, Mortgagors, to , Mortgagee, and Recorded Form

What is the Mortgagors to Mortgagee and Recorded Form?

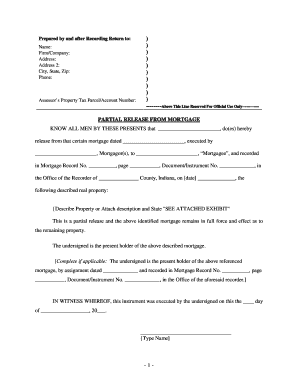

The Mortgagors to Mortgagee and Recorded form is a legal document that establishes the relationship between the mortgagors (borrowers) and the mortgagee (lender). This form is essential in real estate transactions, as it outlines the terms of the mortgage agreement, including the amount borrowed, interest rates, and repayment terms. It serves as a public record, ensuring that all parties involved are aware of the mortgage obligations and rights associated with the property.

Steps to Complete the Mortgagors to Mortgagee and Recorded Form

Completing the Mortgagors to Mortgagee and Recorded form requires careful attention to detail. Here are the key steps:

- Gather necessary information, including personal details of all parties involved, property information, and loan specifics.

- Fill out the form accurately, ensuring that all sections are completed as required.

- Review the completed form for accuracy, checking for any errors or omissions.

- Sign the document in the presence of a notary public, if required by state law.

- Submit the form to the appropriate recording office to ensure it is officially recorded.

Legal Use of the Mortgagors to Mortgagee and Recorded Form

The legal use of the Mortgagors to Mortgagee and Recorded form is crucial for establishing the enforceability of the mortgage agreement. This form must comply with state-specific laws and regulations governing real estate transactions. Proper execution and recording of the form protect the rights of both the mortgagors and the mortgagee, ensuring that the mortgage is legally binding and enforceable in a court of law.

Key Elements of the Mortgagors to Mortgagee and Recorded Form

Several key elements must be included in the Mortgagors to Mortgagee and Recorded form to ensure its validity:

- Names and addresses of the mortgagors and mortgagee.

- Description of the property being mortgaged, including its legal description.

- Loan amount, interest rate, and terms of repayment.

- Signatures of all parties involved, along with notarization if required.

- Recording information, including the date and location of submission.

How to Obtain the Mortgagors to Mortgagee and Recorded Form

The Mortgagors to Mortgagee and Recorded form can typically be obtained from several sources:

- Your lender or mortgage broker may provide the form as part of the loan application process.

- Local government offices, such as the county recorder or clerk's office, often have the form available for public use.

- Online legal document services may offer templates for the form, which can be customized to meet specific needs.

State-Specific Rules for the Mortgagors to Mortgagee and Recorded Form

Each state in the U.S. has its own rules and regulations regarding the Mortgagors to Mortgagee and Recorded form. It is essential to be aware of these variations, as they can affect the form's requirements, execution, and recording process. Some states may require additional disclosures or specific language to be included in the form. Consulting with a legal professional or local real estate expert can ensure compliance with state laws.

Quick guide on how to complete mortgagors to mortgagee and recorded

Effortlessly Prepare , Mortgagors, To , Mortgagee, And Recorded on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents promptly without delays. Manage , Mortgagors, To , Mortgagee, And Recorded on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

The Easiest Way to Edit and eSign , Mortgagors, To , Mortgagee, And Recorded with Ease

- Find , Mortgagors, To , Mortgagee, And Recorded and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and holds the same legal significance as a traditional handwritten signature.

- Review the information, then click the Done button to save your changes.

- Choose how to send your form—via email, SMS, invite link, or download it to your computer.

Forget about lost or misfiled documents, exhausting form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign , Mortgagors, To , Mortgagee, And Recorded while ensuring excellent communication at any point of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the benefits of using airSlate SignNow for Mortgagors, To Mortgagee, And Recorded documentation?

AirSlate SignNow offers an easy-to-use platform that streamlines the signing process between Mortgagors, To Mortgagee, And Recorded documents. This ensures quick turnaround times and reduces the risk of paperwork errors, making it ideal for real estate transactions. Additionally, it enhances compliance by providing a secure way to manage your documents.

-

How does airSlate SignNow ensure the security of Mortgagors, To Mortgagee, And Recorded documents?

Security is a top priority for airSlate SignNow. All documents related to Mortgagors, To Mortgagee, And Recorded interactions are encrypted in transit and at rest. Furthermore, the platform complies with industry regulations, ensuring the confidentiality and integrity of your sensitive data.

-

Can airSlate SignNow integrate with other platforms used for Mortgagors, To Mortgagee, And Recorded processes?

Yes, airSlate SignNow seamlessly integrates with a variety of platforms commonly used in real estate, which can enhance your workflow for Mortgagors, To Mortgagee, And Recorded tasks. Whether you use CRM systems, cloud storage, or accounting software, our integrations simplify your document management and eSigning needs.

-

What are the pricing options for airSlate SignNow related to Mortgagors, To Mortgagee, And Recorded services?

AirSlate SignNow offers flexible pricing plans tailored to fit various business needs associated with Mortgagors, To Mortgagee, And Recorded documentation. Each plan includes essential features, with the option to scale as your requirements grow. Sign up for a free trial to explore the platform's capabilities without any commitment.

-

How does airSlate SignNow help reduce turnaround times for Mortgagors, To Mortgagee, And Recorded transactions?

By automating the eSigning process, airSlate SignNow drastically cuts down the time needed for Mortgagors, To Mortgagee, And Recorded transactions. Users can send documents for signature instantly and receive completed forms in a fraction of the time compared to traditional methods. This efficiency leads to faster closings and satisfied clients.

-

Are there any industry-specific features for Mortgagors, To Mortgagee, And Recorded workflows?

Absolutely! AirSlate SignNow includes several industry-specific features designed to cater to Mortgagors, To Mortgagee, And Recorded workflows. This includes customizable templates, compliance management tools, and support for multiple signature types, all aimed at enhancing efficiency in real estate transactions.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning processes related to Mortgagors, To Mortgagee, And Recorded?

Yes, airSlate SignNow is designed with user experience in mind, making it simple for anyone, even those unfamiliar with eSigning, to navigate the platform for Mortgagors, To Mortgagee, And Recorded tasks. The intuitive interface and helpful tutorials enable users to manage their documents with confidence and ease.

Get more for , Mortgagors, To , Mortgagee, And Recorded

Find out other , Mortgagors, To , Mortgagee, And Recorded

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement