Form16a

What is the Form16a

The Form16a is a tax document used in the United States, primarily for reporting income and tax deductions. It serves as a statement of tax deducted at source (TDS) on various payments, including salaries, interest, and dividends. This form is essential for taxpayers to reconcile their income with the tax deducted and reported by their employers or financial institutions. Understanding the purpose and details of Form16a is crucial for accurate tax filing and compliance.

How to use the Form16a

Using Form16a involves several steps to ensure accurate reporting of income and tax deductions. First, obtain the form from your employer or the financial institution that issued it. Review the details carefully, including your name, tax identification number, and the amounts reported. Use the information on Form16a to complete your tax return, ensuring that the income and taxes deducted match the figures reported. This form can also serve as proof of income when applying for loans or other financial services.

Steps to complete the Form16a

Completing Form16a requires attention to detail. Follow these steps:

- Gather necessary documents, including your W-2 or other income statements.

- Fill in your personal information, ensuring accuracy in your name and tax identification number.

- Input the income amounts as reported by your employer or financial institution.

- Verify the tax deductions listed on the form to ensure they reflect the correct amounts.

- Review the completed form for any errors before submission.

Legal use of the Form16a

The legal use of Form16a is governed by tax laws in the United States. This form must be accurately completed and submitted to ensure compliance with IRS regulations. It acts as an official record of income and tax deductions, which can be reviewed by the IRS during audits. Failing to report income or discrepancies between your Form16a and your tax return can lead to penalties. Therefore, it is essential to use this form correctly to avoid legal issues.

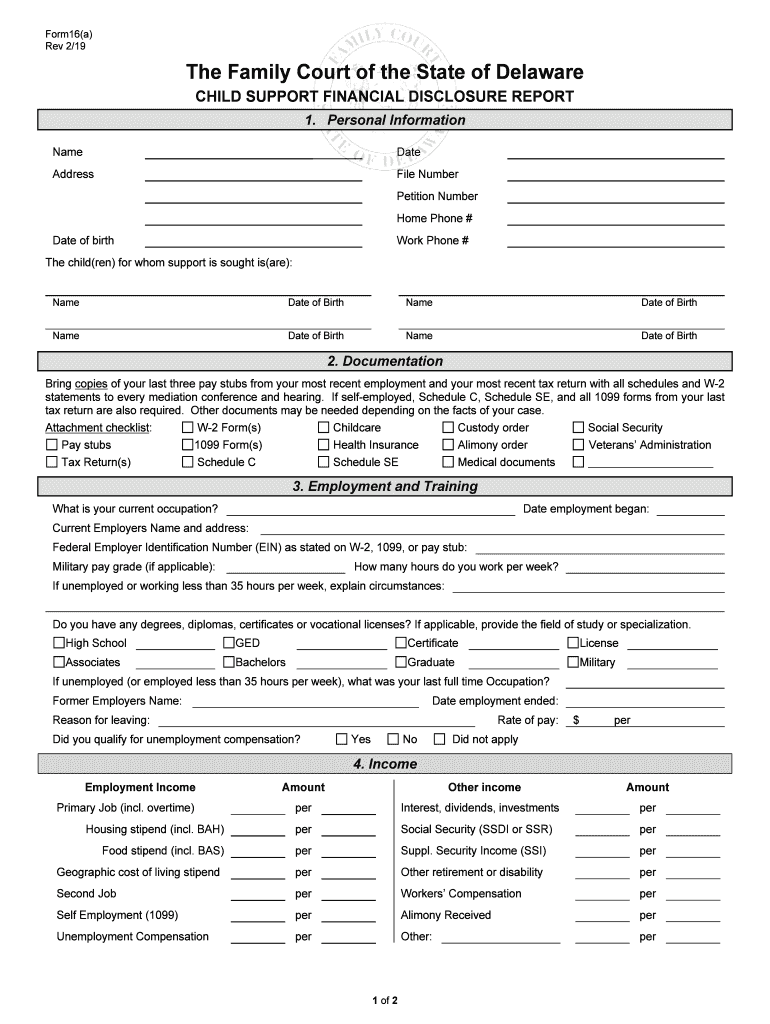

Key elements of the Form16a

Form16a includes several key elements that are vital for accurate tax reporting:

- Taxpayer Information: Name, address, and tax identification number.

- Income Details: Breakdown of various income sources and amounts.

- Tax Deducted: Total tax deducted at source (TDS) for the reporting period.

- Employer/Institution Details: Information about the entity that issued the form.

Form Submission Methods

Form16a can be submitted through various methods, depending on the requirements of the issuing body and the taxpayer's preference. Common submission methods include:

- Online Submission: Many employers and financial institutions allow electronic submission of Form16a through secure portals.

- Mail: You can send a physical copy of the completed form to the relevant tax authority.

- In-Person: Some taxpayers may choose to submit the form directly at designated tax offices.

Quick guide on how to complete form16a

Prepare Form16a effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal environmentally-friendly solution to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Form16a on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and electronically sign Form16a with ease

- Obtain Form16a and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require reprinting. airSlate SignNow caters to all your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Form16a and guarantee outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form16a and how does it work with airSlate SignNow?

Form16a is a tax deduction form utilized by taxpayers to keep track of their income and TDS deductions. With airSlate SignNow, you can easily create, send, and eSign Form16a digitally, streamlining the entire process for better efficiency and compliance.

-

How does airSlate SignNow ensure the security of my Form16a?

airSlate SignNow prioritizes the security of your documents, including Form16a. We use bank-level encryption, secure access controls, and audit trails to ensure that your sensitive information is protected and only accessible to authorized users.

-

Can I customize my Form16a template in airSlate SignNow?

Yes, airSlate SignNow allows you to customize your Form16a templates to meet your specific needs. You can add your branding, adjust fields, and seamlessly incorporate signature prompts, making it tailored and professional.

-

What are the pricing options for using airSlate SignNow for Form16a?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. You can choose from individual, business, or enterprise solutions, allowing you to efficiently manage your Form16a eSigning without breaking the bank.

-

Is airSlate SignNow compatible with other software for managing Form16a?

Absolutely! airSlate SignNow integrates with numerous business applications, enabling you to manage Form16a alongside your existing workflows. Popular integrations include CRM systems, cloud storage, and project management tools for seamless document handling.

-

What are the benefits of using airSlate SignNow for Form16a processing?

Using airSlate SignNow for Form16a processing offers numerous advantages, including faster turnaround times, reduced paperwork, and enhanced organization. With eSigning capabilities, you can impress your clients with a professional, hassle-free experience.

-

How can I track the status of my Form16a documents in airSlate SignNow?

airSlate SignNow provides a comprehensive dashboard that allows you to easily track the status of your Form16a documents. You can see who has viewed, signed, or processed the document, ensuring you are always updated on the progress.

Get more for Form16a

Find out other Form16a

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile