Application for Reduction of Penalty Assessed under Forms

What is the Application For Reduction Of Penalty Assessed Under Forms

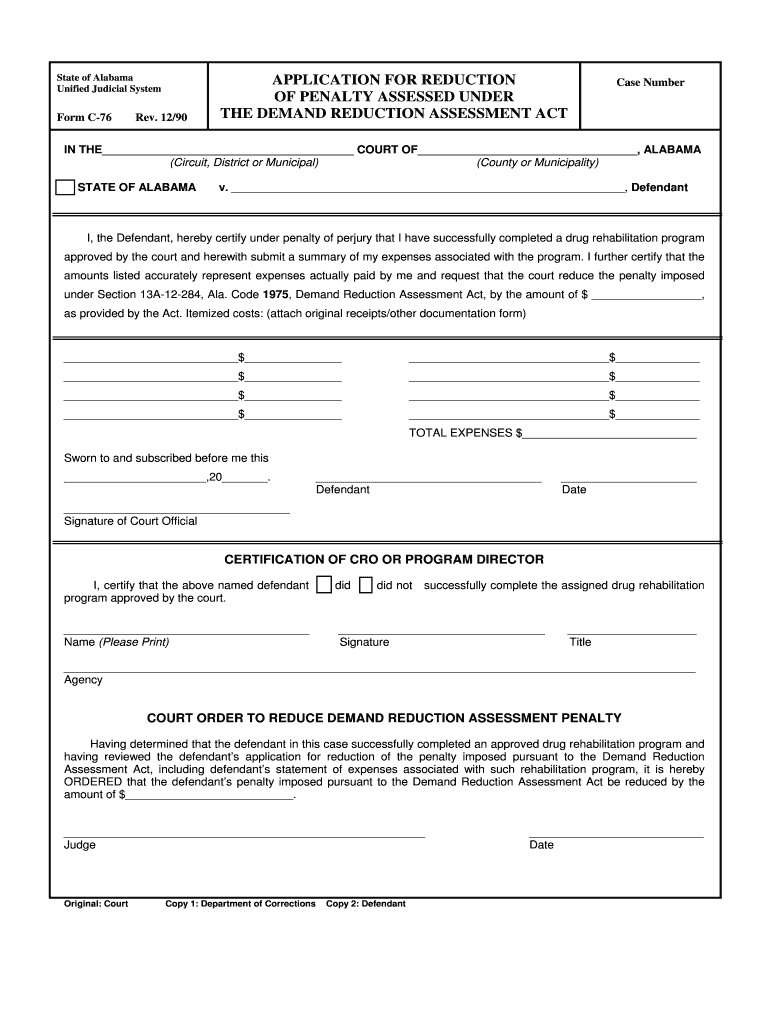

The Application For Reduction Of Penalty Assessed Under Forms is a formal document that individuals or businesses can submit to request a reduction in penalties imposed by tax authorities. This application is often necessary when a taxpayer believes that the penalties are unjust or excessive due to specific circumstances, such as financial hardship or reasonable cause. Understanding the purpose of this application is crucial for anyone facing penalties, as it provides a structured way to appeal and potentially alleviate the financial burden.

Steps to complete the Application For Reduction Of Penalty Assessed Under Forms

Completing the Application For Reduction Of Penalty Assessed Under Forms involves several important steps to ensure accuracy and compliance:

- Gather Required Information: Collect all relevant documentation, including details of the penalties assessed, your tax records, and any supporting evidence that justifies your request for reduction.

- Fill Out the Form: Carefully complete the application, ensuring that all sections are filled out accurately. Pay attention to any specific instructions provided on the form.

- Provide Supporting Documentation: Attach any necessary documents that support your case, such as financial statements, correspondence with tax authorities, or evidence of extenuating circumstances.

- Review the Application: Double-check the completed form for errors or omissions. It is essential that all information is correct before submission.

- Submit the Application: Follow the specified submission method for the form, whether online, by mail, or in person, ensuring it is sent to the correct address.

Legal use of the Application For Reduction Of Penalty Assessed Under Forms

The legal use of the Application For Reduction Of Penalty Assessed Under Forms is governed by tax laws and regulations. When properly filled out and submitted, this application serves as a formal request to the tax authority for reconsideration of penalties. It is essential to ensure that all claims made in the application are truthful and supported by evidence, as false statements can lead to further penalties or legal repercussions. Compliance with all relevant laws is crucial to the legitimacy of the application.

Eligibility Criteria

To qualify for submitting the Application For Reduction Of Penalty Assessed Under Forms, applicants must meet specific eligibility criteria. Generally, these may include:

- Having received a penalty notice from the tax authority.

- Demonstrating reasonable cause for the penalty, such as illness, natural disasters, or other unforeseen circumstances.

- Providing evidence of compliance with tax obligations in the past.

- Submitting the application within the designated timeframe set by the tax authority.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Application For Reduction Of Penalty Assessed Under Forms can typically be done through various methods:

- Online: Many tax authorities offer online submission options through their official websites, allowing for quicker processing.

- Mail: Applicants can print the completed form and send it via postal service to the designated address provided by the tax authority.

- In-Person: Some individuals may choose to submit their application in person at local tax offices for immediate confirmation of receipt.

Key elements of the Application For Reduction Of Penalty Assessed Under Forms

Understanding the key elements of the Application For Reduction Of Penalty Assessed Under Forms is essential for effective completion. These elements typically include:

- Taxpayer Information: Details about the individual or business submitting the application, including name, address, and taxpayer identification number.

- Penalty Details: Specific information about the penalties being contested, including the type of penalty and the amount assessed.

- Reason for Request: A clear explanation of why the penalty should be reduced, supported by relevant documentation.

- Signature: The applicant's signature is required to validate the application, confirming that all information is accurate and truthful.

Quick guide on how to complete application for reduction of penalty assessed under forms

Complete Application For Reduction Of Penalty Assessed Under Forms effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can easily locate the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without any delays. Handle Application For Reduction Of Penalty Assessed Under Forms on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

The easiest way to modify and eSign Application For Reduction Of Penalty Assessed Under Forms effortlessly

- Obtain Application For Reduction Of Penalty Assessed Under Forms and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your requirements in document management with just a few clicks from any device you choose. Edit and eSign Application For Reduction Of Penalty Assessed Under Forms and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the 'Application For Reduction Of Penalty Assessed Under Forms'?

The 'Application For Reduction Of Penalty Assessed Under Forms' is a document used to formally request a reduction in penalties that have been assessed by tax authorities. Using airSlate SignNow, you can easily complete and eSign this application, ensuring a smooth process and quick submission.

-

How can airSlate SignNow help with the 'Application For Reduction Of Penalty Assessed Under Forms'?

airSlate SignNow streamlines the process of completing the 'Application For Reduction Of Penalty Assessed Under Forms' by providing an easy-to-use platform for document management. You can fill out, sign, and send your application with just a few clicks, reducing stress and improving efficiency.

-

Is airSlate SignNow cost-effective for businesses needing to file penalty reduction applications?

Yes, airSlate SignNow offers a cost-effective solution for businesses looking to file the 'Application For Reduction Of Penalty Assessed Under Forms'. With flexible pricing plans and no hidden fees, it allows businesses to save money while accessing powerful eSignature features.

-

What features does airSlate SignNow offer for the 'Application For Reduction Of Penalty Assessed Under Forms'?

airSlate SignNow provides features such as customizable templates, real-time tracking, and secure cloud storage, all tailored for the 'Application For Reduction Of Penalty Assessed Under Forms'. These tools help ensure that your application is completed accurately and submitted on time.

-

Can I collaborate with my team on the 'Application For Reduction Of Penalty Assessed Under Forms' using airSlate SignNow?

Absolutely! airSlate SignNow enables seamless collaboration among team members on the 'Application For Reduction Of Penalty Assessed Under Forms'. You can share documents, gather feedback, and make edits in real-time, ensuring that everyone is on the same page.

-

What are the benefits of using airSlate SignNow for penalty reduction applications?

Using airSlate SignNow for your 'Application For Reduction Of Penalty Assessed Under Forms' offers numerous benefits, including increased speed of submission, enhanced security, and improved organization. The platform ensures your application is processed efficiently, helping you get results faster.

-

Does airSlate SignNow integrate with other applications for handling penalty reduction forms?

Yes, airSlate SignNow integrates seamlessly with various applications, making the handling of the 'Application For Reduction Of Penalty Assessed Under Forms' more efficient. These integrations help streamline your workflow and keep all your documents organized in one place.

Get more for Application For Reduction Of Penalty Assessed Under Forms

Find out other Application For Reduction Of Penalty Assessed Under Forms

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure

- eSignature Arkansas Nanny Contract Template Secure

- eSignature Wyoming New Patient Registration Mobile

- eSignature Hawaii Memorandum of Agreement Template Online

- eSignature Hawaii Memorandum of Agreement Template Mobile

- eSignature New Jersey Memorandum of Agreement Template Safe

- eSignature Georgia Shareholder Agreement Template Mobile

- Help Me With eSignature Arkansas Cooperative Agreement Template

- eSignature Maryland Cooperative Agreement Template Simple

- eSignature Massachusetts Redemption Agreement Simple

- eSignature North Carolina Redemption Agreement Mobile

- eSignature Utah Equipment Rental Agreement Template Now

- Help Me With eSignature Texas Construction Contract Template