Provide Appraisal to Name and Address of Lender, If Selling Form

What is the Provide Appraisal To Name And Address Of Lender, If Selling

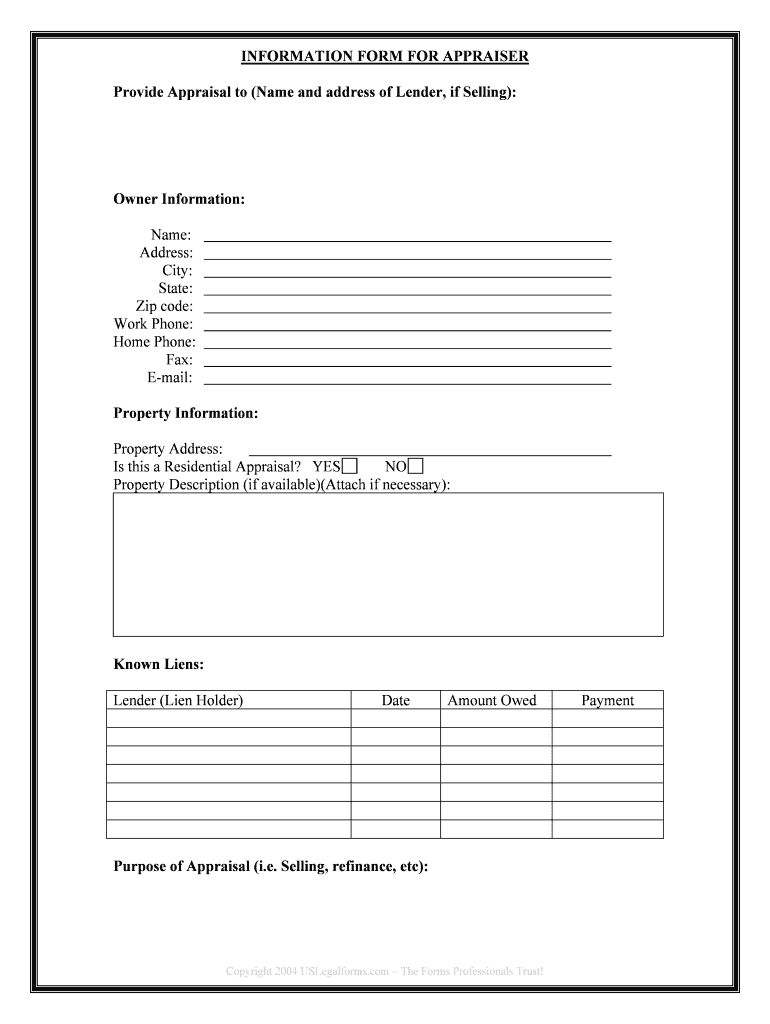

The "Provide Appraisal To Name And Address Of Lender, If Selling" form is a crucial document used in real estate transactions. It serves to formally present an appraisal of the property being sold to the lender involved in the transaction. This appraisal provides an assessment of the property's market value, which is essential for the lender to determine the amount they are willing to finance. The form typically includes details such as the property address, the name of the lender, and the appraised value, ensuring that all parties are informed and in agreement regarding the property's worth.

Steps to Complete the Provide Appraisal To Name And Address Of Lender, If Selling

Completing the "Provide Appraisal To Name And Address Of Lender, If Selling" form involves several key steps:

- Gather necessary information about the property, including its address and relevant details.

- Obtain a professional appraisal from a licensed appraiser to determine the property's market value.

- Fill out the form accurately, ensuring that the lender's name and address are correctly stated.

- Attach the appraisal report to the form, providing evidence of the property's value.

- Review the completed document for accuracy before submission.

Legal Use of the Provide Appraisal To Name And Address Of Lender, If Selling

The "Provide Appraisal To Name And Address Of Lender, If Selling" form holds legal significance in real estate transactions. It ensures that the lender has a clear understanding of the property's value, which is essential for loan approval and risk assessment. The form must be completed with accurate information to avoid potential legal disputes. Additionally, it is important to comply with any state-specific regulations regarding appraisals and disclosures to ensure the document's validity in a legal context.

