Pursuant to 8 43 501, C Form

What is the Pursuant To 8 43 501, C

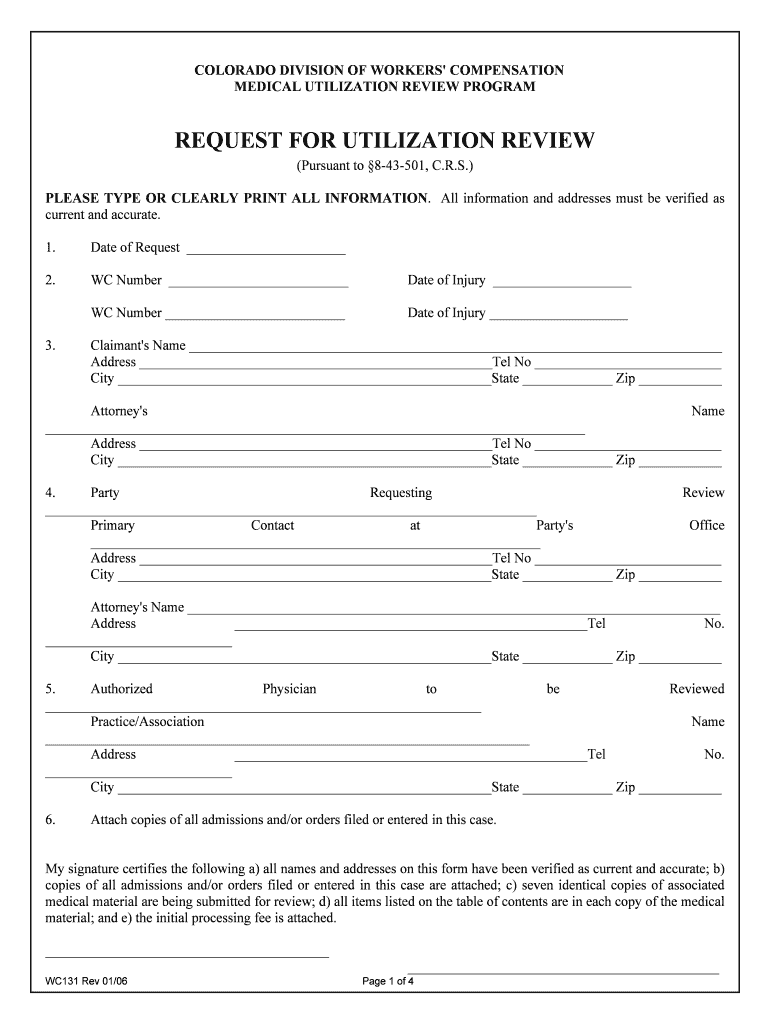

The Pursuant To 8 43 501, C form is a legal document used in specific contexts to ensure compliance with regulatory requirements. This form is essential for individuals and businesses to document particular actions or agreements as mandated by law. Understanding the purpose and implications of this form is crucial for effective compliance and legal standing.

How to use the Pursuant To 8 43 501, C

Using the Pursuant To 8 43 501, C form requires careful attention to detail. Begin by obtaining the form from a reliable source. Complete all required fields accurately, ensuring that all information is current and truthful. Once filled out, the form must be signed, either in person or electronically, depending on the requirements of the governing body. It is advisable to keep a copy of the completed form for your records.

Steps to complete the Pursuant To 8 43 501, C

Completing the Pursuant To 8 43 501, C form involves several key steps:

- Obtain the latest version of the form from an official source.

- Fill in your personal or business information as required.

- Provide any additional information that may be requested, such as supporting documentation.

- Review the completed form for accuracy and completeness.

- Sign the form, ensuring compliance with any signature requirements.

- Submit the form according to the specified submission methods.

Legal use of the Pursuant To 8 43 501, C

The legal use of the Pursuant To 8 43 501, C form is governed by specific statutes and regulations. It is crucial to understand the legal framework surrounding this form to ensure that it is used appropriately. Failure to comply with the legal requirements can result in penalties or invalidation of the document. Legal counsel may be beneficial in navigating these requirements.

Key elements of the Pursuant To 8 43 501, C

Key elements of the Pursuant To 8 43 501, C form include:

- Identification of the parties involved.

- Clear description of the actions or agreements being documented.

- Signature lines for all relevant parties.

- Date of execution.

- Any additional clauses or stipulations required by law.

Examples of using the Pursuant To 8 43 501, C

Examples of using the Pursuant To 8 43 501, C form can vary widely based on the context. For instance, it may be used in real estate transactions to document agreements between buyers and sellers. Additionally, businesses may use this form to formalize contracts or agreements with vendors or clients. Each use case highlights the importance of accuracy and compliance with legal standards.

Quick guide on how to complete pursuant to 8 43 501 c

Prepare Pursuant To 8 43 501, C effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, allowing you to easily locate the right form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without delays. Handle Pursuant To 8 43 501, C on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to adjust and eSign Pursuant To 8 43 501, C with ease

- Locate Pursuant To 8 43 501, C and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious search for forms, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign Pursuant To 8 43 501, C and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to Pursuant To 8 43 501, C.?

airSlate SignNow is an electronic signature solution that allows businesses to send and eSign documents quickly and efficiently. Under Pursuant To 8 43 501, C., electronic signatures are legally recognized, making SignNow a compliant choice for digital document management.

-

How does pricing for airSlate SignNow work, particularly in context to Pursuant To 8 43 501, C.?

The pricing for airSlate SignNow is flexible and designed to accommodate businesses of all sizes. Pursuant To 8 43 501, C. emphasizes the importance of cost-effective solutions for document management, which aligns with our competitive pricing strategy aimed at enhancing productivity without breaking the bank.

-

What features of airSlate SignNow support compliance with Pursuant To 8 43 501, C.?

airSlate SignNow offers numerous features that support compliance, including secure storage, audit trails, and tamper-proof signatures. These functionalities ensure that all electronic transactions meet the standards set forth in Pursuant To 8 43 501, C., promoting trust and integrity in document handling.

-

What benefits does airSlate SignNow provide for businesses under Pursuant To 8 43 501, C.?

Using airSlate SignNow provides businesses with faster turnaround times for document signing and improved workflow efficiencies. Pursuant To 8 43 501, C. requires businesses to adopt reliable document solutions, and SignNow fulfills this need by offering a user-friendly platform that simplifies the signing process.

-

Can airSlate SignNow integrate with other tools in relation to Pursuant To 8 43 501, C.?

Yes, airSlate SignNow seamlessly integrates with popular applications like Google Workspace, Dropbox, and Salesforce. These integrations enhance compliance with Pursuant To 8 43 501, C. by ensuring that all essential tools work together, thereby streamlining the document signing process.

-

Is airSlate SignNow secure and compliant with regulations like Pursuant To 8 43 501, C.?

Absolutely! airSlate SignNow employs advanced encryption protocols to protect user data and ensure document security. Compliance with regulations such as Pursuant To 8 43 501, C. is a top priority, making it a trusted solution for secure electronic signatures.

-

How can businesses ensure effective use of airSlate SignNow pursuant to 8 43 501, C.?

To ensure effective use of airSlate SignNow under Pursuant To 8 43 501, C., businesses should incorporate best practices such as regular training for staff and establishing clear guidelines for document workflows. This maximizes efficiency while ensuring compliance with relevant regulations.

Get more for Pursuant To 8 43 501, C

Find out other Pursuant To 8 43 501, C

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF