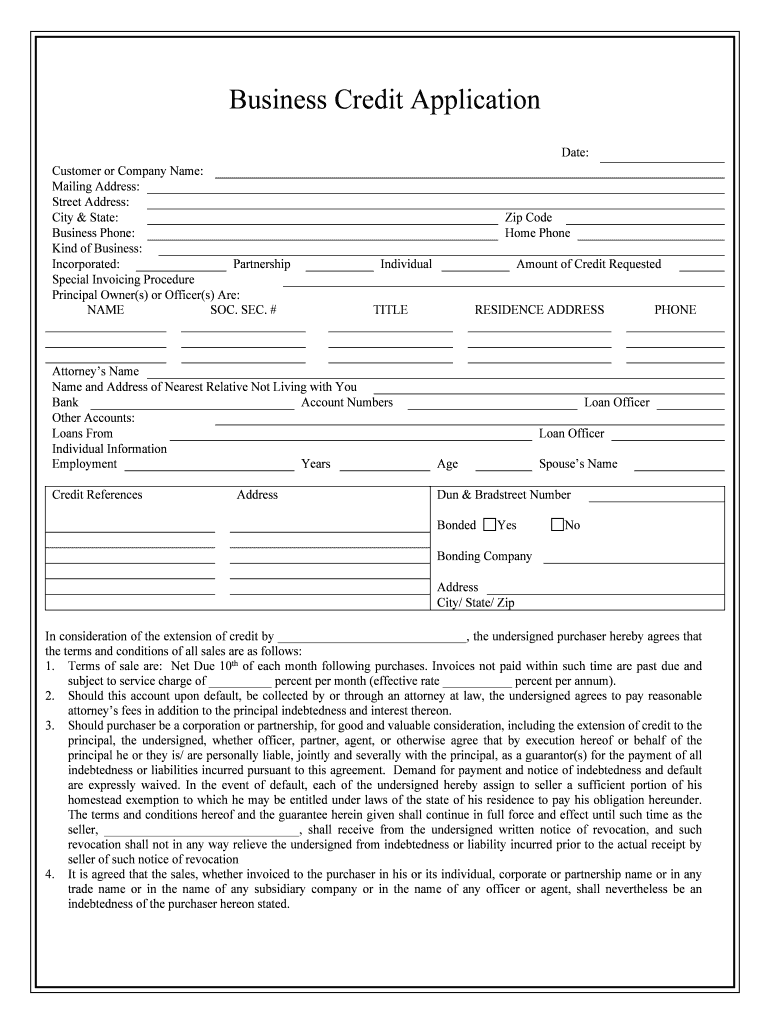

Special Invoicing Procedure Form

What is the Special Invoicing Procedure

The Special Invoicing Procedure is a specific method used by businesses to manage invoicing in a way that meets unique requirements. This procedure allows for the electronic submission and processing of invoices, ensuring compliance with relevant regulations. It is particularly important in industries where precise invoicing is critical, such as finance and healthcare. The procedure outlines the steps necessary for creating, sending, and tracking invoices digitally, making it easier for businesses to maintain accurate records and streamline their financial operations.

How to use the Special Invoicing Procedure

Using the Special Invoicing Procedure involves several key steps. First, businesses must gather all necessary information, including client details, service descriptions, and payment terms. Next, they can create the invoice using digital tools that comply with legal standards. Once the invoice is prepared, it should be sent to the client electronically, ensuring that all parties have access to a copy. Finally, tracking the invoice's status is essential, allowing businesses to follow up on payments and maintain clear communication with clients.

Steps to complete the Special Invoicing Procedure

Completing the Special Invoicing Procedure requires a systematic approach. Begin by collecting all relevant data needed for the invoice. After that, utilize an eSignature platform to create the invoice document. Ensure that the invoice includes all required elements, such as invoice number, date, and due date. Once the invoice is finalized, send it to the client through a secure digital method. After sending, monitor the invoice's status to confirm receipt and payment. Following up with clients can help ensure timely payments and maintain good relationships.

Legal use of the Special Invoicing Procedure

To ensure the legal validity of the Special Invoicing Procedure, businesses must adhere to specific regulations governing electronic invoicing. Compliance with the ESIGN Act and UETA is crucial, as these laws establish the legality of electronic signatures and documents. Additionally, businesses should maintain proper records of all transactions and communications related to invoicing. This includes keeping copies of sent invoices and any correspondence with clients regarding payments. By following these legal guidelines, businesses can protect themselves and ensure that their invoicing practices are recognized in a court of law.

Key elements of the Special Invoicing Procedure

Several key elements define the Special Invoicing Procedure. These include accurate client information, clear descriptions of services rendered, and detailed payment terms. Additionally, the use of digital signatures is essential for validating the invoice. Security measures, such as encryption and two-factor authentication, help protect sensitive information during the invoicing process. Lastly, maintaining an audit trail is important for tracking changes and confirming the integrity of the invoicing process.

Required Documents

When utilizing the Special Invoicing Procedure, certain documents are required to ensure a smooth process. These typically include the invoice itself, which must contain all necessary details, and any supporting documents that justify the charges, such as contracts or service agreements. Additionally, businesses may need to provide proof of delivery or acceptance of services rendered. Keeping these documents organized and accessible is vital for effective invoicing and compliance with legal requirements.

Penalties for Non-Compliance

Failure to comply with the regulations surrounding the Special Invoicing Procedure can lead to significant penalties. Businesses may face fines or legal action if they do not adhere to electronic invoicing laws. Additionally, non-compliance can result in delayed payments and damaged relationships with clients. It is essential for businesses to stay informed about the legal requirements and ensure that their invoicing practices align with these standards to avoid potential repercussions.

Quick guide on how to complete special invoicing procedure

Complete Special Invoicing Procedure effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to access the necessary forms and securely save them online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Special Invoicing Procedure on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to edit and eSign Special Invoicing Procedure without breaking a sweat

- Find Special Invoicing Procedure and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of the documents or black out sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious document searching, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Special Invoicing Procedure and ensure seamless communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Special Invoicing Procedure offered by airSlate SignNow?

The Special Invoicing Procedure with airSlate SignNow allows businesses to streamline their billing process while ensuring compliance and accuracy. This feature enables users to create customized invoices that meet specific client requirements, making it easier to manage payments and track cash flow.

-

How does the Special Invoicing Procedure integrate with existing accounting software?

airSlate SignNow's Special Invoicing Procedure seamlessly integrates with popular accounting software like QuickBooks and Xero. This integration allows for automated data transfer, reducing manual entry errors and enhancing the overall efficiency of the invoicing process.

-

Can I customize my invoices using the Special Invoicing Procedure?

Absolutely! The Special Invoicing Procedure enables users to customize invoices, adding logos, modifying layouts, and including specific payment terms. This ensures that your branding is consistent while meeting the unique needs of your clients.

-

What are the pricing options for using the Special Invoicing Procedure?

airSlate SignNow offers various pricing plans that include access to the Special Invoicing Procedure. Depending on the specific plan chosen, businesses can enjoy different features and benefits, ensuring they find a solution that fits their budget and invoicing requirements.

-

What benefits can businesses expect from the Special Invoicing Procedure?

By utilizing the Special Invoicing Procedure, businesses can expect faster payment cycles, reduced invoice disputes, and enhanced client satisfaction. This streamlined process not only saves time but also improves overall cash flow management.

-

Is there a mobile app available for the Special Invoicing Procedure?

Yes, airSlate SignNow provides a mobile app that supports the Special Invoicing Procedure, allowing users to manage invoices on the go. The app ensures that you can send, eSign, and track invoices directly from your mobile device, increasing accessibility and flexibility.

-

How does airSlate SignNow ensure security in its Special Invoicing Procedure?

Security is a top priority for airSlate SignNow, especially with the Special Invoicing Procedure. The platform employs robust encryption protocols and secure data storage to protect sensitive information, giving users peace of mind while managing their invoicing.

Get more for Special Invoicing Procedure

- Sol licitud certificat damp39esportista secretaria general de lamp39esport esports gencat form

- Asnt level 3 application form

- 032021 sepa form

- Download wikiform

- Employee of the month nomination questions form

- Rv n0003101 form

- Section 1 an agencys request for an initial licensure survey form

- Fillable online mcle judiciary gov mcle form no 09 a

Find out other Special Invoicing Procedure

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document