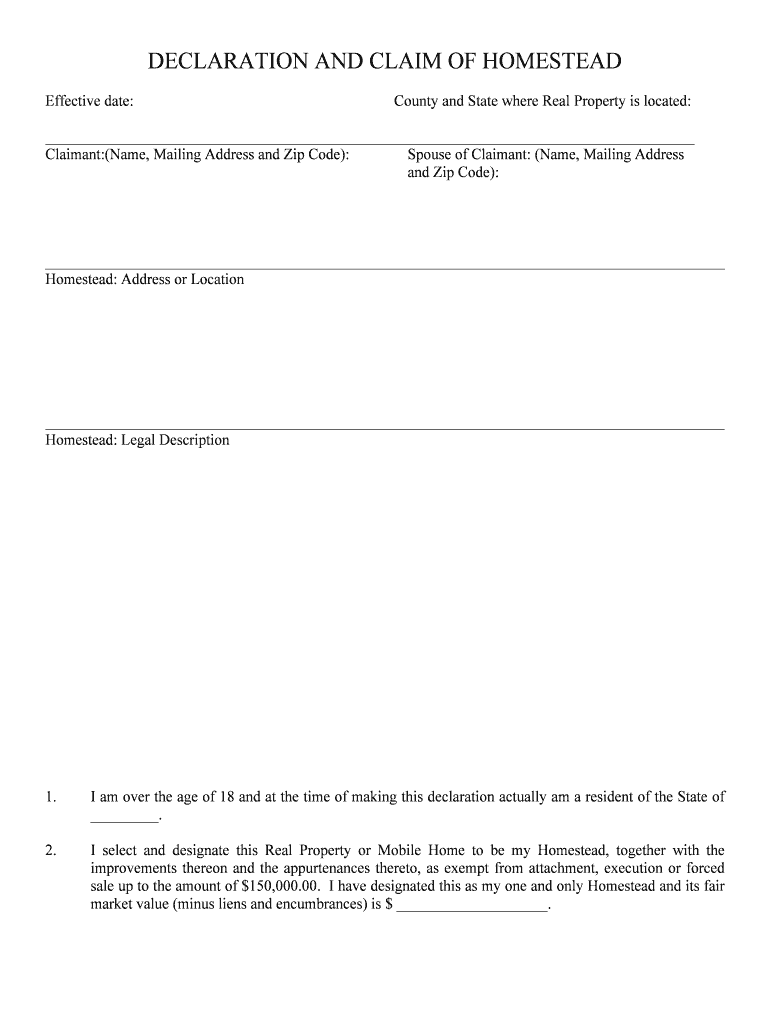

The Form HS 122 is a tax document issued by the Vermont Department of Taxes. It is primarily used for the purpose of reporting and claiming certain tax credits or adjustments. This form is essential for individuals or businesses seeking to ensure compliance with Vermont tax regulations. Understanding the specifics of this form can help taxpayers navigate their obligations effectively.

How to use the Form HS 122 Vermont Department Of Taxes Vermont gov

Using the Form HS 122 involves several key steps. First, ensure you have the correct version of the form, which can be obtained from the Vermont Department of Taxes website. Once you have the form, carefully read the instructions provided. Fill out the necessary fields accurately, providing all required information. After completing the form, review it for any errors before submission to ensure that it is processed without delays.

Steps to complete the Form HS 122 Vermont Department Of Taxes Vermont gov

Completing the Form HS 122 requires attention to detail. Follow these steps:

- Gather all necessary financial documents and information related to your tax situation.

- Download or print the Form HS 122 from the Vermont Department of Taxes website.

- Carefully fill in each section of the form, ensuring accuracy in your entries.

- Double-check all calculations and required signatures.

- Submit the completed form according to the instructions provided, either electronically or via mail.

Legal use of the Form HS 122 Vermont Department Of Taxes Vermont gov

The Form HS 122 is legally binding when filled out and submitted correctly. It must comply with Vermont tax laws and regulations. The information provided on the form should be truthful and complete to avoid penalties. Utilizing electronic signatures through secure platforms can enhance the legal validity of the form, ensuring that it meets all necessary legal requirements.

Key elements of the Form HS 122 Vermont Department Of Taxes Vermont gov

Key elements of the Form HS 122 include:

- Taxpayer identification information, such as name and Social Security number.

- Details regarding the specific tax credits or adjustments being claimed.

- Signature of the taxpayer or authorized representative.

- Date of submission.

Filing Deadlines / Important Dates

It is crucial to be aware of filing deadlines associated with the Form HS 122. Typically, forms must be submitted by the designated tax filing date, which may vary each year. Missing these deadlines can result in penalties or delays in processing. Always check the Vermont Department of Taxes website for the most current deadlines and important dates related to tax filings.

Quick guide on how to complete form hs 122 vermont department of taxes vermontgov

Effortlessly Prepare Form HS 122 Vermont Department Of Taxes Vermont gov on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents swiftly and without delays. Manage Form HS 122 Vermont Department Of Taxes Vermont gov on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Modify and eSign Form HS 122 Vermont Department Of Taxes Vermont gov with Ease

- Locate Form HS 122 Vermont Department Of Taxes Vermont gov and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools specifically designed for that function by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you want to send your form: via email, text message (SMS), or invite link, or download it to your local device.

Eliminate the worry of lost or misplaced files, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Edit and eSign Form HS 122 Vermont Department Of Taxes Vermont gov to ensure excellent communication throughout any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form HS 122 from the Vermont Department of Taxes?

Form HS 122 is a tax return form used by the Vermont Department of Taxes for homeowners to provide information regarding their property tax adjustments. By filling out this form, homeowners can potentially receive refunds or adjustments on their property taxes. It's essential to have the correct documentation ready when submitting Form HS 122 to ensure a smooth processing experience.

-

How can airSlate SignNow assist with filling out Form HS 122 from the Vermont Department of Taxes?

airSlate SignNow provides a user-friendly platform for digitally filling out and signing Form HS 122 for the Vermont Department of Taxes. It allows users to complete the form online, ensuring that all necessary fields are filled out accurately. Additionally, the platform enables you to securely store and share your completed forms, streamlining the submission process.

-

What are the pricing options for using airSlate SignNow for Form HS 122?

airSlate SignNow offers flexible pricing plans that cater to various business needs when processing documents like Form HS 122 from the Vermont Department of Taxes. Users can select from monthly or annual subscriptions based on their usage requirements. This cost-effective solution ensures that you can access the tools needed to handle important tax documents without breaking the budget.

-

Can I integrate airSlate SignNow with other tools I use for preparing Form HS 122?

Yes, airSlate SignNow integrates seamlessly with a variety of applications and tools that can assist in preparing Form HS 122 for the Vermont Department of Taxes. You can connect it with cloud storage services, CRM systems, and other document management tools to streamline your workflow. This integration capability ensures that your document handling process is efficient and organized.

-

What features does airSlate SignNow offer for managing Form HS 122 submissions?

airSlate SignNow provides several features for managing Form HS 122 submissions effectively, including electronic signatures, secure document storage, and real-time tracking. These features allow users to track the status of their submissions and ensure compliance with the Vermont Department of Taxes regulations. The platform enhances communication and collaboration among team members involved in the process.

-

How does airSlate SignNow ensure the security of Form HS 122 information?

Security is a top priority for airSlate SignNow when handling sensitive information like that found on Form HS 122 for the Vermont Department of Taxes. The platform employs industry-standard encryption and secure servers to protect your data at all times. Additionally, user access controls help ensure that only authorized personnel can view or modify documents.

-

Can I access Form HS 122 on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is fully optimized for mobile devices, allowing you to access and complete Form HS 122 from anywhere. This flexibility ensures that you can manage your tax documents on the go, making it easier to stay organized and meet submission deadlines. The mobile app provides the same features and security as the desktop version.

Get more for Form HS 122 Vermont Department Of Taxes Vermont gov

Find out other Form HS 122 Vermont Department Of Taxes Vermont gov

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation