Other Accounts Form

What is the Other Accounts

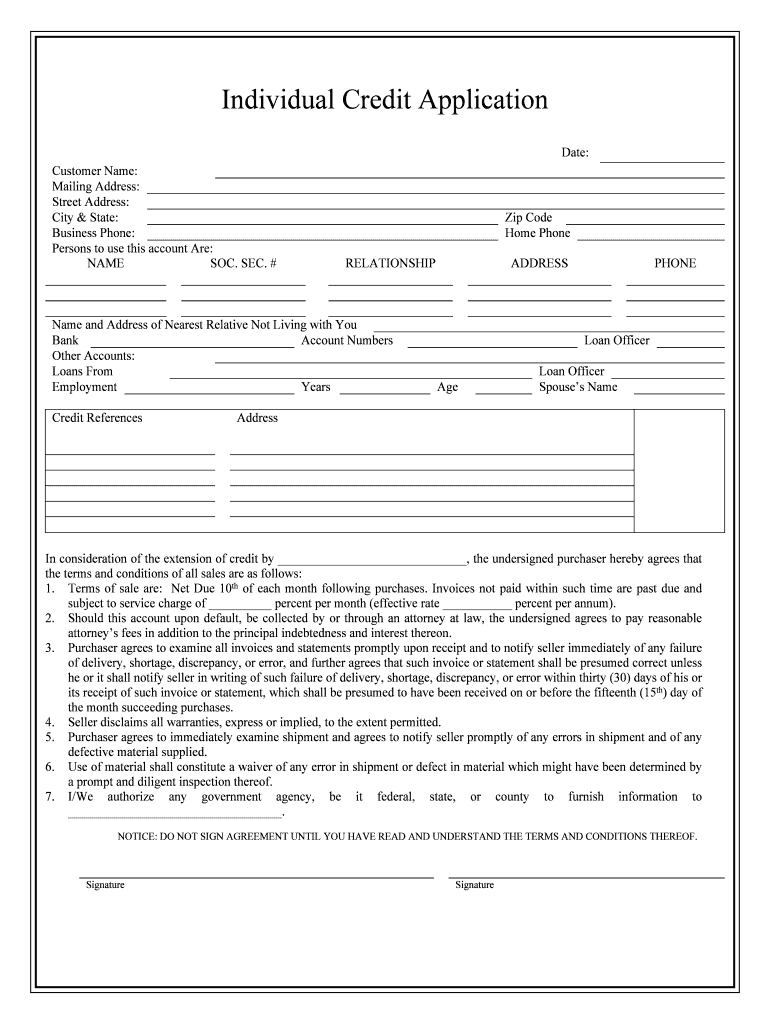

The Other Accounts form is a crucial document used by individuals and businesses to report various types of income or financial activity that do not fit into standard categories. This form allows for the inclusion of income from multiple sources, ensuring that all financial obligations are met in accordance with U.S. tax laws. It is particularly relevant for self-employed individuals, freelancers, and those with diverse income streams, as it provides a comprehensive overview of their financial situation.

How to use the Other Accounts

Using the Other Accounts form involves several key steps to ensure accurate reporting. First, gather all relevant financial documents, including income statements, receipts, and any other supporting materials. Next, fill out the form by detailing each income source, ensuring that all amounts are accurately reported. It is essential to review the completed form for any errors before submission. This form can be submitted electronically or via mail, depending on individual preferences and requirements.

Steps to complete the Other Accounts

Completing the Other Accounts form requires careful attention to detail. Follow these steps:

- Collect all necessary financial documentation related to your income sources.

- Begin filling out the form by entering your personal information at the top.

- List each income source, providing the amount earned and any relevant details.

- Double-check all entries for accuracy and completeness.

- Sign and date the form to validate it.

- Submit the form according to your preferred method, whether online or by mail.

Legal use of the Other Accounts

The Other Accounts form must be completed in compliance with U.S. tax regulations to ensure its legal validity. This includes adhering to guidelines set forth by the IRS regarding income reporting. Using a reliable eSignature platform, like signNow, can enhance the legal standing of your completed form. It is important to note that all signatures must be authentic and verifiable to meet legal standards.

Required Documents

To accurately complete the Other Accounts form, certain documents are required. These may include:

- Income statements from various sources.

- Receipts for expenses related to the reported income.

- Bank statements reflecting deposits from different accounts.

- Any relevant tax documents that support your claims.

Having these documents readily available will facilitate a smoother completion process.

Examples of using the Other Accounts

There are numerous scenarios where the Other Accounts form is applicable. For instance:

- A freelancer who receives payments from multiple clients can use this form to report all income.

- Individuals with rental properties can list income from various tenants.

- Self-employed individuals may report earnings from side gigs or consulting work.

These examples illustrate the form's versatility in capturing diverse financial activities.

Quick guide on how to complete other accounts

Effortlessly Prepare Other Accounts on Any Device

Online document management has gained traction among businesses and individuals. It offers a superb environmentally friendly alternative to conventional printed and signed paperwork, as you can easily find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, adjust, and electronically sign your documents quickly without delays. Handle Other Accounts on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Other Accounts with ease

- Locate Other Accounts and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Other Accounts and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Other Accounts in airSlate SignNow?

Other Accounts in airSlate SignNow refer to the user accounts that can be connected or integrated within the platform. This feature allows you to manage multiple accounts seamlessly, improving efficiency in document management and eSigning processes.

-

How can I integrate Other Accounts with airSlate SignNow?

Integrating Other Accounts with airSlate SignNow is straightforward. You can connect your existing accounts via the settings menu, where you'll find options for linking other platforms. This integration enhances collaboration and streamlines your workflow.

-

Are there any additional costs for using Other Accounts?

Using Other Accounts in airSlate SignNow does not incur extra fees beyond your standard subscription. Our pricing is designed to be cost-effective, providing comprehensive features that include multi-account management without any hidden charges.

-

What are the main benefits of using Other Accounts in airSlate SignNow?

The main benefits of using Other Accounts include improved collaboration through easy access to multiple accounts and enhanced workflow efficiency. With airSlate SignNow, you can manage all your documents and eSignatures in one place, saving you time and resources.

-

Can I switch between Other Accounts easily?

Yes, switching between Other Accounts in airSlate SignNow is quick and user-friendly. Our platform allows you to toggle between accounts effortlessly, enabling you to handle different projects or clients without any hassle.

-

Is there support available for managing Other Accounts?

Absolutely! airSlate SignNow offers comprehensive support for managing Other Accounts. Our help center includes tutorials and guides, and our customer service team is available to assist you with any queries related to your account management.

-

What features are available for Other Accounts in airSlate SignNow?

Other Accounts in airSlate SignNow come equipped with a variety of features including customizable templates, audit trails, and real-time collaboration. These features are designed to enhance the eSigning experience while ensuring compliance and security.

Get more for Other Accounts

Find out other Other Accounts

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template

- eSignature California Renter's contract Safe

- eSignature Florida Renter's contract Myself

- eSignature Florida Renter's contract Free

- eSignature Florida Renter's contract Fast

- eSignature Vermont Real estate sales contract template Later

- Can I eSignature Texas New hire forms

- How Can I eSignature California New hire packet

- How To eSignature South Carolina Real estate document

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later