Form NYC RPT, Real Property Transfer Tax Return Stewart Title

What is the NYC RPT Form?

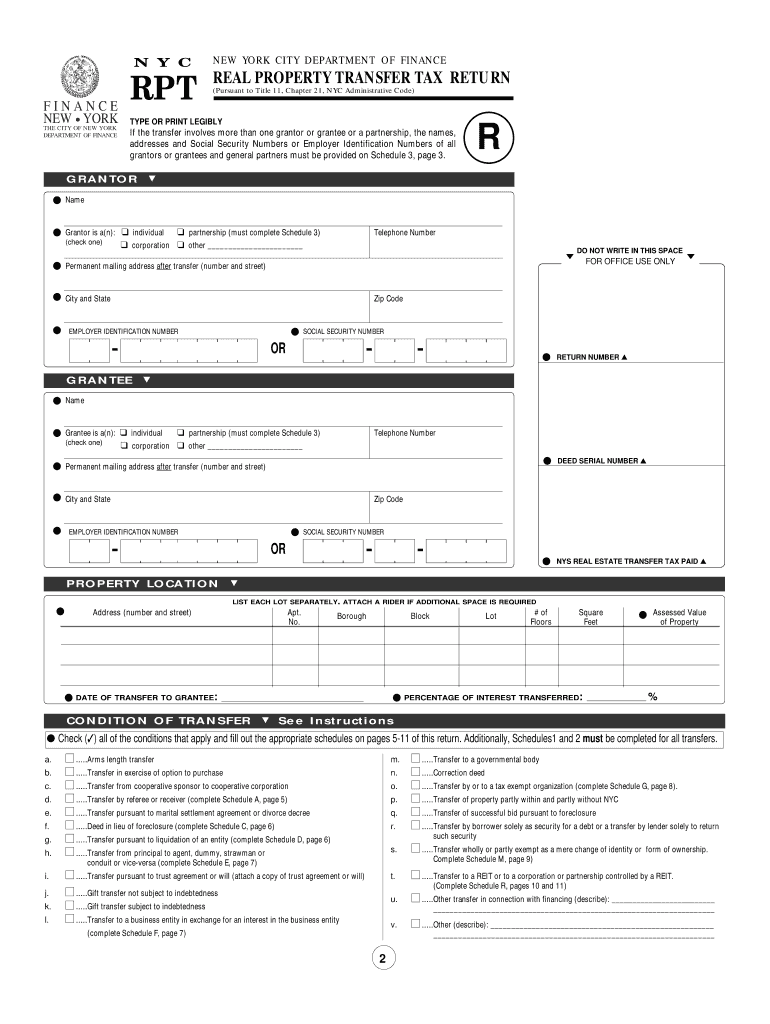

The NYC RPT, or Real Property Transfer Tax Return, is a crucial document required when transferring ownership of real estate in New York City. This form is designed to report the transfer of property and calculate the associated transfer taxes. It is essential for both buyers and sellers to understand the implications of this form, as it ensures compliance with local tax regulations. The NYC RPT form captures key details about the transaction, including the property address, sale price, and the parties involved in the transfer.

Steps to Complete the NYC RPT Form

Filling out the NYC RPT form involves several important steps to ensure accuracy and compliance. Begin by gathering all necessary information, including the property details and the transaction amount. Next, accurately complete each section of the form, paying close attention to the instructions provided. It is vital to double-check the calculations for the transfer tax to avoid discrepancies. Once completed, the form must be signed by both parties before submission. Ensuring that all required signatures are in place is crucial for the form's validity.

Legal Use of the NYC RPT Form

The NYC RPT form serves a legal purpose in documenting the transfer of property ownership. It is essential for fulfilling tax obligations related to real estate transactions in New York City. The form must be filed with the appropriate city agency to ensure that the transfer is recognized legally. Failure to submit this form can result in penalties or delays in the transfer process. Understanding the legal requirements surrounding the NYC RPT form is vital for both parties involved in the transaction.

Filing Deadlines and Important Dates

Timely filing of the NYC RPT form is crucial to avoid penalties. Typically, the form must be submitted within a specified timeframe following the property transfer. It is important to be aware of these deadlines, as they can vary based on the nature of the transaction. Missing the filing deadline may result in additional fees or complications with the property transfer. Keeping track of important dates related to the NYC RPT form can help ensure a smooth transaction process.

