Assumption Agreement of Mortgage Form

What is the Assumption Agreement Of Mortgage

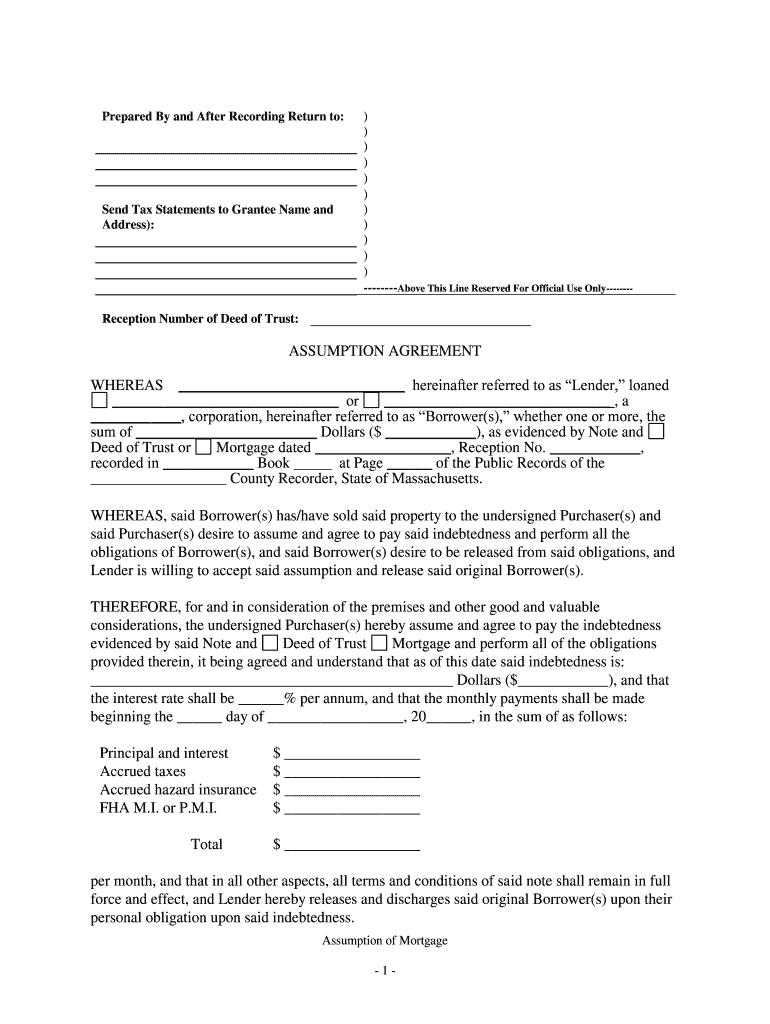

The assumption agreement of mortgage is a legal document that allows a buyer to take over the mortgage obligations of the seller. This agreement typically occurs when a property is sold, and the buyer agrees to assume the existing mortgage terms instead of obtaining a new loan. This arrangement can benefit both parties, as the buyer may secure a lower interest rate than what is currently available, while the seller can transfer their mortgage liability without needing to pay it off entirely. Understanding the terms and conditions outlined in this agreement is essential for both buyers and sellers to ensure a smooth transaction.

How to use the Assumption Agreement Of Mortgage

Using the assumption agreement of mortgage involves several key steps. First, both the buyer and seller should review the existing mortgage terms to ensure that the lender permits the assumption. Next, the parties must draft the agreement, clearly outlining the responsibilities and obligations of each party. Once the document is prepared, it should be signed by all involved parties. Finally, the signed agreement must be submitted to the lender for approval. This process ensures that the lender acknowledges the transfer of obligations and that the buyer is legally responsible for the mortgage moving forward.

Steps to complete the Assumption Agreement Of Mortgage

Completing the assumption agreement of mortgage involves a series of methodical steps:

- Review the existing mortgage terms to confirm the assumption is allowed.

- Draft the assumption agreement, including all necessary details such as property description, mortgage balance, and payment terms.

- Have all parties involved sign the agreement to indicate their consent.

- Submit the signed agreement to the lender for review and approval.

- Once approved, ensure that all parties receive a copy of the finalized document for their records.

Key elements of the Assumption Agreement Of Mortgage

Several key elements are essential in the assumption agreement of mortgage to ensure its validity and clarity:

- Property Description: A detailed description of the property being transferred.

- Mortgage Details: Information about the existing mortgage, including the lender's name, loan number, and outstanding balance.

- Assumption Terms: Clear terms outlining the responsibilities of both the buyer and seller regarding payments and obligations.

- Signatures: Signatures of both parties, indicating their agreement to the terms.

- Lender Approval: A section for the lender to acknowledge and approve the assumption.

Legal use of the Assumption Agreement Of Mortgage

The legal use of the assumption agreement of mortgage is critical for ensuring that all parties adhere to the terms outlined in the document. This agreement must comply with state and federal laws governing mortgage assumptions. It is important for both the buyer and seller to understand their rights and obligations under this agreement. Additionally, the lender's approval is necessary for the assumption to be legally binding, as they retain the right to accept or deny the request based on their policies.

State-specific rules for the Assumption Agreement Of Mortgage

State-specific rules can significantly impact the assumption agreement of mortgage. Each state may have different regulations regarding mortgage assumptions, including whether they are permitted and the specific requirements for documentation. Buyers and sellers should familiarize themselves with their state's laws to ensure compliance. Consulting with a real estate attorney or a knowledgeable real estate professional can provide valuable guidance on navigating these regulations and ensuring that the agreement is valid and enforceable.

Quick guide on how to complete assumption agreement of mortgage

Complete Assumption Agreement Of Mortgage effortlessly on any gadget

Digital document management has gained traction among companies and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, alter, and eSign your documents promptly without complications. Manage Assumption Agreement Of Mortgage on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to alter and eSign Assumption Agreement Of Mortgage with ease

- Find Assumption Agreement Of Mortgage and then click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, invitation link, or download it to your computer.

Put aside concerns about lost or mislaid documents, time-consuming form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Assumption Agreement Of Mortgage and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Assumption Agreement Of Mortgage?

An Assumption Agreement Of Mortgage is a legal document that allows a buyer to take over the mortgage obligations from the seller. This agreement typically requires the lender's approval, ensuring that the buyer is capable of meeting the payment terms. Utilizing airSlate SignNow can simplify this process by enabling easy eSignature and management of the document.

-

How can airSlate SignNow help with an Assumption Agreement Of Mortgage?

airSlate SignNow provides a streamlined platform for drafting and signing an Assumption Agreement Of Mortgage. With customizable templates and secure eSigning features, you can complete the transaction efficiently and with confidence. This enhances the experience for both buyers and sellers, ensuring all necessary steps are managed digitally.

-

What are the costs associated with using airSlate SignNow for an Assumption Agreement Of Mortgage?

airSlate SignNow offers various pricing plans that cater to different business needs when handling an Assumption Agreement Of Mortgage. Subscription costs vary based on the features and usage levels required, making it a cost-effective solution for individuals and businesses. You can explore the pricing options to find the best fit for your documentation needs.

-

Is it secure to send an Assumption Agreement Of Mortgage through airSlate SignNow?

Yes, airSlate SignNow prioritizes security, ensuring that your Assumption Agreement Of Mortgage is protected with advanced encryption and security protocols. The platform complies with industry standards, making sure that sensitive data remains confidential throughout the eSigning process. You can trust that your documents are safe and secure.

-

Can I customize an Assumption Agreement Of Mortgage template in airSlate SignNow?

Absolutely! airSlate SignNow allows you to create and customize templates for an Assumption Agreement Of Mortgage to fit your specific requirements. You can easily edit sections, add clauses, and incorporate your branding, ensuring the document reflects your preferences accurately. This feature simplifies the preparation of legal documents.

-

What features does airSlate SignNow offer for managing Assumption Agreements Of Mortgage?

airSlate SignNow includes features such as customizable templates, in-app notifications, and workflow automation to efficiently manage your Assumption Agreement Of Mortgage. The user-friendly interface enables quick access to important documents, making it easier to track progress and document revisions. These features help streamline your transaction processes.

-

Does airSlate SignNow integrate with other applications for handling Assumption Agreement Of Mortgage?

Yes, airSlate SignNow integrates with various applications, allowing for seamless handling of Assumption Agreements Of Mortgage and other documents. Popular integrations include CRM systems, cloud storage solutions, and project management tools. This flexibility ensures that you can work within your existing software ecosystem without disruption.

Get more for Assumption Agreement Of Mortgage

- Landform test

- Uniform amp equipment issuance agreement cal poly pomona foundation csupomona

- Adjudication form 867424

- Authorization to disclose protected health information oag state tx

- Community service online for court form

- Application for supplemental security income disability claims clinic form

- Suncoast schools federal credit union request to close account form

- Withdrawal request annuities pacificlife com form

Find out other Assumption Agreement Of Mortgage

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free