Key Elements of the Provide Appraisal To Name And Address Of Lender, If Selling

Several key elements must be included in the "Provide Appraisal To Name And Address Of Lender, If Selling" form to ensure its effectiveness:

- Property Details: Include the full address and description of the property being sold.

- Lender Information: Clearly state the name and address of the lender receiving the appraisal.

- Appraisal Value: Provide the appraised market value of the property as determined by a licensed appraiser.

- Signatures: Ensure that the form is signed by the appropriate parties, confirming the accuracy of the information provided.

How to Obtain the Provide Appraisal To Name And Address Of Lender, If Selling

To obtain the "Provide Appraisal To Name And Address Of Lender, If Selling" form, you can follow these steps:

- Contact your lender or real estate agent, as they often have access to the necessary forms.

- Visit official real estate websites or state regulatory agencies that may provide downloadable forms.

- Consult with a legal professional or real estate attorney for guidance on obtaining and completing the form correctly.

Examples of Using the Provide Appraisal To Name And Address Of Lender, If Selling

There are various scenarios where the "Provide Appraisal To Name And Address Of Lender, If Selling" form is utilized:

- A homeowner selling their property must provide this form to their lender to facilitate the sale process.

- A real estate investor may need to submit the form when refinancing a property to secure better loan terms.

- A buyer requesting financing for a new home purchase will need this form to demonstrate the property's value to their lender.

Quick guide on how to complete provide appraisal to name and address of lender if selling

Effortlessly Prepare Provide Appraisal To Name And Address Of Lender, If Selling on Any Device

The management of documents online has become increasingly favored among businesses and individuals alike. It offers an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it in the cloud. airSlate SignNow equips you with all the resources you need to create, alter, and eSign your documents quickly without hold-ups. Manage Provide Appraisal To Name And Address Of Lender, If Selling on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-driven operation today.

How to alter and eSign Provide Appraisal To Name And Address Of Lender, If Selling with ease

- Find Provide Appraisal To Name And Address Of Lender, If Selling and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, a process that takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, exhausting form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Provide Appraisal To Name And Address Of Lender, If Selling and ensure excellent communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process to provide an appraisal to the name and address of the lender, if selling?

To provide an appraisal to the name and address of the lender, if selling, you first need to ensure you have the right appraisal documents ready. You can easily upload these documents using airSlate SignNow. After uploading, simply fill in the lender's details, and you can eSign and send the documents securely.

-

How can airSlate SignNow help streamline my property appraisal process?

airSlate SignNow streamlines the property appraisal process by allowing you to easily upload, sign, and send necessary documents. You can provide appraisal to the name and address of the lender, if selling, with just a few clicks. The user-friendly interface ensures that your workflow is efficient and straightforward.

-

Is there a cost associated with using airSlate SignNow to provide appraisal documents?

Yes, airSlate SignNow offers various pricing plans to fit your business needs. Regardless of the plan you choose, you can efficiently provide appraisal to the name and address of the lender, if selling, without breaking the bank. Our cost-effective solution helps you save time and money.

-

What features does airSlate SignNow offer for the appraisal submission process?

airSlate SignNow provides features like document uploading, eSigning, and real-time notifications. This enables you to provide appraisal to the name and address of the lender, if selling, seamlessly. Additionally, you can track the document status to ensure everything is in order.

-

Can I integrate airSlate SignNow with other software I use for real estate transactions?

Absolutely! airSlate SignNow offers several integrations with popular real estate software and platforms. By integrating those tools, you can easily provide appraisal to the name and address of the lender, if selling, while managing your transactions more effectively.

-

What benefits does electronic signing offer for appraisal documents?

Electronic signing with airSlate SignNow speeds up the process of finalizing appraisal documents. It allows you to provide appraisal to the name and address of the lender, if selling, with secure and legally binding signatures. This reduces delays and enhances your overall transaction experience.

-

How secure is the information I submit through airSlate SignNow?

Security is a top priority for airSlate SignNow. We protect your data with advanced encryption and security protocols, ensuring that when you provide appraisal to the name and address of the lender, if selling, your information remains safe. We comply with industry standards to maintain confidentiality.

Get more for Provide Appraisal To Name And Address Of Lender, If Selling

Find out other Provide Appraisal To Name And Address Of Lender, If Selling

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free