Required Documents for the NYC RPT Form

When completing the NYC RPT form, specific documents are required to support the information provided. These may include a copy of the purchase agreement, proof of identity for both parties, and any prior tax documents related to the property. Having these documents readily available can streamline the completion process and help ensure that the form is filled out accurately. It is advisable to review the list of required documents before starting the form to avoid delays.

Form Submission Methods

The NYC RPT form can be submitted through various methods, including online filing, mail, or in-person submission. Each method has its own set of procedures and requirements. Online submission is often the most efficient option, allowing for quicker processing times. Alternatively, mailing the form requires careful attention to ensure it is sent to the correct address and within the required timeframe. In-person submissions may be necessary in some cases, particularly if additional documentation is required.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the NYC RPT form can lead to significant penalties. These may include fines or additional taxes assessed on the property transfer. Understanding the potential consequences of non-compliance is essential for both buyers and sellers. To avoid these penalties, it is important to adhere to all filing deadlines and ensure that the form is completed accurately. Being proactive in addressing any issues related to the NYC RPT form can help mitigate risks associated with property transactions.

Quick guide on how to complete form nyc rpt real property transfer tax return stewart title

Effortlessly Prepare Form NYC RPT, Real Property Transfer Tax Return Stewart Title on Any Device

Digital document administration has gained traction among businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the proper form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, adjust, and eSign your documents swiftly and without issues. Manage Form NYC RPT, Real Property Transfer Tax Return Stewart Title on any device with airSlate SignNow's Android or iOS applications and simplify any document-driven process today.

Steps to Modify and eSign Form NYC RPT, Real Property Transfer Tax Return Stewart Title with Ease

- Obtain Form NYC RPT, Real Property Transfer Tax Return Stewart Title and click Get Form to begin.

- Utilize our tools to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

No more worrying about lost or mislaid documents, tedious form searches, or errors that necessitate the printing of new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Edit and eSign Form NYC RPT, Real Property Transfer Tax Return Stewart Title and ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are transfer taxes in NYC?

Transfer taxes in NYC are fees imposed by the city and state on the transfer of real property ownership. These taxes can signNowly impact the overall cost of real estate transactions. Understanding transfer taxes NYC can help buyers and sellers better prepare for their financial obligations.

-

How are transfer taxes in NYC calculated?

Transfer taxes NYC are typically calculated based on the sale price of the property. The rates can vary for residential and commercial transactions, and there may be additional city and state fees to consider. It's essential to consult a real estate expert to get an accurate estimate of transfer taxes before proceeding with a sale.

-

What are the typical costs associated with transfer taxes NYC?

The costs associated with transfer taxes NYC can vary, but generally, buyers can expect to pay between 1% to 2.625% of the sale price in taxes. Additionally, sellers may also be responsible for a portion of the transfer taxes. It’s vital to account for these fees in your budget.

-

How can airSlate SignNow help with managing transfer taxes in NYC?

airSlate SignNow provides a streamlined solution for eSigning important documents related to real estate transactions, including those outlining transfer taxes NYC. By using our platform, businesses can efficiently manage and execute documents, reducing delays and ensuring compliance with tax requirements.

-

Are there any exceptions to transfer taxes in NYC?

Yes, there are certain exemptions and reductions available for transfer taxes in NYC, particularly for specific property types or qualified buyers. Understanding these exceptions can provide signNow savings. Consulting with a tax professional or a real estate agent familiar with transfer taxes NYC can help identify possible savings.

-

What features does airSlate SignNow offer that cater to real estate transactions involving transfer taxes in NYC?

airSlate SignNow offers features such as customizable templates, real-time tracking of document status, and secure eSignature capabilities. These features are particularly beneficial for real estate transactions where understanding and complying with transfer taxes NYC is critical. With SignNow, you can manage all documentation effortlessly.

-

How can I integrate airSlate SignNow with my existing systems for better handling of transfer taxes NYC?

airSlate SignNow offers robust integrations with various systems such as CRMs, accounting software, and property management platforms. This seamless integration can enhance your ability to manage documents related to transfer taxes NYC correctly. Utilizing these integrations allows for better data flow and reduced manual input.

Get more for Form NYC RPT, Real Property Transfer Tax Return Stewart Title

- Caste validity form pdf in marathi

- How to fill out a request for payment forservicee or reimbursement for compenable expenses form

- Jdf 999 form

- Notification and completion of community involvement activities form

- Tesco isa transfer form

- How to score stephen b mccarney test form

- Monthly rental agreement template form

- Month to month rental agreement template form

Find out other Form NYC RPT, Real Property Transfer Tax Return Stewart Title

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement