Special Needs Trust Elder Law & Medicaid Planning Attorneys Form

What is the Special Needs Trust Elder Law & Medicaid Planning Attorneys

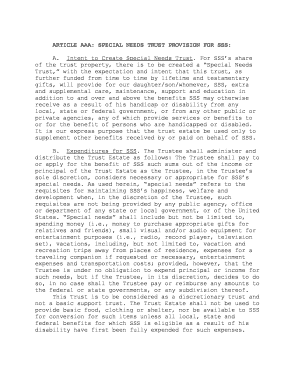

A Special Needs Trust is a legal arrangement designed to provide financial support for individuals with disabilities without jeopardizing their eligibility for government benefits. This type of trust allows funds to be set aside for the benefit of a person with special needs, ensuring that they can receive care and support while maintaining access to essential services like Medicaid. Elder law and Medicaid planning attorneys specialize in creating these trusts, ensuring they comply with state and federal laws.

Key Elements of the Special Needs Trust Elder Law & Medicaid Planning Attorneys

Several key elements define a Special Needs Trust. These include:

- Beneficiary: The individual with special needs who will benefit from the trust.

- Trustee: The person or entity responsible for managing the trust and ensuring funds are used for the beneficiary's needs.

- Trust Document: A legal document outlining the terms of the trust, including how funds can be used and the powers of the trustee.

- Funding Sources: Various assets, such as cash, property, or investments, can be placed in the trust to support the beneficiary.

Steps to Complete the Special Needs Trust Elder Law & Medicaid Planning Attorneys

Completing a Special Needs Trust involves several important steps:

- Consultation: Meet with an elder law or Medicaid planning attorney to discuss your specific needs and goals.

- Drafting the Trust: The attorney will create a trust document tailored to your situation, including all necessary provisions.

- Funding the Trust: Transfer assets into the trust, ensuring they are designated for the benefit of the individual with special needs.

- Review and Sign: Review the trust document carefully and sign it in accordance with state laws to make it legally binding.

Legal Use of the Special Needs Trust Elder Law & Medicaid Planning Attorneys

The legal use of a Special Needs Trust is crucial for protecting the beneficiary's rights and benefits. This trust must comply with specific regulations to ensure that it does not interfere with government assistance programs. For example, funds from the trust can be used for supplemental needs, such as education, therapy, and recreational activities, without affecting eligibility for Medicaid or Supplemental Security Income (SSI).

Eligibility Criteria

Eligibility for establishing a Special Needs Trust generally requires that the beneficiary has a qualifying disability as defined by state or federal regulations. Additionally, the trust must be set up with the intent to benefit the individual without disqualifying them from receiving essential government benefits. It is advisable to consult with an attorney to understand the specific criteria that apply in your state.

How to Obtain the Special Needs Trust Elder Law & Medicaid Planning Attorneys

To obtain a Special Needs Trust, individuals should seek the assistance of an elder law or Medicaid planning attorney. These professionals have the expertise to guide you through the process, ensuring that all legal requirements are met. The attorney will help gather necessary documentation, draft the trust, and provide ongoing support to manage the trust effectively.

Quick guide on how to complete special needs trust elder law ampamp medicaid planning attorneys

Complete Special Needs Trust Elder Law & Medicaid Planning Attorneys effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the features required to create, modify, and eSign your documents quickly without delays. Manage Special Needs Trust Elder Law & Medicaid Planning Attorneys on any device using the airSlate SignNow Android or iOS applications and simplify your document-based tasks today.

The easiest way to alter and eSign Special Needs Trust Elder Law & Medicaid Planning Attorneys without hassle

- Acquire Special Needs Trust Elder Law & Medicaid Planning Attorneys and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Select how you want to send your form, via email, SMS, invite link, or download it to your computer.

Set aside concerns about lost or misplaced files, tedious document searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from the device of your choice. Alter and eSign Special Needs Trust Elder Law & Medicaid Planning Attorneys and guarantee effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Special Needs Trust and why do I need one?

A Special Needs Trust is an essential legal tool designed to protect the financial assets of individuals with disabilities while maintaining their eligibility for Medicaid and other government benefits. Engaging with experienced Special Needs Trust Elder Law & Medicaid Planning Attorneys ensures that your trust complies with relevant laws and effectively meets your loved one’s needs.

-

How much do Special Needs Trust services cost?

The costs associated with setting up a Special Needs Trust can vary signNowly based on the complexity of your needs and the expertise of the Special Needs Trust Elder Law & Medicaid Planning Attorneys you choose. Generally, initial setup fees may range from a few hundred to a few thousand dollars, depending on the legal services provided.

-

What are the main benefits of using Special Needs Trust Elder Law & Medicaid Planning Attorneys?

Special Needs Trust Elder Law & Medicaid Planning Attorneys offer invaluable expertise in navigating the Medicaid system, ensuring that your loved ones maintain eligibility for vital benefits while enjoying additional financial resources. Their guidance can greatly enhance the quality of life for individuals with special needs.

-

Can I manage a Special Needs Trust on my own?

While managing a Special Needs Trust independently is possible, it is highly recommended to seek assistance from Special Needs Trust Elder Law & Medicaid Planning Attorneys. They can help you avoid potential pitfalls and ensure the trust operates according to both your wishes and legal requirements.

-

How can a Special Needs Trust affect Medicaid eligibility?

A properly structured Special Needs Trust can allow individuals with disabilities to retain their eligibility for Medicaid benefits. By placing assets in a Special Needs Trust, those funds are typically not counted as resources, thus not interfering with Medicaid qualification.

-

What features should I look for in a Special Needs Trust attorney?

When choosing Special Needs Trust Elder Law & Medicaid Planning Attorneys, look for attorneys with extensive experience in disability law, positive client reviews, and a deep understanding of Medicaid regulations. It is also beneficial to select attorneys who offer personalized services and ongoing support for your trust.

-

How long does it take to establish a Special Needs Trust?

The timeline for establishing a Special Needs Trust can vary but typically takes a few weeks after all necessary documentation is gathered. Collaborating with knowledgeable Special Needs Trust Elder Law & Medicaid Planning Attorneys can expedite the process and help ensure all legal requirements are met promptly.

Get more for Special Needs Trust Elder Law & Medicaid Planning Attorneys

Find out other Special Needs Trust Elder Law & Medicaid Planning Attorneys

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation