Request for Compromise on a Debt Form

What is the Request For Compromise On A Debt

The Request For Compromise On A Debt is a formal document submitted to a creditor or financial institution, seeking a reduction in the total amount owed. This request is typically made when a debtor is experiencing financial hardship and cannot meet the original terms of repayment. By submitting this request, individuals aim to negotiate a more manageable payment plan or a lower settlement amount. Understanding the purpose and implications of this form is crucial for anyone looking to alleviate their debt burden.

Steps to complete the Request For Compromise On A Debt

Completing the Request For Compromise On A Debt involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense reports, to support your case. Next, clearly outline your reasons for requesting a compromise, detailing your financial situation and the inability to pay the full amount. Fill out the form completely, ensuring all required fields are addressed. Finally, review the document for any errors before submitting it to the creditor, either online or via mail, depending on their submission guidelines.

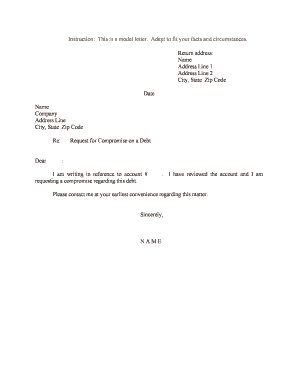

Key elements of the Request For Compromise On A Debt

Several essential elements must be included in the Request For Compromise On A Debt to enhance its effectiveness. These elements typically include:

- Personal Information: Your name, address, and contact details.

- Creditor Information: The name and address of the creditor or financial institution.

- Debt Details: A description of the debt, including the total amount owed.

- Financial Disclosure: A summary of your income, expenses, and any other relevant financial obligations.

- Compromise Proposal: A clear statement of the amount you are willing to pay and the reasons for this request.

Legal use of the Request For Compromise On A Debt

The legal use of the Request For Compromise On A Debt is governed by various laws and regulations that protect both debtors and creditors. When submitted correctly, this form can serve as a binding agreement if both parties reach a settlement. It is essential to ensure compliance with relevant state and federal laws, as improper use of the form may lead to legal complications. Understanding your rights and obligations under the law can help in effectively negotiating a compromise.

Eligibility Criteria

To qualify for a Request For Compromise On A Debt, certain eligibility criteria must be met. Generally, individuals must demonstrate financial hardship, which could include job loss, medical expenses, or other significant financial burdens. Creditors may also consider the debtor's payment history and overall financial stability. Meeting these criteria can significantly increase the chances of a successful compromise.

Form Submission Methods

The Request For Compromise On A Debt can be submitted through various methods, depending on the creditor's policies. Common submission methods include:

- Online Submission: Many creditors offer digital platforms for submitting requests, making the process quicker and more efficient.

- Mail: Traditional mail is still a viable option, allowing for physical documentation to be sent directly to the creditor.

- In-Person: Some individuals may choose to submit their request in person, providing an opportunity for immediate discussion with a representative.

Quick guide on how to complete request for compromise on a debt

Prepare Request For Compromise On A Debt effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Request For Compromise On A Debt on any device with airSlate SignNow's Android or iOS applications and streamline any document-based process today.

How to edit and eSign Request For Compromise On A Debt with ease

- Locate Request For Compromise On A Debt and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Request For Compromise On A Debt to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Request For Compromise On A Debt?

A Request For Compromise On A Debt is a formal proposal made to a creditor, asking them to accept a reduced amount as payment for a debt. This process allows individuals to negotiate their obligations and can lead to financial relief. Using airSlate SignNow can streamline this process by providing an efficient way to sign and send the necessary documents.

-

How can airSlate SignNow help with my Request For Compromise On A Debt?

airSlate SignNow offers an intuitive platform for creating, signing, and sending documents related to a Request For Compromise On A Debt. Its eSignature capabilities ensure that all agreements are legally binding and can accelerate the negotiation process. By using this tool, you can manage all necessary paperwork swiftly and efficiently.

-

What features does airSlate SignNow provide for debt negotiation documents?

airSlate SignNow provides a range of features for debt negotiation documents, including customizable templates for a Request For Compromise On A Debt. Additionally, users benefit from secure eSigning, document tracking, and cloud storage. These features make it easier to manage multiple requests and keep track of the negotiations.

-

Is there a cost associated with using airSlate SignNow for managing debt compromise requests?

Yes, there is a pricing structure for using airSlate SignNow, but it is designed to be cost-effective for businesses of all sizes. Depending on your needs, you can choose from several subscription plans that offer different features. Investing in this tool can save you time and effort when processing a Request For Compromise On A Debt.

-

What benefits do I get from using airSlate SignNow for my Request For Compromise On A Debt?

The primary benefits of using airSlate SignNow for a Request For Compromise On A Debt include increased efficiency, enhanced security, and better document management. By digitizing your paperwork, you can reduce turnaround time and ensure that all documents are completed accurately. This can signNowly improve the chances of achieving a favorable outcome in your negotiations.

-

Can I integrate airSlate SignNow with other tools I use?

Yes, airSlate SignNow supports seamless integrations with various third-party applications. This allows you to connect it with your favorite tools, such as CRM systems and cloud storage solutions. Integrating SignNow can enhance your workflow, especially when preparing a Request For Compromise On A Debt and managing related communications.

-

How secure is airSlate SignNow for handling sensitive debt documents?

Security is a top priority for airSlate SignNow. The platform employs advanced encryption protocols to protect your documents, ensuring that any Request For Compromise On A Debt is handled securely. Additionally, the system provides audit trails and user authentication features to keep your information safe.

Get more for Request For Compromise On A Debt

- Triple check checklist form

- Lpe1 form

- Camden county police department print application pdf form

- Schengen visa application form 11240

- Enduring power of attorney wa form

- Form fda 4035 fda 4035dynsec05 30 24 pdf

- Foster home monthly report national youth advocate program form

- 26 civil grand jury application and nomination form

Find out other Request For Compromise On A Debt

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now