Including but Not Limited To, the Payment of Real Estate or Other Ad Valorem Taxes, Labor and Form

What is the Including But Not Limited To, The Payment Of Real Estate Or Other Ad Valorem Taxes, Labor And

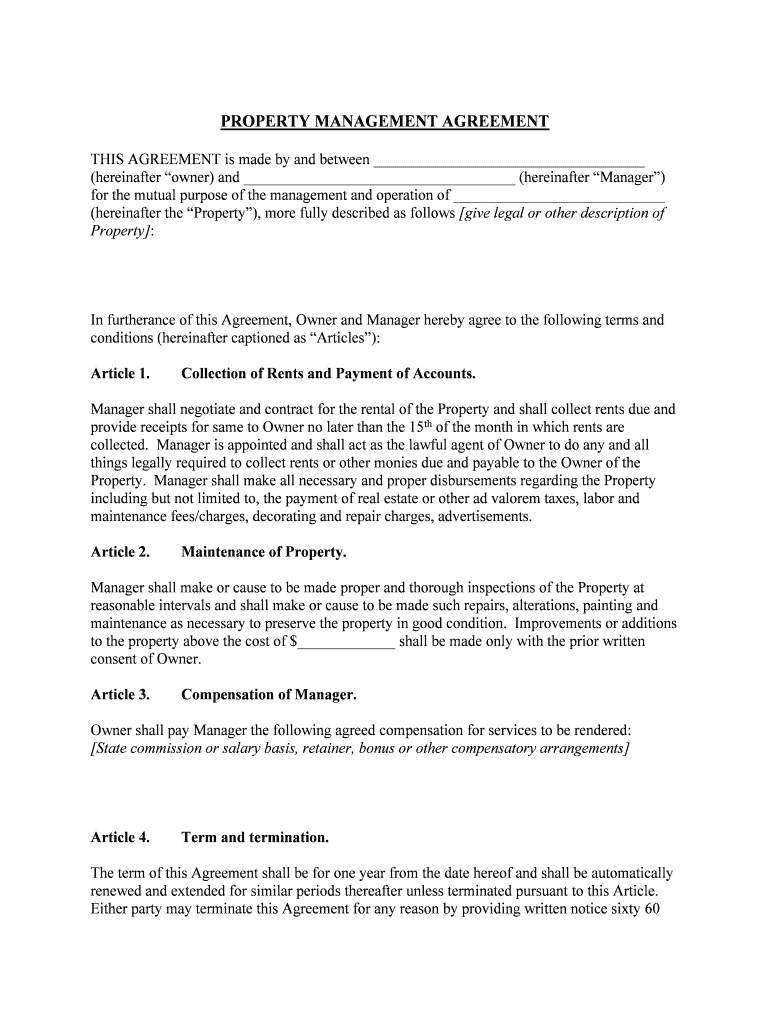

The form titled "Including But Not Limited To, The Payment Of Real Estate Or Other Ad Valorem Taxes, Labor And" serves as a critical document in various financial and legal contexts. It encompasses obligations related to real estate taxes and other ad valorem taxes, which are assessed based on property value. This form may be required for property transactions, tax filings, or compliance with local regulations. Understanding its purpose is essential for individuals and businesses involved in real estate or financial management.

How to use the Including But Not Limited To, The Payment Of Real Estate Or Other Ad Valorem Taxes, Labor And

Using the form effectively requires careful attention to detail. Begin by gathering all necessary information, including property details and tax obligations. Fill out the form accurately, ensuring that all sections are completed as required. This may include specifying the type of taxes involved and any relevant labor costs associated with property management. Once completed, the form can be submitted electronically or in paper format, depending on the requirements of the relevant authority.

Steps to complete the Including But Not Limited To, The Payment Of Real Estate Or Other Ad Valorem Taxes, Labor And

Completing the form involves several key steps:

- Collect all necessary documentation, including property tax statements and labor cost estimates.

- Carefully read through the form to understand the required information.

- Fill in each section, ensuring accuracy and completeness.

- Review the form for any errors or omissions before submission.

- Submit the form according to the specified method, whether online or by mail.

Legal use of the Including But Not Limited To, The Payment Of Real Estate Or Other Ad Valorem Taxes, Labor And

This form is legally binding when completed and submitted in compliance with applicable laws. It is essential to understand the legal implications of the information provided, as inaccuracies can lead to penalties or disputes. The form must adhere to relevant federal and state regulations regarding property taxes and labor costs. Proper use ensures that all parties involved are protected and that obligations are met according to legal standards.

Key elements of the Including But Not Limited To, The Payment Of Real Estate Or Other Ad Valorem Taxes, Labor And

Several key elements are vital for the form's effectiveness:

- Identification of the property and its owner.

- Details regarding the specific taxes being addressed.

- Accurate labor cost estimates related to property management.

- Signatures of all relevant parties to validate the document.

Examples of using the Including But Not Limited To, The Payment Of Real Estate Or Other Ad Valorem Taxes, Labor And

This form can be utilized in various scenarios, such as:

- When selling a property and needing to disclose outstanding tax obligations.

- For annual tax filings to report real estate and labor costs.

- In legal disputes regarding property tax assessments or labor-related claims.

Quick guide on how to complete including but not limited to the payment of real estate or other ad valorem taxes labor and

Prepare Including But Not Limited To, The Payment Of Real Estate Or Other Ad Valorem Taxes, Labor And effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly solution to traditional printed and signed papers, allowing you to find the right template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without unnecessary delays. Handle Including But Not Limited To, The Payment Of Real Estate Or Other Ad Valorem Taxes, Labor And on any device with airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

The simplest way to modify and eSign Including But Not Limited To, The Payment Of Real Estate Or Other Ad Valorem Taxes, Labor And with ease

- Obtain Including But Not Limited To, The Payment Of Real Estate Or Other Ad Valorem Taxes, Labor And and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Including But Not Limited To, The Payment Of Real Estate Or Other Ad Valorem Taxes, Labor And and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer to assist with document signing?

airSlate SignNow provides a range of features designed to streamline the eSigning process. This includes customizable templates, secure cloud storage, and robust tracking capabilities. Our platform supports various document types, allowing users to manage agreements, including but not limited to, the payment of real estate or other ad valorem taxes, labor and.

-

How does airSlate SignNow ensure the security of my documents?

Security is a top priority at airSlate SignNow. We utilize encrypted channels for data transfer and at-rest encryption for stored documents. This ensures that your sensitive information—including but not limited to, the payment of real estate or other ad valorem taxes, labor and—is protected from unauthorized access.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Our plans include essential features at competitive rates, allowing for scalability as your needs grow. You can choose a plan that fits your budget while still providing tools necessary for handling documents, including but not limited to, the payment of real estate or other ad valorem taxes, labor and.

-

Can airSlate SignNow integrate with other software applications?

Yes, airSlate SignNow integrates seamlessly with numerous popular applications, enhancing your workflow efficiency. This includes CRM systems, cloud storage solutions, and accounting software. By integrating with your existing tools, you can manage documents more effectively, including but not limited to, the payment of real estate or other ad valorem taxes, labor and.

-

Is it easy to use airSlate SignNow for new users?

Absolutely! airSlate SignNow is designed with user-friendliness in mind. Our intuitive interface and guided tutorials make it easy for new users to start sending and signing documents quickly, which is crucial for managing tasks such as including but not limited to, the payment of real estate or other ad valorem taxes, labor and.

-

What types of documents can I eSign using airSlate SignNow?

You can eSign a variety of documents using airSlate SignNow, such as contracts, agreements, and forms. Our platform is versatile enough to handle both simple and complex document types. This capability is especially useful for agreements that involve aspects like including but not limited to, the payment of real estate or other ad valorem taxes, labor and.

-

Does airSlate SignNow offer customer support?

Yes, we provide comprehensive customer support to assist you with any inquiries or issues. Our support team is available via chat, email, and phone to ensure that you have access to help when needed. Whether you have questions about features or how to manage documents, including but not limited to, the payment of real estate or other ad valorem taxes, labor and, we're here for you.

Get more for Including But Not Limited To, The Payment Of Real Estate Or Other Ad Valorem Taxes, Labor And

- Afrs 1397 form

- Car pre trip inspection form

- Professional development plan template for schools form

- Sample of envirotainer checklist form

- Iowa llc certificate of organization how to form an llc in iowa download this fillable certificate of organization and send to

- Article 2 formation certificate of organization and other

- Graeters application form

- 20152016 verification worksheet ventura college form

Find out other Including But Not Limited To, The Payment Of Real Estate Or Other Ad Valorem Taxes, Labor And

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement

- Can I Electronic signature New York Residential lease agreement form

- eSignature Pennsylvania Letter Bankruptcy Inquiry Computer

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself