Other Credits Not Shown on Another Schedule Describe Form

What is the Other Credits Not Shown On Another Schedule describe

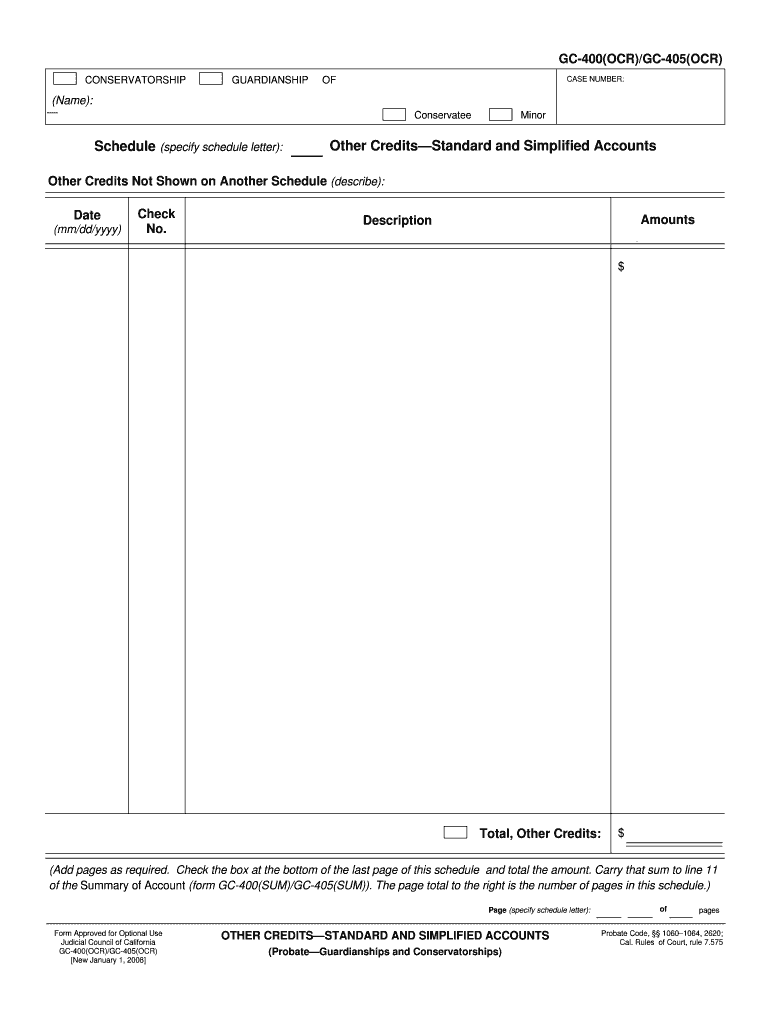

The Other Credits Not Shown On Another Schedule describe form is a tax document used by individuals and businesses to report various tax credits that do not appear on other schedules. This form allows taxpayers to claim credits that may reduce their overall tax liability. It is particularly important for those who have unique situations or additional credits that are not captured in standard tax forms. Understanding this form can help ensure that you receive all eligible credits, ultimately lowering your tax burden.

Steps to complete the Other Credits Not Shown On Another Schedule describe

Completing the Other Credits Not Shown On Another Schedule describe form involves several key steps:

- Gather necessary documentation, including any records of credits you wish to claim.

- Carefully read the instructions provided with the form to understand the requirements.

- Fill out the form accurately, ensuring all information is complete and correct.

- Double-check your entries to avoid errors that could delay processing.

- Submit the form by the specified deadline, either electronically or by mail.

Legal use of the Other Credits Not Shown On Another Schedule describe

The legal use of the Other Credits Not Shown On Another Schedule describe form is governed by IRS regulations. To ensure compliance, it is essential to follow all guidelines outlined in the form's instructions. This includes accurately reporting all relevant credits and maintaining proper documentation to support your claims. Failure to adhere to these regulations can result in penalties or disallowance of credits claimed. It is advisable to consult with a tax professional if there are uncertainties regarding legal compliance.

IRS Guidelines

The IRS provides specific guidelines for completing the Other Credits Not Shown On Another Schedule describe form. These guidelines detail the types of credits that can be claimed, eligibility criteria, and the required documentation. Taxpayers should refer to the latest IRS publications related to this form to ensure they are following current regulations. Staying informed about IRS updates can help prevent mistakes and ensure that all eligible credits are claimed.

Eligibility Criteria

Eligibility for claiming credits on the Other Credits Not Shown On Another Schedule describe form varies depending on the specific credits being claimed. Generally, taxpayers must meet certain income thresholds or have specific circumstances, such as being a student, self-employed, or retired. It is important to review the eligibility criteria for each credit listed on the form to determine if you qualify. This ensures that you can maximize your tax benefits while remaining compliant with IRS regulations.

Required Documents

When completing the Other Credits Not Shown On Another Schedule describe form, several documents may be required to substantiate your claims. Common documents include:

- Proof of income, such as W-2s or 1099s.

- Receipts or statements for expenses related to the credits.

- Any previous tax returns that may provide context for your claims.

- Documentation of eligibility for specific credits, such as enrollment verification for education credits.

Form Submission Methods

The Other Credits Not Shown On Another Schedule describe form can be submitted through various methods, including:

- Electronically via IRS e-file systems, which can expedite processing.

- By mail, sending the completed form to the appropriate IRS address based on your location.

- In-person at designated IRS offices, if necessary.

Quick guide on how to complete other credits not shown on another schedule describe

Complete Other Credits Not Shown On Another Schedule describe effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents promptly without delays. Manage Other Credits Not Shown On Another Schedule describe on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric activity today.

How to alter and eSign Other Credits Not Shown On Another Schedule describe effortlessly

- Locate Other Credits Not Shown On Another Schedule describe and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your adjustments.

- Choose your delivery method for the form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from your preferred device. Modify and eSign Other Credits Not Shown On Another Schedule describe to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are 'Other Credits Not Shown On Another Schedule' in airSlate SignNow?

'Other Credits Not Shown On Another Schedule' describe specific credits that may not be detailed in a primary schedule. This feature allows users to identify and manage additional credits effectively within airSlate SignNow, ensuring all relevant credits are accounted for in your financial documentation.

-

How does airSlate SignNow handle pricing for 'Other Credits Not Shown On Another Schedule'?

airSlate SignNow offers competitive pricing that includes the ability to manage 'Other Credits Not Shown On Another Schedule'. By choosing our service, you gain access to tools that simplify the management of these credits, promoting better financial decision-making without hidden fees.

-

What features does airSlate SignNow provide for managing 'Other Credits Not Shown On Another Schedule'?

Features that support 'Other Credits Not Shown On Another Schedule' include intuitive workflows, customizable templates, and detailed reporting tools. These capabilities enable users to easily incorporate and track these credits in their document workflows, enhancing organizational efficiency.

-

How can I benefit from using airSlate SignNow for 'Other Credits Not Shown On Another Schedule'?

Using airSlate SignNow helps streamline the processing of 'Other Credits Not Shown On Another Schedule', allowing you to maintain clearer financial records. This results in improved productivity as your team can focus on more critical tasks while the software manages complex credit tracking.

-

Can I integrate airSlate SignNow with other accounting software to manage 'Other Credits Not Shown On Another Schedule'?

Yes, airSlate SignNow seamlessly integrates with various accounting software solutions, enabling you to manage 'Other Credits Not Shown On Another Schedule' alongside your existing data. This integration ensures that all relevant financial information is synchronized and easily accessible.

-

Is there a trial period available for testing 'Other Credits Not Shown On Another Schedule' management features?

airSlate SignNow offers a free trial period where prospective customers can explore features related to 'Other Credits Not Shown On Another Schedule'. During the trial, you can test the platform's capabilities and see firsthand how it can enhance your document management and credit tracking processes.

-

What customer support options are available for airSlate SignNow users focusing on 'Other Credits Not Shown On Another Schedule'?

We provide robust customer support for airSlate SignNow users that address queries related to 'Other Credits Not Shown On Another Schedule'. Support options include email assistance, live chat, and comprehensive help resources designed to ensure that you can use the platform effectively.

Get more for Other Credits Not Shown On Another Schedule describe

- Beta sigma phi program ideas form

- Form doj 201a 33904229

- Bar application for administrative approval city of alexandria alexandriava form

- Mdjs form 306a1

- 5011 form

- A case study on the effects of a blended inclusive preschool program on child outcomes using the learning accomplishment profi form

- Lancer agreement template form

- Land access agreement template form

Find out other Other Credits Not Shown On Another Schedule describe

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online