GC 400C4 Schedule C, Disbursements, Fiduciary and Form

What is the GC 400C4 Schedule C, Disbursements, Fiduciary And

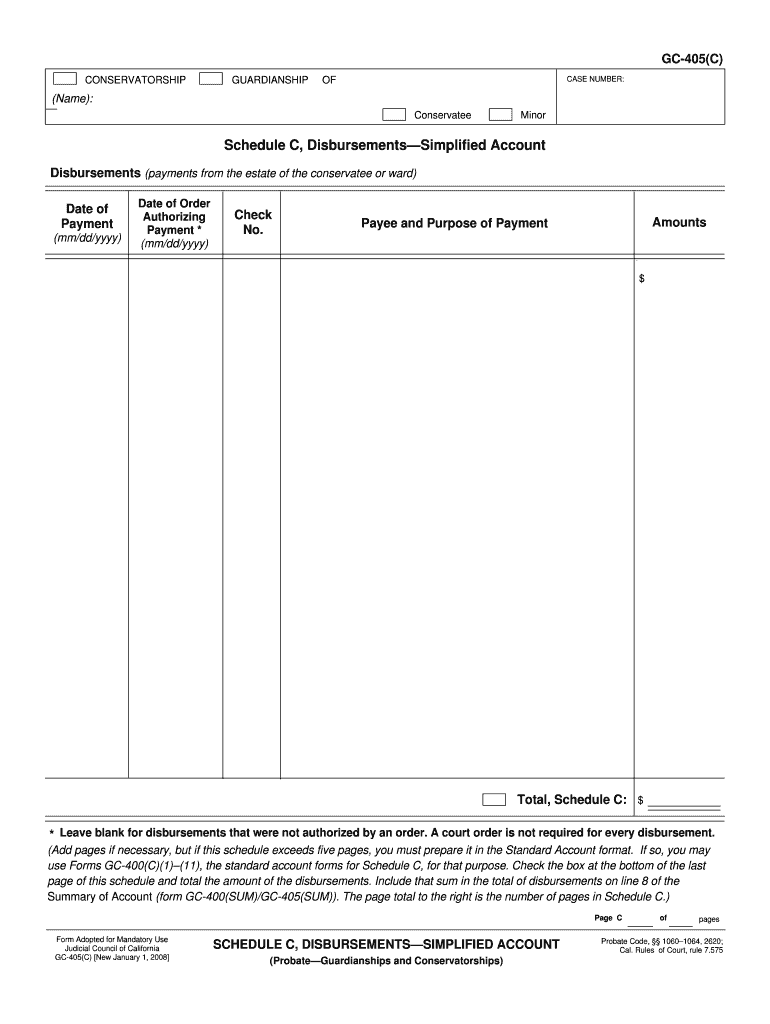

The GC 400C4 Schedule C, Disbursements, Fiduciary And is a specific tax form used in the United States for reporting disbursements made by fiduciaries. This form is crucial for individuals or entities acting in a fiduciary capacity, such as trustees or executors, who manage funds on behalf of beneficiaries. It provides a structured way to report financial transactions, ensuring compliance with tax regulations and transparency in financial dealings.

How to use the GC 400C4 Schedule C, Disbursements, Fiduciary And

Using the GC 400C4 Schedule C involves several steps. First, gather all necessary financial records related to disbursements made during the reporting period. This includes receipts, invoices, and any documentation that supports the transactions. Next, accurately fill out the form, ensuring that all figures are correct and that you have included all required information. Once completed, the form must be submitted to the appropriate tax authority, typically along with your annual tax return.

Steps to complete the GC 400C4 Schedule C, Disbursements, Fiduciary And

Completing the GC 400C4 Schedule C requires careful attention to detail. Follow these steps:

- Gather all relevant financial documents, including receipts and invoices.

- Begin filling out the form by entering basic information about the fiduciary and the beneficiaries.

- List each disbursement made, including dates, amounts, and purposes.

- Ensure that all calculations are accurate and that totals match supporting documents.

- Review the completed form for accuracy and completeness.

- Submit the form along with your tax return before the applicable deadline.

Legal use of the GC 400C4 Schedule C, Disbursements, Fiduciary And

The GC 400C4 Schedule C is legally recognized as a valid document for reporting fiduciary disbursements. To ensure its legal standing, it must be filled out accurately and submitted in accordance with IRS regulations. The information provided on the form must reflect true and correct financial transactions, as inaccuracies can lead to penalties or legal issues. It is essential to maintain thorough records to support the entries made on the form.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the GC 400C4 Schedule C. These guidelines outline the required information, deadlines for submission, and the importance of accuracy in reporting. Familiarizing yourself with these guidelines can help prevent errors and ensure compliance with tax laws. It is advisable to consult the IRS website or a tax professional for the most current information and any updates related to the form.

Form Submission Methods (Online / Mail / In-Person)

The GC 400C4 Schedule C can be submitted through various methods. Taxpayers have the option to file online, which is often the quickest method, or to mail the form to the appropriate tax office. In-person submission may also be available at certain IRS offices, but it is essential to check local availability. Each method has its own processing times, so choosing the right one can affect when you receive confirmation of your submission.

Quick guide on how to complete gc 400c4 schedule c disbursements fiduciary and

Easily Prepare GC 400C4 Schedule C, Disbursements, Fiduciary And on Any Gadget

Managing documents online has become increasingly common among businesses and users. It offers a great eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and safely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage GC 400C4 Schedule C, Disbursements, Fiduciary And on any device with the airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The Simplest Way to Edit and eSign GC 400C4 Schedule C, Disbursements, Fiduciary And with Ease

- Obtain GC 400C4 Schedule C, Disbursements, Fiduciary And and click Get Form to commence.

- Use the tools we provide to fill out your document.

- Mark important sections of the documents or conceal sensitive data with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional ink signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method of sending your form via email, text message (SMS), or an invite link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign GC 400C4 Schedule C, Disbursements, Fiduciary And while ensuring excellent communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the GC 400C4 Schedule C, Disbursements, Fiduciary And?

The GC 400C4 Schedule C, Disbursements, Fiduciary And is a critical financial document used in fiduciary accounting and reporting. It outlines the disbursements made by fiduciaries and ensures transparency in financial transactions. Understanding this schedule is essential for compliance and accurate reporting.

-

How can airSlate SignNow streamline the completion of the GC 400C4 Schedule C, Disbursements, Fiduciary And?

airSlate SignNow simplifies the process of completing the GC 400C4 Schedule C, Disbursements, Fiduciary And by providing intuitive eSignature solutions and easy document sharing. Users can quickly fill out, sign, and send required documents while maintaining compliance. Our platform enhances efficiency and reduces paperwork hassles.

-

What pricing options does airSlate SignNow offer for managing the GC 400C4 Schedule C, Disbursements, Fiduciary And?

airSlate SignNow offers flexible pricing plans that cater to various business needs for managing the GC 400C4 Schedule C, Disbursements, Fiduciary And. You can choose from individual, team, or enterprise plans that fit your budget and requirements. Each plan includes essential features to simplify eSigning and document management.

-

What features does airSlate SignNow provide for the GC 400C4 Schedule C, Disbursements, Fiduciary And?

Key features of airSlate SignNow for the GC 400C4 Schedule C, Disbursements, Fiduciary And include customizable templates, secure eSignatures, and real-time tracking. Users can also integrate with various applications for seamless workflows. These features make it easy to manage fiduciary disbursements efficiently.

-

Is airSlate SignNow compliant with legal requirements for the GC 400C4 Schedule C, Disbursements, Fiduciary And?

Yes, airSlate SignNow is compliant with all legal standards for eSigning documents, including the GC 400C4 Schedule C, Disbursements, Fiduciary And. Our platform adheres to regulations like ESIGN and UETA, ensuring that your signatures and documents are legally binding. This compliance builds trust and guarantees the integrity of your transactions.

-

Can airSlate SignNow integrate with other software for managing the GC 400C4 Schedule C?

Absolutely! airSlate SignNow offers integrations with a wide range of software, making it easy to incorporate the GC 400C4 Schedule C, Disbursements, Fiduciary And into your existing workflows. You can connect with CRM systems, accounting software, and more to enhance your document management process for fiduciaries.

-

What are the benefits of using airSlate SignNow for the GC 400C4 Schedule C, Disbursements, Fiduciary And?

Using airSlate SignNow for the GC 400C4 Schedule C, Disbursements, Fiduciary And provides numerous benefits such as improved efficiency, reduced turnaround time, and increased accuracy in document handling. It eliminates the need for physical paperwork, allowing for a streamlined digital experience that fosters effective communication and collaboration.

Get more for GC 400C4 Schedule C, Disbursements, Fiduciary And

- Order form kitchen cabinetry bathroom cabinets

- Time in hundredths form

- New property management client information sheet the spectrum

- Irs form 8908 walkthrough claiming the energy efficient

- Order agreement template form

- Options agreement template form

- Ordering agreement template form

- Organization agreement template form

Find out other GC 400C4 Schedule C, Disbursements, Fiduciary And

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding