REAL PROPERTY of DECEDENT Form

What is the real property of decedent

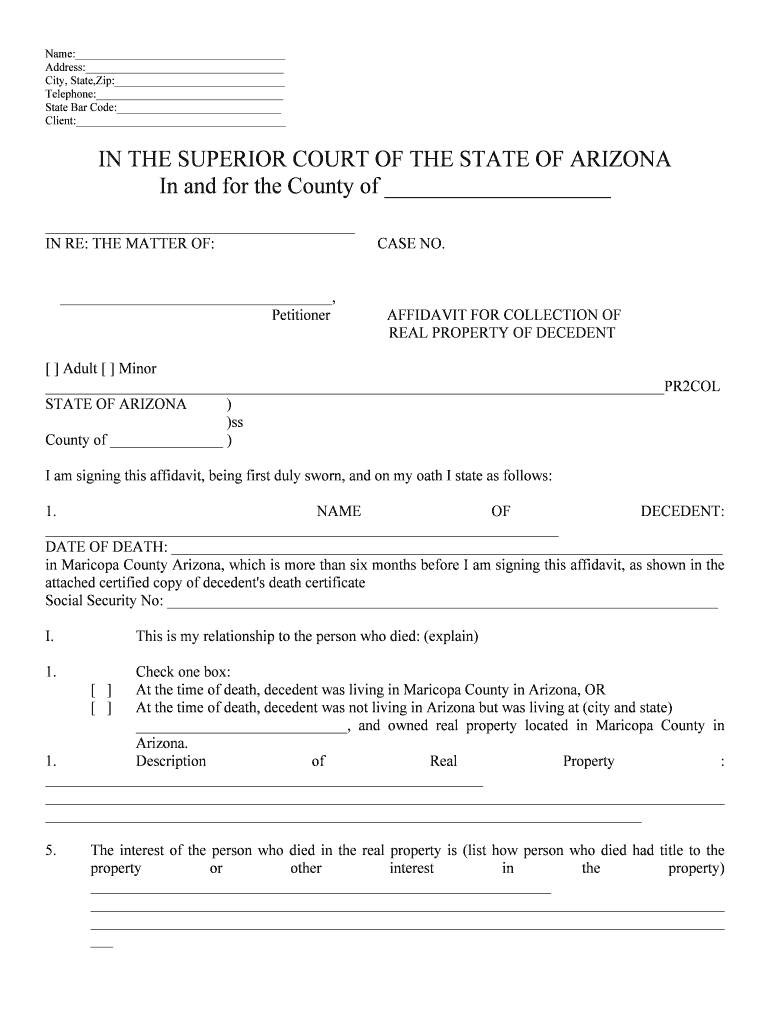

The real property of decedent refers to the real estate assets owned by an individual at the time of their death. This includes any land, buildings, or other structures that may be part of the estate. Understanding the nature of these properties is crucial for the proper administration of the decedent's estate, as it impacts how assets are distributed among heirs and beneficiaries. The process typically involves determining the value of the property, assessing any outstanding debts, and ensuring compliance with state laws regarding inheritance and property transfer.

Steps to complete the real property of decedent

Completing the real property of decedent form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation related to the decedent's property, including deeds, titles, and any relevant tax information. Next, accurately fill out the form, providing details about the property, such as its location, value, and any liens or mortgages. After completing the form, it is essential to review it for any errors or omissions before signing. Finally, submit the form according to the specific requirements of your state, which may include filing with a probate court or local government office.

Legal use of the real property of decedent

The legal use of the real property of decedent form is primarily to facilitate the transfer of ownership of real estate assets after a person's death. This form serves as a legal document that helps establish the rightful heirs or beneficiaries of the property. It is essential for ensuring that the decedent's wishes, as expressed in their will or through state intestacy laws, are honored. Additionally, the form may be required to clear any title issues and to ensure that property taxes are appropriately assessed and paid.

Required documents

To complete the real property of decedent form, several documents are typically required. These may include:

- The decedent's will or trust documents, if applicable.

- Property deeds or titles to establish ownership.

- Death certificate to confirm the decedent's passing.

- Any existing mortgage documents or liens on the property.

- Tax assessments or appraisals to determine the property's value.

Having these documents on hand will streamline the process and help ensure that the form is completed accurately.

State-specific rules for the real property of decedent

Each state has its own laws and regulations governing the transfer of real property after death. These state-specific rules can affect how the real property of decedent form is completed and submitted. For example, some states may require additional documentation or specific language in the form. Additionally, the process for probating a will or handling intestate succession varies by state. It is important to consult state statutes or a legal professional familiar with local laws to ensure compliance and avoid potential legal issues.

Examples of using the real property of decedent

There are various scenarios in which the real property of decedent form may be utilized. For instance, if a homeowner passes away and leaves their property to their children, the form would be necessary to transfer the title from the deceased parent to the heirs. Another example includes a situation where a decedent has multiple properties, and the form must be used for each property to ensure proper distribution according to the will. These examples illustrate the importance of the form in facilitating the legal transfer of real estate assets.

Quick guide on how to complete real property of decedent

Effortlessly prepare REAL PROPERTY OF DECEDENT on any device

The management of online documents has gained traction among businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed papers, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without any hindrances. Manage REAL PROPERTY OF DECEDENT on any device using the airSlate SignNow applications for Android or iOS and enhance any document-focused operation today.

How to modify and electronically sign REAL PROPERTY OF DECEDENT with ease

- Find REAL PROPERTY OF DECEDENT and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or conceal sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal authority as a conventional wet ink signature.

- Review all details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Put aside the worries of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from a device of your choosing. Modify and electronically sign REAL PROPERTY OF DECEDENT and assure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the REAL PROPERTY OF DECEDENT and why is it important?

The REAL PROPERTY OF DECEDENT refers to the real estate owned by an individual at the time of their death. Understanding this concept is essential for executing wills and managing estate plans. It helps ensure that property is distributed according to the decedent's wishes and regulatory requirements.

-

How does airSlate SignNow support the handling of REAL PROPERTY OF DECEDENT?

airSlate SignNow provides a streamlined platform for eSigning and managing documents related to the REAL PROPERTY OF DECEDENT. Our solution simplifies the signing process for wills, property transfers, and other essential documents, ensuring compliance and efficiency in estate planning.

-

Are there any costs associated with managing REAL PROPERTY OF DECEDENT using airSlate SignNow?

Yes, airSlate SignNow offers flexible pricing plans to suit various business needs for managing the REAL PROPERTY OF DECEDENT. Our affordable solutions allow you to scale as necessary while ensuring that all estate-related document processes are efficient and legally compliant.

-

What features does airSlate SignNow offer for dealing with REAL PROPERTY OF DECEDENT?

airSlate SignNow includes features like customizable templates, document sharing, and eSignature capabilities that facilitate efficient management of the REAL PROPERTY OF DECEDENT. These tools help simplify tasks such as preparing wills and property distribution agreements.

-

Can airSlate SignNow integrate with other tools for managing REAL PROPERTY OF DECEDENT?

Yes, airSlate SignNow integrates seamlessly with various business applications, allowing you to centralize your processes related to the REAL PROPERTY OF DECEDENT. This enhances your workflow and ensures that all information is consistent and accessible across different platforms.

-

Is airSlate SignNow secure for managing sensitive documents related to REAL PROPERTY OF DECEDENT?

Absolutely! airSlate SignNow employs advanced security measures to protect sensitive documents associated with the REAL PROPERTY OF DECEDENT. Our platform includes encryption, multi-factor authentication, and secure cloud storage to safeguard your data.

-

How can airSlate SignNow improve the speed of transactions related to REAL PROPERTY OF DECEDENT?

By enabling electronic signatures and document automation, airSlate SignNow signNowly speeds up transactions related to the REAL PROPERTY OF DECEDENT. This efficiency helps reduce turnaround times for approvals and closings, benefiting both executors and beneficiaries.

Get more for REAL PROPERTY OF DECEDENT

- Prescription drug authorization bformb moore medical

- Certificate of stability for continued use of school form

- Tennessee residential rental lease agreement form

- Newark political contribution disclosure eform the city of ci newark nj

- Certain forms instructions and publications used

- 480 7c rev 07 23 form

- Clean break agreement template form

- Cleaning service agreement template form

Find out other REAL PROPERTY OF DECEDENT

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online

- eSignature Idaho Real Estate Cease And Desist Letter Online