I Received the Notice on Form

What is the I Received The Notice On

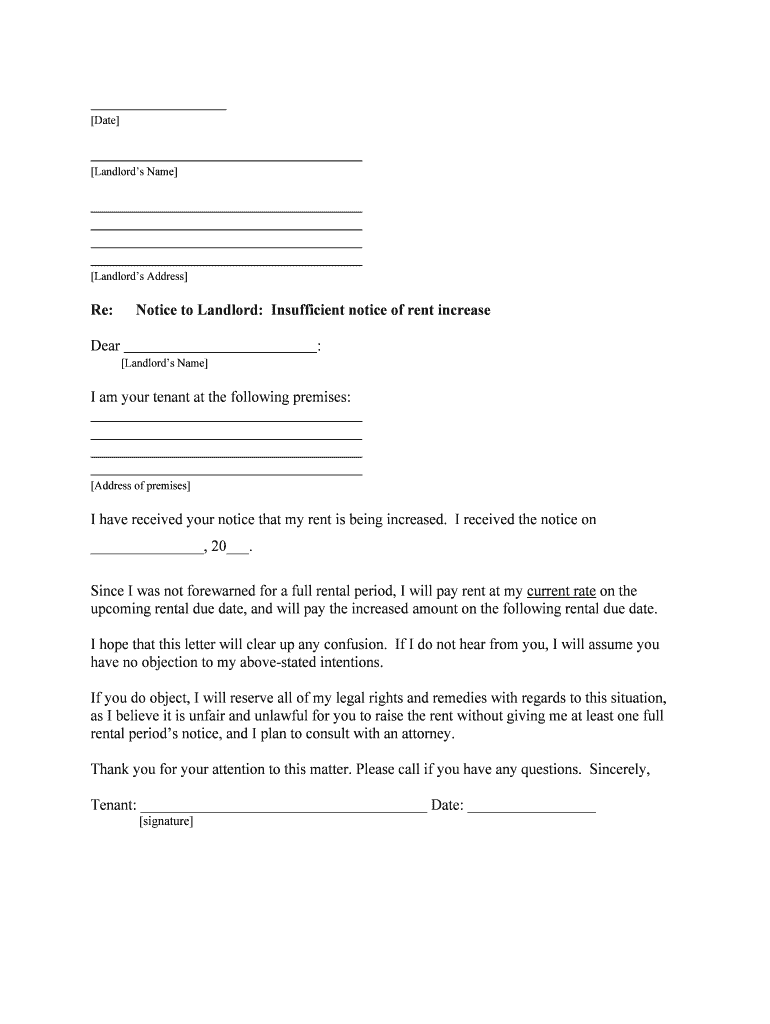

The "I Received The Notice On" form is a document often used in various legal and administrative contexts to confirm the date on which a notice was received. This form serves as an essential record for both individuals and organizations, ensuring that there is a clear timeline regarding notifications and communications. It is particularly relevant in situations involving legal proceedings, tax matters, or compliance with regulatory requirements.

How to use the I Received The Notice On

Using the "I Received The Notice On" form involves a few straightforward steps. First, ensure that you have the correct version of the form, which can typically be obtained from official sources or legal advisors. Next, fill in the necessary details, including your name, the date you received the notice, and any relevant case or reference numbers. Finally, sign and date the form to validate it. This completed form can then be submitted as required, either electronically or in paper format.

Steps to complete the I Received The Notice On

Completing the "I Received The Notice On" form requires careful attention to detail. Follow these steps:

- Obtain the form from a reliable source.

- Enter your personal information accurately, including your name and address.

- Specify the date you received the notice clearly.

- Include any additional information that may be necessary, such as case numbers or reference details.

- Review the form for accuracy before signing it.

- Sign and date the form to confirm its validity.

Legal use of the I Received The Notice On

The "I Received The Notice On" form has legal implications, particularly in contexts where timing is crucial. It can serve as evidence in legal disputes, demonstrating that a party was notified within a specific timeframe. This form is often required in administrative hearings, tax filings, and other legal processes where proof of notice is essential. Ensuring that this form is completed correctly can help protect your rights and interests.

Who Issues the Form

The "I Received The Notice On" form may be issued by various entities depending on its purpose. Common issuers include government agencies, legal courts, and administrative bodies. Each entity may have specific requirements regarding the format and content of the form, so it's important to verify the guidelines provided by the issuing authority to ensure compliance.

Filing Deadlines / Important Dates

Filing deadlines associated with the "I Received The Notice On" form can vary based on the context in which it is used. For instance, in tax matters, there may be specific dates by which the form must be submitted to avoid penalties. It is crucial to be aware of these deadlines to ensure that you comply with all legal and administrative requirements. Always check the relevant guidelines or consult with a legal professional for the most accurate information.

Quick guide on how to complete i received the notice on

Effortlessly Prepare I Received The Notice On on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly and efficiently. Manage I Received The Notice On on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The Easiest Way to Edit and eSign I Received The Notice On with Ease

- Obtain I Received The Notice On and click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Highlight important areas of your documents or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign I Received The Notice On to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What should I do if I received the notice on an unsigned document?

If I received the notice on a document that remains unsigned, it’s essential to take prompt action. You can log into your airSlate SignNow account to review the document and send reminders to the signers. This feature ensures that all necessary parties can complete the signing process quickly and efficiently.

-

How does airSlate SignNow handle legal notices?

If I received the notice on a legal document, rest assured that airSlate SignNow complies with applicable laws regarding electronic signatures. Our platform maintains a secure audit trail to confirm that all actions taken on the document are legally binding, enabling you to manage compliance easily.

-

What pricing options are available if I received the notice on multiple documents?

If I received the notice on several documents requiring signatures, airSlate SignNow offers various pricing plans to accommodate different needs. You can select from monthly or annual subscriptions, which include options for unlimited documents, making it cost-effective for businesses handling multiple files.

-

Can I integrate airSlate SignNow with other applications if I received the notice on a document?

Yes, if I received the notice on a document that needs action, you can easily integrate airSlate SignNow with a variety of applications like Google Drive, Salesforce, and Dropbox. This integration allows for seamless workflow management and ensures that you can handle documents from multiple platforms without hassle.

-

What features should I explore after I received the notice on my signed documents?

After I received the notice on my signed documents, it’s beneficial to explore features such as document templates and automated workflows in airSlate SignNow. These features can simplify your document management process and enhance productivity, making it easier to handle future notices effectively.

-

How secure is airSlate SignNow if I received the notice on sensitive information?

If I received the notice on documents containing sensitive information, you can trust that airSlate SignNow employs industry-leading security measures. We utilize encryption and secure access technology to protect your data, ensuring your documents remain confidential and safe.

-

Is customer support available if I received the notice on a document issue?

Absolutely! If I received the notice on a document and require assistance, airSlate SignNow provides excellent customer support. Our team is ready to help you through live chat, phone, or email, ensuring your queries are resolved efficiently and promptly.

Get more for I Received The Notice On

Find out other I Received The Notice On

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter