The Specific Deductions Are Itemized as Follows Form

What is the Specific Deductions Are Itemized As Follows

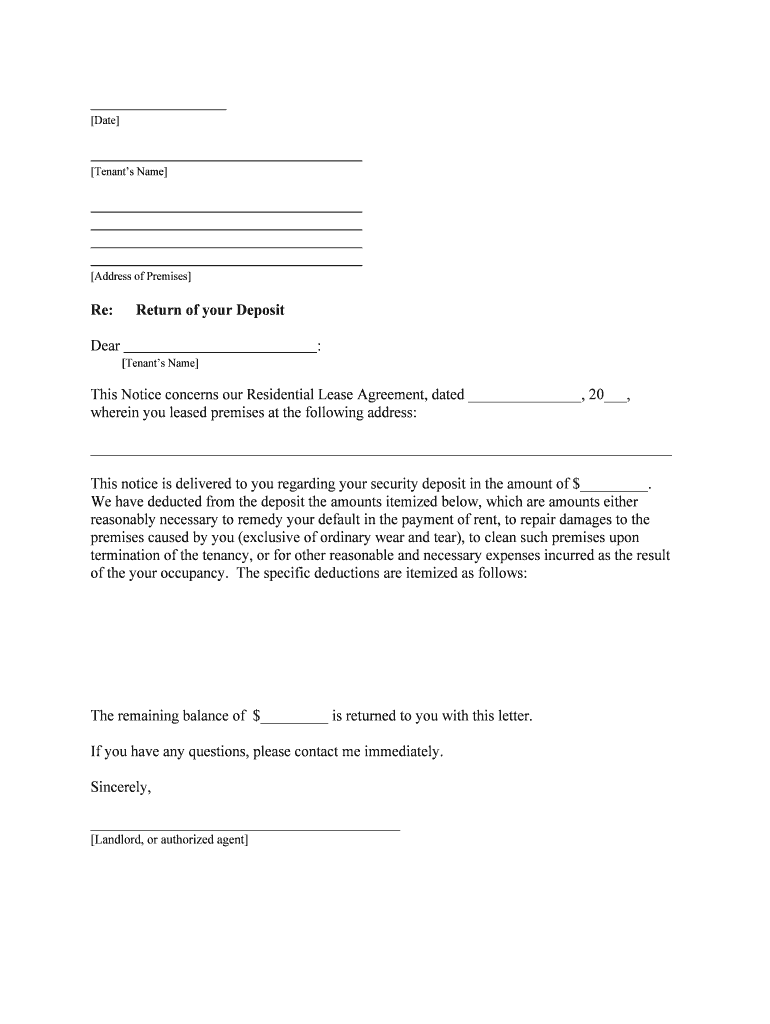

The Specific Deductions Are Itemized As Follows form is a crucial document used primarily for tax purposes in the United States. It allows taxpayers to detail specific deductions they are claiming on their tax returns. This form is essential for individuals and businesses looking to reduce their taxable income by listing eligible expenses. Common deductions may include medical expenses, mortgage interest, and charitable contributions. Understanding this form is vital for accurate tax reporting and compliance with IRS regulations.

Steps to Complete the Specific Deductions Are Itemized As Follows

Completing the Specific Deductions Are Itemized As Follows form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, such as receipts and statements related to your deductions. Next, carefully fill out each section of the form, ensuring that all amounts are accurate and correspond to your supporting documents. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the form according to the IRS guidelines, either electronically or by mail, depending on your preference.

Legal Use of the Specific Deductions Are Itemized As Follows

The legal use of the Specific Deductions Are Itemized As Follows form is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted within the designated filing deadlines. It is important to adhere to the legal requirements surrounding documentation and substantiation of claimed deductions. Failure to comply with these regulations can result in penalties or disallowance of deductions during an audit. Therefore, understanding the legal implications of this form is essential for taxpayers.

IRS Guidelines

The IRS provides specific guidelines for completing the Specific Deductions Are Itemized As Follows form. These guidelines outline which expenses are eligible for deduction and the necessary documentation required to substantiate each claim. Taxpayers should refer to the IRS instructions for the form to ensure compliance with current tax laws. Additionally, the IRS updates these guidelines periodically, so it is crucial to stay informed about any changes that may affect your deductions.

Required Documents

When completing the Specific Deductions Are Itemized As Follows form, certain documents are required to support your claims. These may include:

- Receipts for medical expenses

- Mortgage statements

- Charitable contribution receipts

- Records of state and local taxes paid

- Documentation for any other deductible expenses

Having these documents readily available will facilitate the completion of the form and help ensure that all claimed deductions are substantiated.

Filing Deadlines / Important Dates

Filing deadlines for the Specific Deductions Are Itemized As Follows form align with the general tax filing deadlines set by the IRS. Typically, individual taxpayers must file their tax returns by April fifteenth of each year. However, extensions may be available under certain circumstances. It is important to keep track of these deadlines to avoid penalties and ensure timely submission of your form and tax return.

Quick guide on how to complete the specific deductions are itemized as follows

Complete The Specific Deductions Are Itemized As Follows effortlessly on any gadget

Virtual document management has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to locate the necessary form and safely keep it online. airSlate SignNow equips you with all the tools needed to create, modify, and electronically sign your documents swiftly and without interruptions. Handle The Specific Deductions Are Itemized As Follows on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to alter and electronically sign The Specific Deductions Are Itemized As Follows with ease

- Obtain The Specific Deductions Are Itemized As Follows and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, either by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Modify and electronically sign The Specific Deductions Are Itemized As Follows and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the specific deductions included in airSlate SignNow pricing?

The specific deductions are itemized as follows: our pricing includes various features such as document templates, collaboration tools, and secure eSignature capabilities. This transparency enables businesses to understand what they are paying for and how these features can help them save on costs. Additionally, our plans cater to different business sizes and needs, ensuring that everyone can find a suitable option.

-

How does airSlate SignNow improve document management?

With airSlate SignNow, the specific deductions are itemized as follows: automated workflows, real-time collaboration, and easy document tracking. These features streamline document management processes and reduce the time spent on manual tasks, allowing businesses to focus on their core operations. Additionally, the user-friendly interface makes it easy for teams to adopt and leverage these tools effectively.

-

Can airSlate SignNow integrate with other tools we use?

Yes, airSlate SignNow offers integrations with popular apps and services, ensuring seamless workflow management. The specific deductions are itemized as follows: our platform connects easily with tools such as Google Drive, Salesforce, and Slack. This integration capability allows businesses to leverage existing software solutions while benefiting from the enhanced functionalities of airSlate SignNow.

-

What security measures does airSlate SignNow provide?

Security is a top priority at airSlate SignNow. The specific deductions are itemized as follows: we implement SSL encryption, two-factor authentication, and regular security audits to protect your documents and data. This ensures that users can confidently send and eSign documents without worrying about unauthorized access or data bsignNowes.

-

How does airSlate SignNow benefit small businesses?

airSlate SignNow is designed with small businesses in mind, offering an affordable solution that doesn't compromise on features. The specific deductions are itemized as follows: you can save time, reduce paper usage, and enhance client communication through our eSignature platform. This empowers small businesses to operate efficiently while maintaining a professional image.

-

Is there a free trial available for airSlate SignNow?

Yes, we offer a free trial for airSlate SignNow to help you gauge its effectiveness for your business needs. The specific deductions are itemized as follows: during the trial, you'll have access to all key features, allowing you to experience firsthand how our eSignature solution works. This risk-free option enables potential customers to make informed decisions before committing.

-

What user support options are available for airSlate SignNow?

airSlate SignNow provides comprehensive user support to ensure a smooth experience. The specific deductions are itemized as follows: our support includes live chat, email assistance, and a robust help center with tutorials and FAQs. This multi-channel approach ensures that users can get help whenever they need it, regardless of their location.

Get more for The Specific Deductions Are Itemized As Follows

Find out other The Specific Deductions Are Itemized As Follows

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast