Using Form SS 8 to Apply for Worker Status Determination from the IRS

What is the Using Form SS-8 To Apply For Worker Status Determination From The IRS

The Using Form SS-8 is a critical document utilized to request a determination of worker status from the Internal Revenue Service (IRS). This form helps clarify whether a worker is classified as an independent contractor or an employee, which has significant implications for tax obligations and benefits. Understanding the distinctions between these classifications is essential for both workers and employers, as it affects tax withholding, eligibility for benefits, and liability for employment taxes.

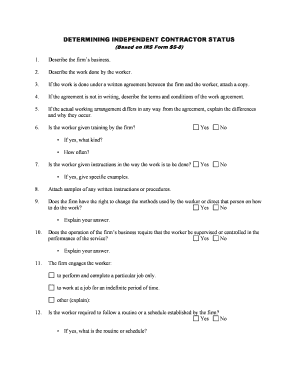

Steps to Complete the Using Form SS-8 To Apply For Worker Status Determination From The IRS

Completing the Using Form SS-8 involves several key steps to ensure accurate submission. First, gather all necessary information, including details about the worker's relationship with the company, the nature of the work performed, and any relevant contracts or agreements. Next, fill out the form by providing detailed responses to each question, focusing on the specific aspects of the working relationship. Once completed, review the form for accuracy and completeness before submitting it to the IRS. It is advisable to keep a copy for your records.

Legal Use of the Using Form SS-8 To Apply For Worker Status Determination From The IRS

The legal use of the Using Form SS-8 is grounded in its ability to clarify the tax obligations of both workers and employers. By submitting this form, parties can seek an official determination from the IRS, which can help prevent disputes regarding worker classification. It is essential to provide truthful and thorough information, as inaccuracies can lead to legal repercussions or penalties. The IRS will review the submitted details and issue a determination, which can be relied upon for compliance with federal tax laws.

Eligibility Criteria for Using Form SS-8

To be eligible to use the Using Form SS-8, the worker must be involved in a specific working relationship where the classification is uncertain. This typically applies to situations where an employer and worker disagree on whether the worker is an independent contractor or an employee. Both the worker and the employer can initiate the request, making it a versatile tool for clarifying tax responsibilities. It is important to note that the form is not intended for use by all workers; it is specifically designed for those whose status is ambiguous.

How to Obtain the Using Form SS-8

The Using Form SS-8 can be obtained directly from the IRS website or by contacting the IRS for a physical copy. It is available as a downloadable PDF, allowing users to print and fill it out at their convenience. Additionally, instructions for completing the form are included, providing guidance on how to accurately fill out each section. Ensuring you have the most current version of the form is crucial, as outdated forms may not be accepted by the IRS.

Form Submission Methods for Form SS-8

Once the Using Form SS-8 is completed, it can be submitted to the IRS via mail. The address for submission is typically provided in the form's instructions. It is important to ensure that the form is sent to the correct address to avoid delays in processing. Electronic submission is not currently an option for this form, so users should plan for mailing times when submitting their requests. Keeping a record of the submission is advisable for future reference.

Quick guide on how to complete using form ss 8 to apply for worker status determination from the irs

Prepare Using Form SS 8 To Apply For Worker Status Determination From The IRS effortlessly on any device

Digital document management has gained popularity among companies and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow offers a comprehensive set of tools for you to create, modify, and electronically sign your documents swiftly without any delays. Manage Using Form SS 8 To Apply For Worker Status Determination From The IRS across any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to modify and eSign Using Form SS 8 To Apply For Worker Status Determination From The IRS with ease

- Find Using Form SS 8 To Apply For Worker Status Determination From The IRS and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or conceal sensitive information using tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click the Done button to finalize your edits.

- Select your preferred method of submitting your form, whether via email, SMS, or invitation link, or download it directly to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device of your choice. Edit and eSign Using Form SS 8 To Apply For Worker Status Determination From The IRS to guarantee effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the form ss 8 and how does it work?

The form ss 8 is a document used by employers to request a determination as to whether a worker is an employee or an independent contractor. With airSlate SignNow, businesses can easily complete and eSign the form ss 8, ensuring compliance and clarity in their hiring practices.

-

How can airSlate SignNow improve my experience with form ss 8?

airSlate SignNow streamlines the process of managing the form ss 8 by allowing you to fill out, send, and sign documents electronically. This reduces the time spent on paperwork and helps to eliminate errors, making your workflow more efficient.

-

Is there a fee for using airSlate SignNow to process the form ss 8?

While airSlate SignNow offers various pricing plans, there are no hidden fees. By subscribing to one of our plans, you can access all the features needed to manage the form ss 8 effectively, including cloud storage and eSigning capabilities.

-

Can I integrate airSlate SignNow with other tools for handling the form ss 8?

Yes, airSlate SignNow seamlessly integrates with numerous applications such as Google Drive, Dropbox, and CRM tools. This ensures that your workflow is not interrupted while managing the form ss 8 alongside your other business tools.

-

What are the security features of airSlate SignNow when submitting form ss 8?

AirSlate SignNow prioritizes security, utilizing state-of-the-art encryption and secure storage practices. When submitting the form ss 8, you can rest assured that your sensitive information is protected from unauthorized access.

-

How long does it take to complete and eSign the form ss 8 using airSlate SignNow?

Completing and eSigning the form ss 8 with airSlate SignNow is typically a quick process, often taking just a few minutes. Our user-friendly interface and guided workflows are designed to help you finish your documents efficiently.

-

Can airSlate SignNow help track the status of my form ss 8?

Absolutely! AirSlate SignNow offers real-time tracking features, allowing you to monitor the status of your form ss 8 as it moves through the signing process. This transparency ensures that you are always informed about the progress of your document.

Get more for Using Form SS 8 To Apply For Worker Status Determination From The IRS

- Af form 88

- Sf 1190 addendum 100078769 form

- Bullfrogs and bumblebees daycare form

- More than of vehicle accidents are caused by driver error or poor driving habits form

- Guided reading the constitution lesson 1 answer key form

- Skyrizi enrollment form

- Letterhead msgme multi site mc9000 21 letterhead msgme multi site 200 street sw rochester minnesota 55905 507 284 2220 school form

- Va form 10 10d

Find out other Using Form SS 8 To Apply For Worker Status Determination From The IRS

- How Do I Electronic signature Michigan General contract template

- Electronic signature Maine Email Contracts Later

- Electronic signature New Mexico General contract template Free

- Can I Electronic signature Rhode Island Email Contracts

- How Do I Electronic signature California Personal loan contract template

- Electronic signature Hawaii Personal loan contract template Free

- How To Electronic signature Hawaii Personal loan contract template

- Electronic signature New Hampshire Managed services contract template Computer

- Electronic signature Alabama Real estate sales contract template Easy

- Electronic signature Georgia Real estate purchase contract template Secure

- Electronic signature South Carolina Real estate sales contract template Mobile

- Can I Electronic signature Kentucky Residential lease contract

- Can I Electronic signature Nebraska Residential lease contract

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast