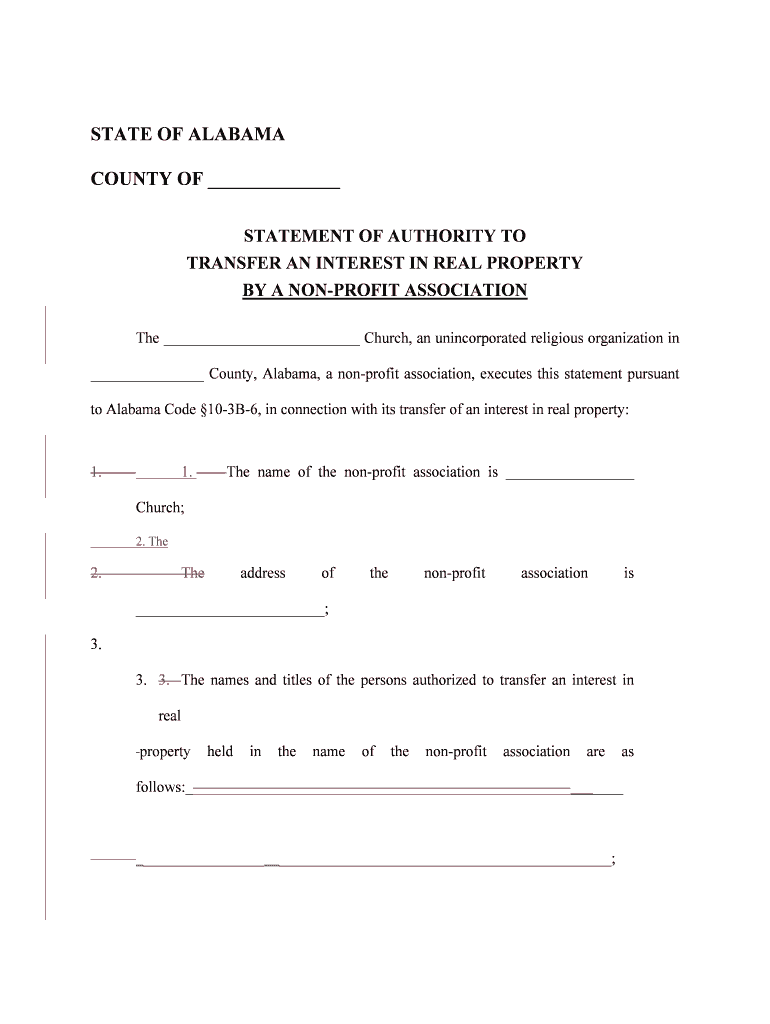

TRANSFER an INTEREST in REAL PROPERTY Form

What is the transfer an interest in real property?

The transfer an interest in real property form is a legal document that facilitates the transfer of ownership or interest in real estate from one party to another. This form is essential in various real estate transactions, including sales, gifts, and inheritance. It serves to formalize the change of ownership and is typically required to be recorded with the appropriate government office to ensure public notice of the transfer. Understanding the specifics of this form is crucial for both buyers and sellers in real estate transactions.

Key elements of the transfer an interest in real property

Several key elements must be included in the transfer an interest in real property form to ensure its validity. These elements typically include:

- Parties involved: The full names and addresses of the grantor (the person transferring the interest) and the grantee (the person receiving the interest).

- Description of the property: A clear and accurate description of the property being transferred, including its legal description and any relevant identifiers.

- Consideration: The amount of money or value exchanged for the transfer, which may be a nominal amount in some cases.

- Signatures: Signatures of both parties, along with the date of signing, are crucial for the document's enforceability.

- Notarization: Many jurisdictions require the form to be notarized to add an extra layer of authenticity.

Steps to complete the transfer an interest in real property

Completing the transfer an interest in real property form involves several steps to ensure that the transfer is executed correctly. Here are the typical steps:

- Gather necessary information about the property and the parties involved.

- Obtain the appropriate form, which can often be found online or through legal resources.

- Fill out the form accurately, ensuring all required elements are included.

- Have both parties review the document for accuracy and completeness.

- Sign the document in the presence of a notary public, if required by state law.

- File the completed form with the appropriate local government office to officially record the transfer.

Legal use of the transfer an interest in real property

The legal use of the transfer an interest in real property form is governed by state laws, which may vary significantly across the United States. This form is legally binding when executed properly, meaning that it must meet all state-specific requirements to be enforceable in a court of law. It is crucial for both parties to understand their rights and obligations under the law when engaging in such transactions.

State-specific rules for the transfer an interest in real property

Each state has its own rules and regulations governing the transfer an interest in real property. These rules may dictate the specific format of the form, the necessity of notarization, and the filing process. It is essential for individuals involved in real estate transactions to familiarize themselves with their state's requirements to ensure compliance and avoid potential legal issues.

Examples of using the transfer an interest in real property

There are various scenarios in which the transfer an interest in real property form may be utilized. Common examples include:

- A homeowner selling their property to a buyer.

- A parent transferring ownership of a property to their child as a gift.

- An heir receiving property as part of an estate settlement.

- Business partners transferring interest in a commercial property.

Quick guide on how to complete transfer an interest in real property

Effortlessly Prepare TRANSFER AN INTEREST IN REAL PROPERTY on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage TRANSFER AN INTEREST IN REAL PROPERTY on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-centered workflow today.

The Easiest Way to Edit and Electrically Sign TRANSFER AN INTEREST IN REAL PROPERTY with Ease

- Locate TRANSFER AN INTEREST IN REAL PROPERTY and click on Get Form to begin.

- Take advantage of the tools we provide to complete your document.

- Mark relevant sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select how you want to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign TRANSFER AN INTEREST IN REAL PROPERTY to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does it mean to TRANSFER AN INTEREST IN REAL PROPERTY?

TRANSFERRING AN INTEREST IN REAL PROPERTY means legally changing the ownership of a property from one individual or entity to another. This can involve various types of interests such as a full sale, lease, or partial ownership. Understanding this process is essential for anyone dealing with real estate transactions.

-

How can airSlate SignNow help with the process of TRANSFERRING AN INTEREST IN REAL PROPERTY?

airSlate SignNow streamlines the process of TRANSFERRING AN INTEREST IN REAL PROPERTY by allowing users to create, send, and eSign essential documents quickly and securely. With our platform, you can manage real estate agreements effortlessly, ensuring that all parties can review and sign documents from anywhere at any time.

-

What features does airSlate SignNow offer for efficient document management?

airSlate SignNow offers features such as customizable templates, automatic reminders, and secure cloud storage which are crucial for managing documents when you need to TRANSFER AN INTEREST IN REAL PROPERTY. These capabilities enhance productivity and ensure that your transactions are completed smoothly and without delay.

-

Is there a cost associated with using airSlate SignNow for document signing?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, making it an affordable solution for those looking to TRANSFER AN INTEREST IN REAL PROPERTY. Each plan provides access to different features, so you can choose one that fits your business requirements and budget.

-

Can I integrate airSlate SignNow with other tools I use?

Yes, airSlate SignNow offers integrations with several popular business applications, making it easy to incorporate our solution into your existing workflows. This is particularly beneficial when you need to efficiently TRANSFER AN INTEREST IN REAL PROPERTY alongside other processes such as customer relationship management.

-

What type of support does airSlate SignNow provide to its users?

airSlate SignNow provides comprehensive customer support through various channels, including live chat, email, and a robust knowledge base. Our team is ready to assist you with any questions you may have regarding the process of TRANSFERRING AN INTEREST IN REAL PROPERTY, ensuring you have the resources to succeed.

-

Is airSlate SignNow secure for signing legal documents?

Absolutely, airSlate SignNow employs advanced encryption and security measures to protect your data and ensure that all documents signed electronically are legally binding. When you need to TRANSFER AN INTEREST IN REAL PROPERTY, security is paramount, and our platform provides peace of mind.

Get more for TRANSFER AN INTEREST IN REAL PROPERTY

Find out other TRANSFER AN INTEREST IN REAL PROPERTY

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed