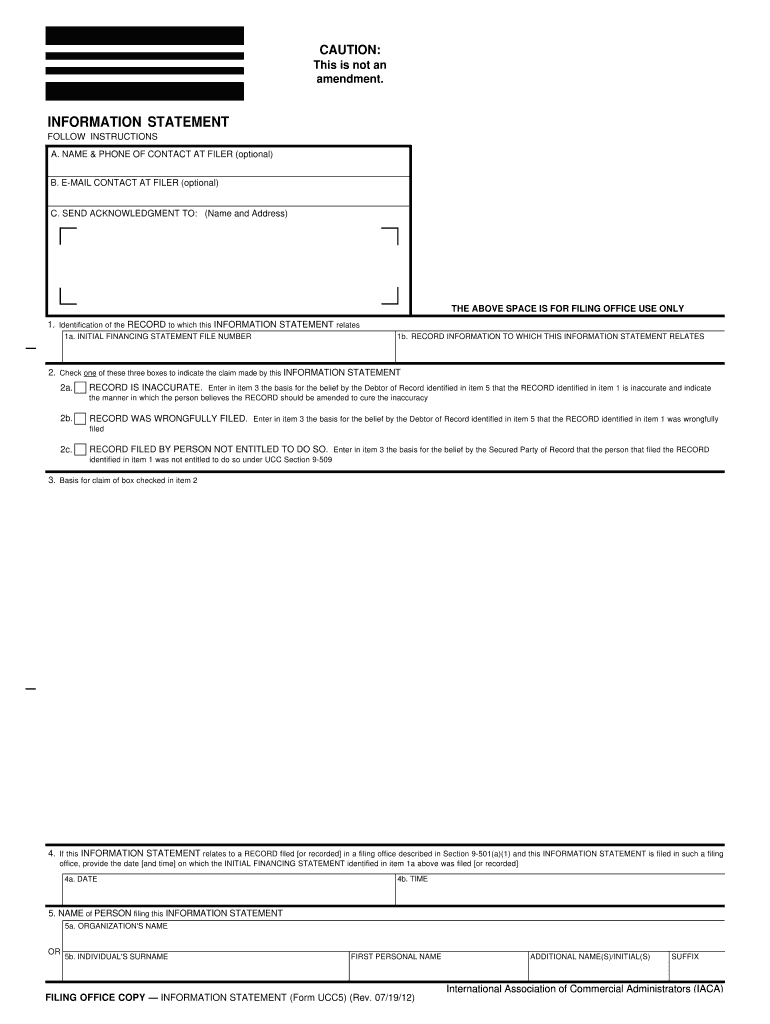

RECORD INFORMATION to WHICH THIS INFORMATION STATEMENT RELATES

What is the record information to which this information statement relates?

The record information to which this information statement relates is a formal document that serves as a declaration of specific details required for legal, financial, or administrative purposes. This information often includes personal or business data that must be accurately reported to comply with regulations or fulfill obligations. Understanding the context and requirements surrounding this record is essential for ensuring that it is completed correctly and submitted on time.

Steps to complete the record information to which this information statement relates

Completing the record information to which this information statement relates involves several key steps:

- Gather necessary documents that provide the required information.

- Carefully read the instructions associated with the statement to understand what details are needed.

- Fill out the form accurately, ensuring that all information is complete and truthful.

- Review the completed statement for any errors or omissions.

- Submit the form electronically or via mail, depending on the specified submission method.

Legal use of the record information to which this information statement relates

The legal use of the record information to which this information statement relates is crucial for maintaining compliance with applicable laws. This document may be used in various contexts, such as tax reporting, legal proceedings, or regulatory compliance. To ensure its legal validity, it must be completed accurately and submitted within the designated timeframe. Additionally, using a secure electronic signature solution can enhance the document's legal standing.

Examples of using the record information to which this information statement relates

There are various scenarios in which the record information to which this information statement relates may be utilized:

- Filing tax returns, where accurate reporting of income and deductions is required.

- Applying for loans or grants, necessitating the disclosure of financial information.

- Submitting legal documents in court, where specific information must be validated.

Required documents for the record information to which this information statement relates

To complete the record information to which this information statement relates, certain documents are typically required. These may include:

- Identification documents, such as a driver's license or passport.

- Financial records, including bank statements or tax returns.

- Business documentation, if applicable, such as articles of incorporation or operating agreements.

Form submission methods for the record information to which this information statement relates

The record information to which this information statement relates can be submitted through various methods, depending on the specific requirements outlined in the instructions. Common submission methods include:

- Online submission through a secure portal.

- Mailing a physical copy to the designated address.

- In-person submission at specified offices or agencies.

Quick guide on how to complete record information to which this information statement relates

Prepare RECORD INFORMATION TO WHICH THIS INFORMATION STATEMENT RELATES effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle RECORD INFORMATION TO WHICH THIS INFORMATION STATEMENT RELATES on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related operation today.

How to modify and eSign RECORD INFORMATION TO WHICH THIS INFORMATION STATEMENT RELATES seamlessly

- Locate RECORD INFORMATION TO WHICH THIS INFORMATION STATEMENT RELATES and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive details using tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, be it via email, SMS, or an invite link, or download it to your computer.

Forget about lost or misplaced files, cumbersome form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and eSign RECORD INFORMATION TO WHICH THIS INFORMATION STATEMENT RELATES and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it help RECORD INFORMATION TO WHICH THIS INFORMATION STATEMENT RELATES?

airSlate SignNow is an electronic signature solution that streamlines the document signing process. By using our platform, businesses can easily send, sign, and manage documents, ensuring that they accurately RECORD INFORMATION TO WHICH THIS INFORMATION STATEMENT RELATES. This ultimately enhances efficiency and reduces the risk of errors.

-

How much does airSlate SignNow cost, especially for features that help RECORD INFORMATION TO WHICH THIS INFORMATION STATEMENT RELATES?

Our pricing plans are designed to be cost-effective, catering to various business sizes and needs. You can choose from different tiers, each providing specific features to assist in the management and secure RECORD INFORMATION TO WHICH THIS INFORMATION STATEMENT RELATES. Visit our pricing page to find the plan that best fits your requirements.

-

What features does airSlate SignNow offer to RECORD INFORMATION TO WHICH THIS INFORMATION STATEMENT RELATES effectively?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure cloud storage, all aimed at enhancing your document management. These capabilities ensure that when you RECORD INFORMATION TO WHICH THIS INFORMATION STATEMENT RELATES, the process is efficient and compliant, helping you maintain accurate records.

-

Can airSlate SignNow integrate with other software to assist in recording information?

Yes, airSlate SignNow offers seamless integration with various applications like CRM systems, accounting software, and more. By integrating with these tools, you can better RECORD INFORMATION TO WHICH THIS INFORMATION STATEMENT RELATES within your existing workflows, improving data accuracy and accessibility.

-

What security measures does airSlate SignNow have in place for sensitive information?

airSlate SignNow prioritizes security with advanced encryption, two-factor authentication, and compliance with industry standards such as GDPR. These measures ensure that any documents you send or receive, and the information you RECORD INFORMATION TO WHICH THIS INFORMATION STATEMENT RELATES, are kept safe and secure.

-

How can airSlate SignNow benefit small businesses in managing documents?

Small businesses can greatly benefit from airSlate SignNow's user-friendly interface and cost-effective pricing. By utilizing our platform to RECORD INFORMATION TO WHICH THIS INFORMATION STATEMENT RELATES, small businesses can increase their operational efficiency and reduce the time spent on paperwork, allowing them to focus on growth.

-

Is support available if I encounter issues with RECORD INFORMATION TO WHICH THIS INFORMATION STATEMENT RELATES?

Absolutely! airSlate SignNow provides dedicated customer support through various channels, including email, phone, and a knowledge base. If you have any questions or need assistance with the process of RECORD INFORMATION TO WHICH THIS INFORMATION STATEMENT RELATES, our support team is here to help.

Get more for RECORD INFORMATION TO WHICH THIS INFORMATION STATEMENT RELATES

- Form 4327

- Reid state technical college nursing application form

- Lesson 6 reteach multiply fractions answer key form

- Small claims court summons 21598098 form

- Community cancer program annual report lawrence general lawrencegeneral form

- Form or 706 ext application for extension of time to file

- Dog adoption agreement template form

- Dog sitting agreement template form

Find out other RECORD INFORMATION TO WHICH THIS INFORMATION STATEMENT RELATES

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP

- eSign Missouri Legal Living Will Computer

- eSign Connecticut Non-Profit Job Description Template Now

- eSign Montana Legal Bill Of Lading Free

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template