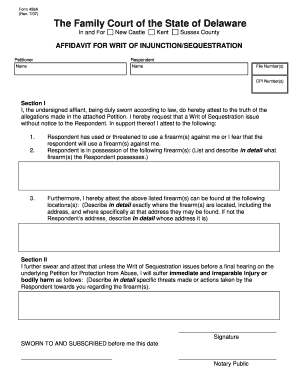

Form 458A

What is the Form 458A

The Form 458A is a specific document used in the United States for various legal and administrative purposes. It is often associated with the filing of certain claims or requests that require formal documentation. Understanding the purpose of this form is essential for individuals and businesses to ensure compliance with relevant regulations. The form typically includes sections that require detailed information about the filer, the nature of the request, and any supporting documentation that may be necessary.

How to use the Form 458A

Using the Form 458A involves several important steps to ensure that it is completed accurately and submitted correctly. First, gather all relevant information that will be required on the form, including personal identification details and any necessary financial information. Next, carefully fill out each section of the form, ensuring that all entries are clear and legible. After completing the form, review it for any errors or omissions before submitting it to the appropriate authority. This process helps to avoid delays or complications in the handling of your request.

Steps to complete the Form 458A

Completing the Form 458A involves a systematic approach to ensure accuracy and compliance. Here are the key steps:

- Gather necessary documents and information, including identification and financial records.

- Read the instructions carefully to understand what is required for each section of the form.

- Fill out the form, ensuring all information is accurate and up-to-date.

- Double-check the completed form for any errors or missing information.

- Submit the form through the appropriate channels, whether online or via mail.

Legal use of the Form 458A

The legal use of the Form 458A is governed by specific regulations and requirements. To be considered valid, the form must be completed in accordance with the applicable laws and guidelines. This includes ensuring that all signatures are obtained where necessary and that the form is submitted within any specified deadlines. Understanding the legal implications of using this form is crucial for individuals and businesses to avoid potential penalties or issues with compliance.

Key elements of the Form 458A

The Form 458A contains several key elements that are essential for its proper use. These elements typically include:

- Identification information of the filer, including name and contact details.

- A detailed description of the request or claim being made.

- Any supporting documentation that may be required to substantiate the request.

- Signature lines for the filer and any necessary witnesses or representatives.

Examples of using the Form 458A

There are various scenarios in which the Form 458A may be utilized. For instance, it may be used by individuals applying for specific benefits, businesses seeking to formalize a request with a government agency, or parties involved in legal proceedings that require documentation of claims. Each example highlights the form's versatility and importance in facilitating official processes.

Quick guide on how to complete form 458a

Complete Form 458A effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct format and securely save it online. airSlate SignNow provides you with all the tools necessary to generate, modify, and electronically sign your documents swiftly without delays. Manage Form 458A on any device using airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The simplest method to modify and eSign Form 458A seamlessly

- Obtain Form 458A and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically available from airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details thoroughly and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or disorganized documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign Form 458A and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form 458A?

Form 458A is a document used for various business and financial purposes, often related to tax and legal processes. With airSlate SignNow, you can easily fill out, sign, and send Form 458A electronically. This makes handling such documents more efficient in your business operations.

-

How can airSlate SignNow help with Form 458A?

airSlate SignNow provides a user-friendly platform that allows you to manage Form 458A efficiently. You can create, edit, and sign the form online, eliminating paperwork hassles and saving time. Our solution ensures your documents are secured and compliant with industry standards.

-

Is there a free trial for using airSlate SignNow for Form 458A?

Yes, airSlate SignNow offers a free trial that allows you to explore the features when managing Form 458A. You can test the ease of eSigning, sharing, and managing your documents without any financial commitment. After the trial, you can choose from various pricing plans based on your needs.

-

What kind of integrations does airSlate SignNow offer for Form 458A?

airSlate SignNow integrates seamlessly with a variety of business tools, enhancing your workflow when handling Form 458A. Whether you use CRM systems, cloud storage, or other document management tools, you can connect and streamline your processes effortlessly. This ensures a cohesive experience across platforms.

-

Can I use airSlate SignNow for bulk sending of Form 458A?

Absolutely! airSlate SignNow allows for bulk sending of Form 458A to multiple recipients. This feature is beneficial for businesses that need to distribute forms quickly across teams or clients, ensuring everyone gets their documents at the same time without delays.

-

What security features does airSlate SignNow provide for Form 458A?

Security is a priority with airSlate SignNow, especially when handling sensitive documents like Form 458A. Our platform uses encryption for data storage and transmission, ensuring that your information is protected. Additionally, we offer audit trails and access controls to enhance document security.

-

Are there any customization options for Form 458A in airSlate SignNow?

Yes, airSlate SignNow allows for customization of Form 458A to fit your business’s unique requirements. You can add fields, adjust branding, and modify documents to ensure they align with your professional standards. This flexibility enhances the usability of the form within your organization.

Get more for Form 458A

Find out other Form 458A

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word