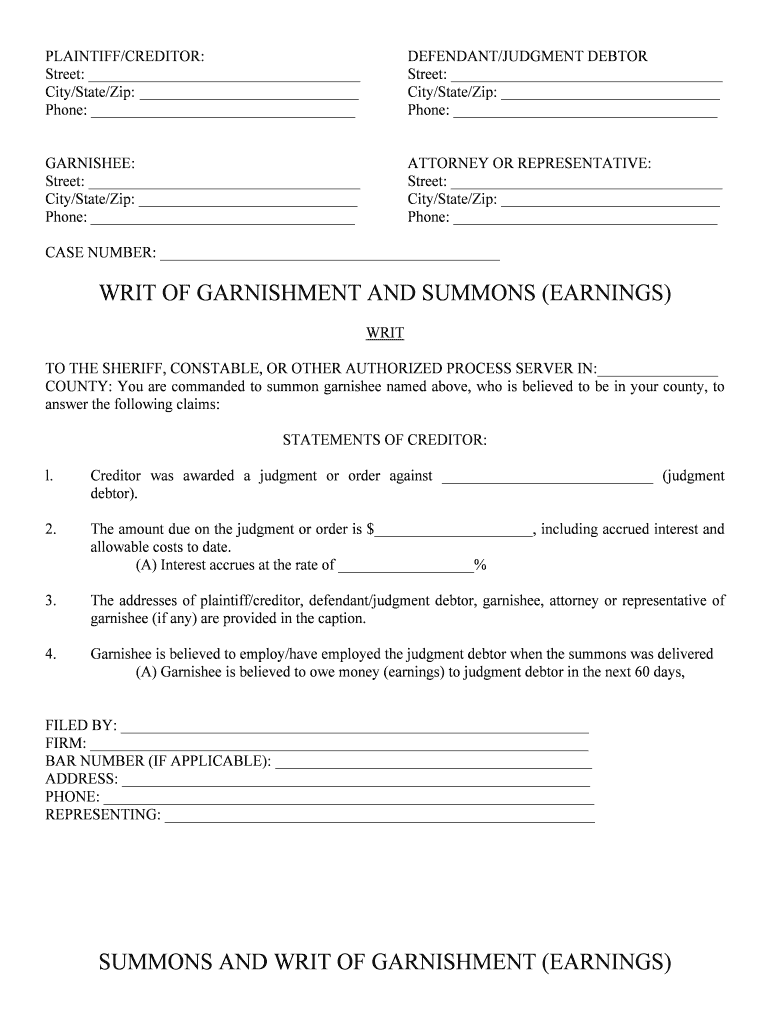

WRIT of GARNISHMENT and SUMMONS EARNINGS Form

What is the writ of garnishment and summons earnings?

The writ of garnishment and summons earnings is a legal document used in the United States to collect debts directly from a debtor's earnings. This form allows creditors to request a court order that mandates an employer to withhold a portion of an employee's wages to satisfy an outstanding debt. The process ensures that creditors can obtain payment while still allowing debtors to retain a portion of their earnings for living expenses. Understanding the specifics of this writ is essential for both creditors and debtors to navigate the legal landscape effectively.

Key elements of the writ of garnishment and summons earnings

Several critical components define the writ of garnishment and summons earnings. These include:

- Identification of parties: The document must clearly identify the creditor, debtor, and the employer involved in the garnishment process.

- Amount owed: It should specify the total amount of debt that the creditor is attempting to collect.

- Withholding percentage: The writ outlines the percentage of the debtor's earnings that will be withheld from each paycheck.

- Legal compliance: The writ must adhere to federal and state laws regarding garnishment, including limits on the amount that can be garnished.

How to use the writ of garnishment and summons earnings

Using the writ of garnishment and summons earnings involves several steps. First, a creditor must obtain a court judgment against the debtor. Once the judgment is secured, the creditor can file the writ with the appropriate court. After the court issues the writ, it must be served to the debtor's employer, who is then legally obligated to comply with the order. Employers should ensure they understand their responsibilities and the timelines for withholding payments to avoid legal repercussions.

Steps to complete the writ of garnishment and summons earnings

Completing the writ of garnishment and summons earnings involves a systematic approach:

- Obtain a court judgment against the debtor.

- Fill out the writ of garnishment form accurately, ensuring all necessary information is included.

- File the completed writ with the court to receive an official court order.

- Serve the writ to the debtor's employer, following local rules for service of process.

- Monitor the employer's compliance and ensure that the correct amounts are being withheld.

State-specific rules for the writ of garnishment and summons earnings

Each state in the U.S. has its own regulations regarding the writ of garnishment and summons earnings. These rules can dictate the maximum amount that can be garnished, the process for serving the writ, and the rights of debtors. It is crucial for creditors and employers to familiarize themselves with their state’s specific laws to ensure compliance and avoid potential legal issues.

Legal use of the writ of garnishment and summons earnings

The legal use of the writ of garnishment and summons earnings is governed by both federal and state laws. Creditors must follow the proper legal procedures to ensure that the garnishment is enforceable. This includes obtaining a court judgment, filing the writ correctly, and adhering to any state-specific regulations. Failure to comply with these legal requirements can result in the garnishment being deemed invalid, leaving creditors without recourse to collect the owed amounts.

Quick guide on how to complete writ of garnishment and summons earnings

Complete WRIT OF GARNISHMENT AND SUMMONS EARNINGS seamlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage WRIT OF GARNISHMENT AND SUMMONS EARNINGS on any device with the airSlate SignNow apps for Android or iOS and enhance any document-focused process today.

How to modify and electronically sign WRIT OF GARNISHMENT AND SUMMONS EARNINGS effortlessly

- Locate WRIT OF GARNISHMENT AND SUMMONS EARNINGS and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional wet-ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your method of sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, endless form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign WRIT OF GARNISHMENT AND SUMMONS EARNINGS and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a writ of garnishment and summons earnings?

A writ of garnishment and summons earnings is a legal order that allows a creditor to collect what is owed directly from a debtor's earnings. This process ensures that a portion of a debtor's paycheck is paid to the creditor until the debt is satisfied, making it a critical tool for debt recovery.

-

How does airSlate SignNow help with a writ of garnishment and summons earnings?

airSlate SignNow simplifies the process by enabling users to create, send, and eSign documents related to writs of garnishment and summons earnings quickly and efficiently. With its user-friendly interface, businesses can ensure that all necessary legal paperwork is promptly delivered and signed, reducing the potential for errors.

-

What are the pricing options for using airSlate SignNow for writ of garnishment and summons earnings?

airSlate SignNow offers flexible pricing plans suitable for businesses of all sizes. By providing a cost-effective solution, users can choose a plan that fits their needs while still accessing the tools required to manage writs of garnishment and summons earnings effectively.

-

Can I integrate airSlate SignNow with other software for managing writ of garnishment and summons earnings?

Yes, airSlate SignNow supports integrations with various software applications, allowing users to seamlessly manage writs of garnishment and summons earnings. This feature enhances productivity by connecting your document management system with other crucial business tools.

-

What are the benefits of using airSlate SignNow for legal documents like writs of garnishment and summons earnings?

Using airSlate SignNow for legal documents such as writs of garnishment and summons earnings offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced compliance. The platform’s electronic signature capabilities ensure that documents are legally binding and securely stored.

-

Is airSlate SignNow user-friendly for those unfamiliar with legal documentation?

Absolutely! airSlate SignNow is designed to be intuitive, making it easy for users, even those unfamiliar with legal documentation, to manage writs of garnishment and summons earnings. The step-by-step guidance provided helps streamline the process and ensures all necessary steps are followed.

-

How secure is airSlate SignNow when handling sensitive documents related to writs of garnishment and summons earnings?

airSlate SignNow prioritizes security, employing advanced encryption and secure storage methods for all documents, including those related to writs of garnishment and summons earnings. Users can trust that their sensitive information is protected throughout the document lifecycle.

Get more for WRIT OF GARNISHMENT AND SUMMONS EARNINGS

- Declaration of intent to homeschool federal way public schools fwps form

- Nhc partner handbook form

- Growing up with us form

- Hcc learning web form

- Certificacin de gastos fijos por medicamentos form

- Individual support plan nc department of health and human ncdhhs form

- File review bformb oregongov oregon

- California residential lease agreement this residential form

Find out other WRIT OF GARNISHMENT AND SUMMONS EARNINGS

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online