DR 115 1 Amend of Agreement on Claiming Tax Exemption for Children 10 15 Domestic Relations Form

What is the DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations

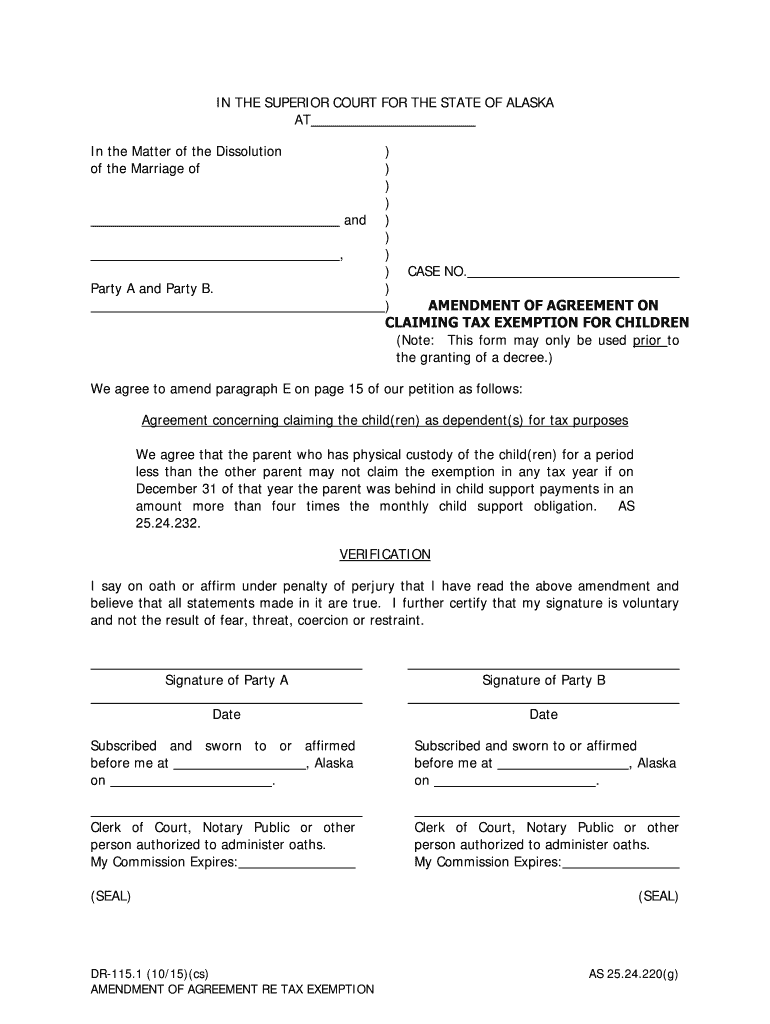

The DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations is a legal form used in the United States to amend an existing agreement regarding the tax exemption status for children aged ten to fifteen in domestic relations cases. This form is particularly relevant for parents or guardians who wish to clarify or change the allocation of tax exemptions for dependents following a divorce or separation. By completing this form, individuals can ensure that the tax benefits are properly assigned according to the latest agreements or court orders.

Steps to complete the DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations

Completing the DR 115 1 form involves several important steps to ensure accuracy and compliance with legal requirements:

- Gather necessary information, including the names and Social Security numbers of the children, and details of the current tax exemption agreement.

- Review any existing agreements or court orders to ensure the amendments reflect the current situation.

- Fill out the form carefully, ensuring all sections are completed accurately.

- Sign and date the form, ensuring that all parties involved in the agreement also provide their signatures if required.

- Submit the completed form to the appropriate tax authority or court, depending on the specific requirements of your jurisdiction.

Legal use of the DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations

The legal use of the DR 115 1 form is essential for maintaining compliance with tax laws and ensuring that tax exemptions are properly claimed. This form serves as an official record of any amendments made to the original agreement, which can be crucial in case of disputes or audits. It is important to understand that both parties must agree to the changes and that any amendments should be documented to avoid future complications with the IRS or state tax authorities.

IRS Guidelines

According to IRS guidelines, tax exemptions for children can significantly impact a taxpayer's financial situation. The DR 115 1 form must align with IRS regulations regarding dependency exemptions. Taxpayers should consult IRS publications or a tax professional to ensure compliance with current tax laws and to understand how changes in exemptions may affect their tax filings. It is advisable to keep thorough records of any agreements and amendments made using this form.

Required Documents

To complete the DR 115 1 form, certain documents may be required. These typically include:

- Original tax exemption agreement or court order.

- Identification documents for all parties involved, such as driver's licenses or Social Security cards.

- Any previous amendments or related forms that may impact the current agreement.

- Proof of residency for the children, if applicable.

Form Submission Methods (Online / Mail / In-Person)

The DR 115 1 form can be submitted through various methods, depending on the requirements of the local tax authority or court. Common submission methods include:

- Online submission through the official tax authority website, if available.

- Mailing the completed form to the designated address provided by the tax authority or court.

- In-person submission at the local tax office or court clerk's office, which may also allow for immediate confirmation of receipt.

Quick guide on how to complete dr 1151 amend of agreement on claiming tax exemption for children 10 15 domestic relations 490101904

Complete DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Handle DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The easiest way to modify and electronically sign DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations with ease

- Obtain DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, either by email, text message (SMS), or an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations and ensure clear communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations?

The DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations is a form that allows parents to legally amend their agreement regarding tax exemptions for children aged between 10 to 15 in domestic relations cases. This amendment aims to clarify the tax responsibilities of each parent and ensure compliance with tax regulations.

-

How can airSlate SignNow assist in the process of completing the DR 115 1 Amend Of Agreement?

airSlate SignNow provides an intuitive platform that simplifies the completion of the DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations. Users can easily fill out, eSign, and manage the document online, ensuring a smooth and efficient process for both parties involved.

-

Is there a cost associated with using airSlate SignNow for the DR 115 1 form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, including a plan suitable for users who need to complete the DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations. The cost-effective solution ensures that users can access essential features without any financial burden.

-

What features does airSlate SignNow offer for handling the DR 115 1 form?

airSlate SignNow provides features like customizable templates, real-time collaboration, and secure cloud storage for forms like the DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations. These tools enhance the efficiency and effectiveness of document management.

-

Can the DR 115 1 form be signed electronically?

Absolutely! With airSlate SignNow, the DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations can be signed electronically, which is legally binding and quickens the process of finalizing agreements. This feature allows both parties to conveniently eSign from anywhere at any time.

-

What benefits does using airSlate SignNow provide when dealing with the DR 115 1 form?

Using airSlate SignNow offers several benefits for managing the DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations, including increased efficiency, reduced paperwork, and improved compliance with legal requirements. It streamlines the entire document process, saving time and ensuring accuracy.

-

Does airSlate SignNow integrate with other software for managing the DR 115 1 form?

Yes, airSlate SignNow integrates seamlessly with various productivity and management software, enabling users to handle the DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations within their preferred workflow. This integration helps centralize document management and improve collaboration.

Get more for DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations

Find out other DR 115 1 Amend Of Agreement On Claiming Tax Exemption For Children 10 15 Domestic Relations

- How Do I eSign Maryland Non-Profit Word

- Help Me With eSign New Jersey Legal PDF

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word