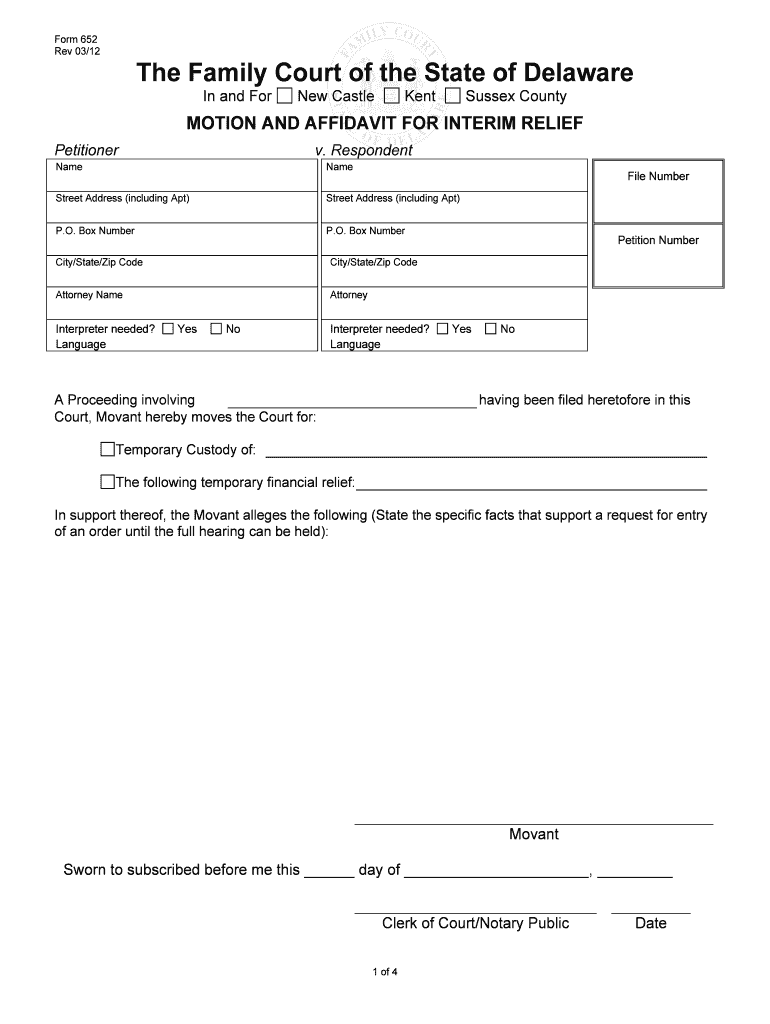

Form 652

What is the Form 652

The Form 652 is a specific document used primarily for reporting certain financial and tax-related information in the United States. This form is essential for individuals and businesses to ensure compliance with federal regulations. It is typically utilized in various scenarios, including tax reporting and financial disclosures, making it a critical component of the documentation process.

How to use the Form 652

Using the Form 652 involves several steps to ensure accurate completion and submission. First, gather all necessary information, such as personal identification details and financial data relevant to the form. Next, carefully fill out each section of the form, ensuring that all entries are accurate and complete. After completing the form, review it for any errors before submission. Depending on the requirements, you may need to submit the form electronically or via traditional mail.

Steps to complete the Form 652

Completing the Form 652 requires a systematic approach to ensure accuracy. Start by downloading the form from an official source. Follow these steps:

- Read the instructions carefully to understand the requirements.

- Fill in your personal information, including your name, address, and tax identification number.

- Provide the necessary financial information as specified in the form.

- Double-check all entries for accuracy.

- Sign and date the form where required.

Once completed, submit the form according to the provided guidelines.

Legal use of the Form 652

The legal use of the Form 652 is governed by specific regulations that dictate how the form should be completed and submitted. Compliance with these regulations is crucial for the form to be considered valid. The form must be signed and dated appropriately, and any supporting documents must be included as required. Failure to adhere to these legal stipulations can result in penalties or the rejection of the form.

Key elements of the Form 652

Key elements of the Form 652 include various sections that require specific information. These typically encompass personal identification details, financial data, and any relevant disclosures. It is important to ensure that all key elements are filled out accurately to avoid complications during processing. Each section serves a purpose in providing a comprehensive overview of the individual's or business's financial situation.

Form Submission Methods

The Form 652 can be submitted through various methods, depending on the requirements set forth by the issuing authority. Common submission methods include:

- Online submission through a designated portal.

- Mailing the completed form to the appropriate address.

- In-person submission at specified locations.

Choosing the correct submission method is essential to ensure timely processing and compliance with regulations.

Quick guide on how to complete form 652

Complete Form 652 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without interruptions. Manage Form 652 on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Form 652 effortlessly

- Locate Form 652 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Identify key sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and bears the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to submit your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Form 652 to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Form 652 and how does airSlate SignNow utilize it?

Form 652 refers to a specific document that can be easily managed through airSlate SignNow. Our platform enables users to create, send, and eSign Form 652 efficiently, ensuring that all necessary information is captured and signed in a seamless process.

-

How much does it cost to use airSlate SignNow for managing Form 652?

airSlate SignNow offers competitive pricing plans suitable for various business needs. You can start with a free trial and choose a plan that fits your budget for handling Form 652 alongside other document management tasks.

-

What features does airSlate SignNow provide for Form 652?

airSlate SignNow includes features like customizable templates, real-time collaboration, and secure storage specifically for Form 652. Users can also enjoy advanced tracking and reporting capabilities to monitor the signing status of their documents.

-

How does airSlate SignNow enhance the eSigning process for Form 652?

The airSlate SignNow solution simplifies the eSigning process for Form 652 by providing a user-friendly interface. With just a few clicks, your signers can review, sign, and return the document, saving time and improving efficiency.

-

Is it possible to integrate airSlate SignNow with other applications for working with Form 652?

Yes, airSlate SignNow supports integrations with various applications, allowing you to streamline your workflow for Form 652. Whether you use CRM systems, cloud storage, or project management tools, our platform can easily connect to enhance your document management.

-

What benefits can businesses expect from using airSlate SignNow for Form 652?

By utilizing airSlate SignNow for Form 652, businesses can expect faster turnaround times and improved accuracy in document handling. Our solution not only saves time but also reduces paperwork costs and enhances compliance with legal standards.

-

Can multiple users collaborate on Form 652 documents in airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on Form 652 documents simultaneously. This feature facilitates better communication and ensures that all team members can contribute effectively, regardless of their location.

Get more for Form 652

- Internet access lease addendum form

- Special excess weight permit vermont department of motor vehicles dmv vermont form

- Request for certificate of insurance forms girl guides of canada

- Diploma replacement request form towson university towson

- Imm 5476 form

- Nsw department of educationapplication for extende form

- Fast track application as an enrolled nurse registered nurse or midwife aftr 40 form

- Pdf referees statement nsw fair trading form

Find out other Form 652

- How Do I Sign Alaska Paid-Time-Off Policy

- Sign Virginia Drug and Alcohol Policy Easy

- How To Sign New Jersey Funeral Leave Policy

- How Can I Sign Michigan Personal Leave Policy

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple

- Sign Louisiana Company Bonus Letter Safe

- How To Sign Delaware Letter of Appreciation to Employee

- How To Sign Florida Letter of Appreciation to Employee

- How Do I Sign New Jersey Letter of Appreciation to Employee

- How Do I Sign Delaware Direct Deposit Enrollment Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form