Form W 9 Taxpayer Identification Number Request Response

What is the Form W-9 Taxpayer Identification Number Request Response

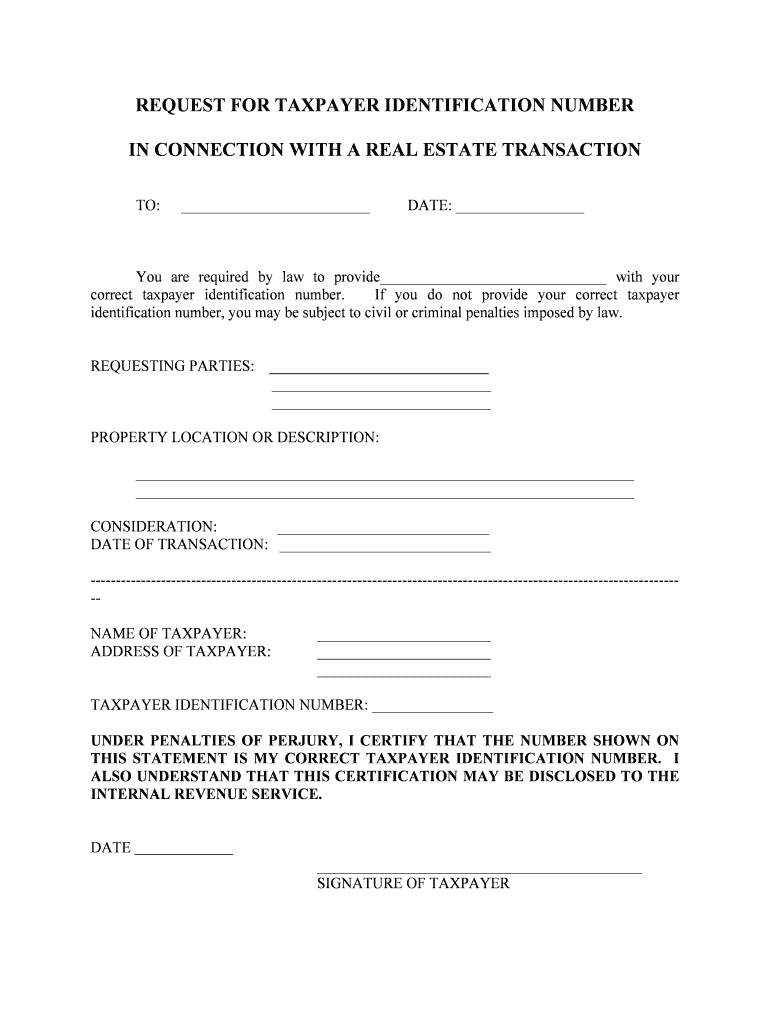

The Form W-9 is a crucial document used in the United States for tax purposes. It is officially titled the Taxpayer Identification Number Request Response and is primarily utilized by individuals and businesses to provide their taxpayer identification number (TIN) to entities that are required to report certain income paid to them. This form is essential for freelancers, contractors, and other self-employed individuals who receive payments from clients or businesses. By completing the W-9, the taxpayer certifies their TIN, which can be a Social Security number (SSN) or an Employer Identification Number (EIN), ensuring accurate tax reporting by the payer.

Steps to Complete the Form W-9 Taxpayer Identification Number Request Response

Completing the Form W-9 involves several straightforward steps:

- Download the Form W-9 from the IRS website or obtain it from the requesting entity.

- Enter your name as it appears on your tax return in the first field.

- If applicable, provide your business name in the second line.

- Select the appropriate federal tax classification that applies to you or your business, such as individual, corporation, or partnership.

- Fill in your address, including street, city, state, and ZIP code.

- Input your taxpayer identification number, which can be your SSN or EIN.

- Sign and date the form to certify that the information provided is correct.

Once completed, the form should be submitted to the requester, not the IRS.

Legal Use of the Form W-9 Taxpayer Identification Number Request Response

The Form W-9 serves a legal purpose in the context of U.S. tax compliance. It is used by businesses to collect the correct TIN from payees to ensure accurate reporting of income to the IRS. The information provided on the W-9 is critical for the issuance of Form 1099, which reports various types of income other than wages. Failure to provide accurate information can lead to backup withholding, where the payer is required to withhold a percentage of payments for tax purposes. Therefore, it is vital that the information on the W-9 is accurate and up-to-date.

How to Obtain the Form W-9 Taxpayer Identification Number Request Response

The Form W-9 can be easily obtained through various means:

- Visit the official IRS website to download the latest version of the form.

- Request a copy from the entity that needs the form, such as a client or business partner.

- Access tax preparation software that may include the form as part of their services.

It is important to ensure that you are using the most current version of the form to avoid any issues with compliance.

Examples of Using the Form W-9 Taxpayer Identification Number Request Response

The Form W-9 is commonly used in various scenarios, including:

- A freelancer providing services to a company that requires a TIN for reporting purposes.

- A contractor working on a project who needs to submit their W-9 to receive payment.

- A business that hires independent consultants must collect W-9 forms to report payments on Form 1099.

These examples illustrate the form's importance in facilitating proper tax reporting and compliance.

Quick guide on how to complete form w 9 taxpayer identification number request response

Prepare Form W 9 Taxpayer Identification Number Request Response effortlessly on any device

Digital document handling has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Form W 9 Taxpayer Identification Number Request Response on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The simplest method to update and eSign Form W 9 Taxpayer Identification Number Request Response without hassle

- Find Form W 9 Taxpayer Identification Number Request Response and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent parts of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as an old-fashioned wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, be it via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your preference. Update and eSign Form W 9 Taxpayer Identification Number Request Response and facilitate effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Form W 9 Taxpayer Identification Number Request Response?

The Form W 9 Taxpayer Identification Number Request Response is a document used by businesses to request a taxpayer identification number from contractors or vendors. It's essential for ensuring accurate reporting of income to the IRS. By using airSlate SignNow, you can easily send, receive, and eSign the Form W 9, streamlining your compliance process.

-

How does airSlate SignNow simplify the process of obtaining a Form W 9 Taxpayer Identification Number Request Response?

With airSlate SignNow, businesses can quickly create and send a Form W 9 Taxpayer Identification Number Request Response to multiple recipients. Our user-friendly interface allows for real-time tracking and reminders, ensuring you get the completed forms back without delay. This simplifies the workflow and helps maintain organized documentation.

-

Is there a cost associated with using airSlate SignNow for Form W 9 processing?

Yes, airSlate SignNow offers competitive pricing plans that cater to different business needs. Our subscription options provide access to features that facilitate the completion of Form W 9 Taxpayer Identification Number Request Responses efficiently. You can choose a plan that fits your budget while enjoying comprehensive functionality.

-

Can I integrate airSlate SignNow with other software for managing Form W 9 requests?

Absolutely! airSlate SignNow integrates seamlessly with various popular business applications, enhancing your workflow. Whether you're using accounting software or project management tools, our platform allows for easy provision and management of Form W 9 Taxpayer Identification Number Request Responses within your existing systems.

-

What features does airSlate SignNow offer for managing Form W 9 Taxpayer Identification Number Request Responses?

airSlate SignNow includes features like document templates, customization options, and secure eSigning specifically designed for Form W 9 Taxpayer Identification Number Request Responses. Additionally, the platform offers a robust audit trail that helps you keep track of who completed the form and when, ensuring compliance and transparency.

-

How does airSlate SignNow ensure the security of Form W 9 Taxpayer Identification Number Request Responses?

Security is a priority at airSlate SignNow. We employ advanced encryption and secure cloud storage to protect your Form W 9 Taxpayer Identification Number Request Responses. Your data remains confidential, ensuring compliance with regulatory standards and safeguarding sensitive taxpayer information.

-

Can I access Form W 9 Taxpayer Identification Number Request Responses from any device?

Yes, airSlate SignNow is accessible on any device with internet connectivity, including smartphones, tablets, and desktops. This means you can obtain, send, and eSign Form W 9 Taxpayer Identification Number Request Responses on the go, making it convenient for busy professionals.

Get more for Form W 9 Taxpayer Identification Number Request Response

Find out other Form W 9 Taxpayer Identification Number Request Response

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe