THIS MEANS IF a LIEN is FILED YOUR PROPERTY COULD BE Form

What is the THIS MEANS IF A LIEN IS FILED YOUR PROPERTY COULD BE

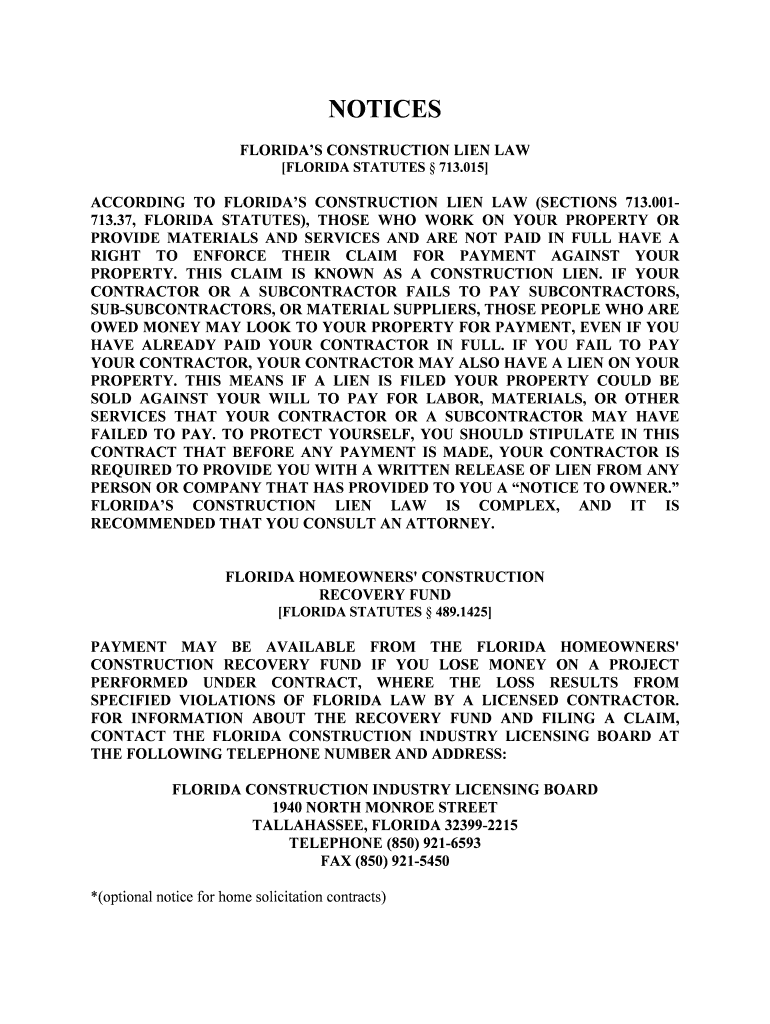

The phrase "this means if a lien is filed your property could be" refers to the potential consequences of a lien being placed on a property. A lien is a legal claim against a property, often used by creditors to secure payment for debts. When a lien is filed, it indicates that the property owner has an outstanding obligation, which could affect their ability to sell or refinance the property. Understanding this concept is crucial for property owners, as it can impact their financial stability and property rights.

How to use the THIS MEANS IF A LIEN IS FILED YOUR PROPERTY COULD BE

Using the "this means if a lien is filed your property could be" form involves understanding its implications and the necessary steps to address any liens on your property. Begin by gathering relevant information about the lien, including the creditor's details and the amount owed. Next, complete the form accurately, ensuring all required fields are filled out. Once completed, submit the form to the appropriate authorities or creditors, depending on the nature of the lien. This process helps clarify your obligations and can facilitate negotiations to resolve the lien.

Steps to complete the THIS MEANS IF A LIEN IS FILED YOUR PROPERTY COULD BE

Completing the "this means if a lien is filed your property could be" form involves several key steps:

- Gather all necessary documentation related to the lien.

- Fill out the form with accurate information, including your personal details and specifics of the lien.

- Review the completed form for any errors or omissions.

- Submit the form to the relevant party, whether it be a court, creditor, or other authority.

- Keep a copy of the submitted form for your records.

Legal use of the THIS MEANS IF A LIEN IS FILED YOUR PROPERTY COULD BE

The legal use of the "this means if a lien is filed your property could be" form is essential for protecting property rights. This form serves as a formal acknowledgment of the lien and outlines the obligations of the property owner. It is crucial to ensure that the form complies with local laws and regulations to avoid any legal complications. Proper use of this form can help in negotiating with creditors and may provide a pathway to resolving the lien effectively.

Key elements of the THIS MEANS IF A LIEN IS FILED YOUR PROPERTY COULD BE

Key elements of the "this means if a lien is filed your property could be" form include:

- The identification of the property owner and the property in question.

- Details of the lien, including the creditor's name and the amount owed.

- Signatures of the involved parties, indicating acknowledgment of the lien.

- Any relevant dates, such as the date the lien was filed and the deadline for resolution.

State-specific rules for the THIS MEANS IF A LIEN IS FILED YOUR PROPERTY COULD BE

State-specific rules regarding the "this means if a lien is filed your property could be" form can vary significantly. Each state has its own laws governing liens, including how they are filed, enforced, and resolved. It is important for property owners to familiarize themselves with their state's regulations to ensure compliance. Consulting with a legal professional can provide guidance tailored to individual circumstances and help navigate any complexities.

Quick guide on how to complete this means if a lien is filed your property could be

Effortlessly Prepare THIS MEANS IF A LIEN IS FILED YOUR PROPERTY COULD BE on Any Device

The use of online document management has surged among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly without any obstacles. Manage THIS MEANS IF A LIEN IS FILED YOUR PROPERTY COULD BE on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign THIS MEANS IF A LIEN IS FILED YOUR PROPERTY COULD BE with minimal effort

- Obtain THIS MEANS IF A LIEN IS FILED YOUR PROPERTY COULD BE and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize key sections of your documents or conceal sensitive information with specialized tools that airSlate SignNow provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to store your changes.

- Choose how you wish to send your form, whether by email, SMS, or shareable link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes requiring new document prints. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Adjust and eSign THIS MEANS IF A LIEN IS FILED YOUR PROPERTY COULD BE and maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does it mean if a lien is filed against my property?

If a lien is filed against your property, it signifies that a creditor has a legal right to your property until you settle a debt. This means if a lien is filed your property could be claimed to satisfy the owed amount, which can complicate any future sale or refinancing.

-

How does airSlate SignNow protect my documents concerning liens?

airSlate SignNow utilizes advanced encryption technology to ensure that your documents are secure from unauthorized access. By using our platform, you can rest easy knowing that if a lien is filed against your property, your important documents remain protected and easily accessible for legal purposes.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore all features without any commitment. This means if a lien is filed your property could be documented quickly and securely, ensuring your transactions are recorded under the best conditions.

-

Can I integrate airSlate SignNow with my existing software?

Absolutely! airSlate SignNow offers seamless integrations with various software solutions including CRM systems and project management tools. This means if a lien is filed your property could be managed efficiently alongside your other business processes.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides flexible pricing plans to accommodate businesses of all sizes. This means if a lien is filed your property could be addressed with affordable document management solutions tailored to your needs.

-

What benefits does airSlate SignNow offer regarding lien documentation?

With airSlate SignNow, you can automate the signing process, track documents, and ensure compliance, which greatly simplifies lien documentation. This means if a lien is filed your property could be effectively managed and protected through our platform's reliable features.

-

How easy is it to send documents for eSignature using airSlate SignNow?

Sending documents for eSignature is incredibly simple with airSlate SignNow. You can upload files, add signers, and send them out for signature in just a few clicks. This means if a lien is filed your property could be signed off efficiently, maintaining all necessary legal processes.

Get more for THIS MEANS IF A LIEN IS FILED YOUR PROPERTY COULD BE

- Chset 57782 form

- Chapter 23 test form a

- Warranty deed from llc to individual form

- 15627la mony equity master vul surrenderloan momentum seriestops telephone operated program support election form

- Dermapal for home phototherapy dosing manual form

- Pima county development services minor lands division application form

- Cse 1016a waiver of paternity affidavit englishspanish waiver of paternity affidavit englishspanish form

- Ddd 0191a incident report form

Find out other THIS MEANS IF A LIEN IS FILED YOUR PROPERTY COULD BE

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form