Notice to the EmployerGarnishee Form

What is the Notice To The EmployerGarnishee

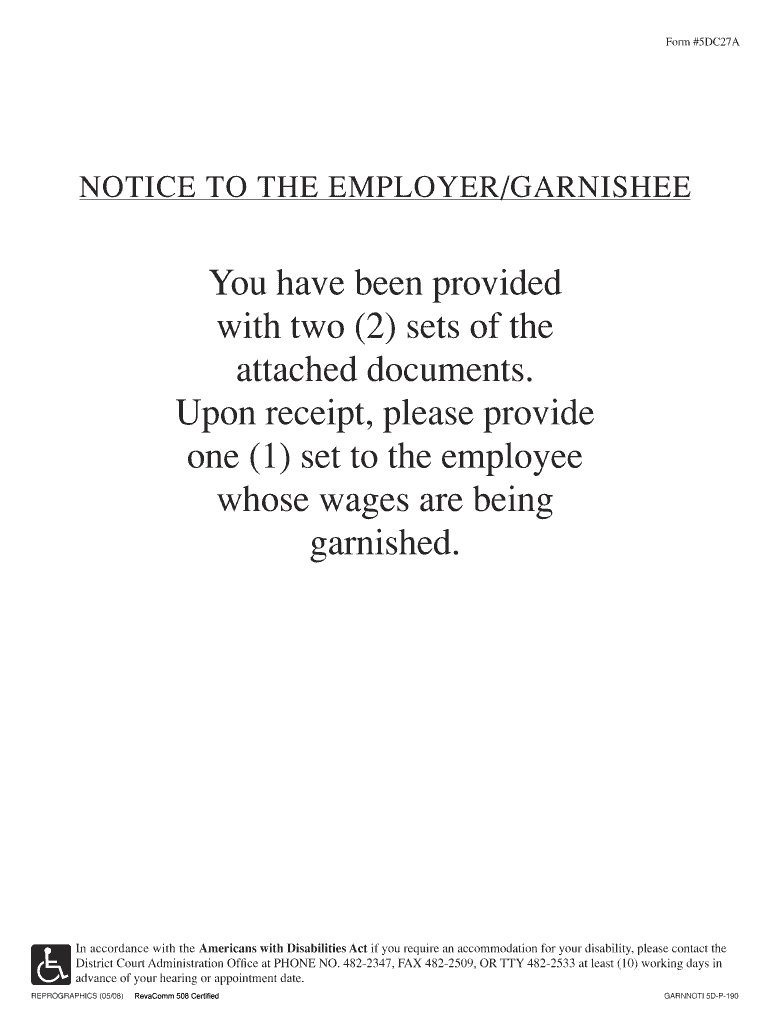

The Notice To The EmployerGarnishee is a legal document used to inform an employer about a garnishment order. This order typically arises from a court judgment or debt obligation where a portion of an employee's wages is withheld to satisfy a debt. The notice serves as an official communication that mandates the employer to deduct a specified amount from the employee's paycheck and remit it to the creditor or court. Understanding this document is crucial for both employers and employees to ensure compliance with legal requirements and protect the rights of all parties involved.

How to use the Notice To The EmployerGarnishee

Using the Notice To The EmployerGarnishee involves several key steps. First, the creditor or their legal representative must complete the notice by filling in the necessary details, including the employee's information, the amount to be garnished, and any relevant court information. Once completed, the notice must be served to the employer, who is then responsible for adhering to the garnishment order. Employers should review the notice carefully to ensure compliance with state laws regarding wage garnishment, including limits on the amount that can be withheld.

Steps to complete the Notice To The EmployerGarnishee

Completing the Notice To The EmployerGarnishee requires careful attention to detail. Follow these steps:

- Gather necessary information about the employee, including their full name, address, and Social Security number.

- Identify the amount to be garnished based on the court order or debt agreement.

- Fill out the notice form accurately, ensuring all required fields are completed.

- Attach any supporting documentation, such as the court order or judgment.

- Sign and date the notice to validate it before submission.

Legal use of the Notice To The EmployerGarnishee

The legal use of the Notice To The EmployerGarnishee is governed by state and federal laws. It is essential that the notice complies with the Fair Debt Collection Practices Act (FDCPA) and any applicable state statutes. Employers must ensure they do not violate employee rights during the garnishment process. This includes adhering to limits on the amount that can be garnished and providing employees with proper notification regarding the garnishment. Failure to comply with these legal requirements can result in penalties for the employer.

Key elements of the Notice To The EmployerGarnishee

Several key elements must be included in the Notice To The EmployerGarnishee for it to be considered valid:

- The employee's full name and contact information.

- The creditor's name and contact information.

- The amount to be garnished from the employee's wages.

- The legal basis for the garnishment, including any relevant court case numbers.

- Instructions for the employer on how to process the garnishment.

State-specific rules for the Notice To The EmployerGarnishee

State-specific rules regarding the Notice To The EmployerGarnishee can vary significantly. Each state has its own regulations concerning wage garnishment, including the maximum percentage of wages that can be garnished and the procedures for serving the notice. Employers should familiarize themselves with their state’s laws to ensure compliance and avoid legal repercussions. It is advisable to consult legal counsel or state resources to understand the specific requirements applicable in their jurisdiction.

Quick guide on how to complete notice to the employergarnishee

Complete Notice To The EmployerGarnishee effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without delays. Manage Notice To The EmployerGarnishee on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric task today.

The simplest way to modify and electronically sign Notice To The EmployerGarnishee easily

- Locate Notice To The EmployerGarnishee and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your edits.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Notice To The EmployerGarnishee and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Notice To The EmployerGarnishee, and why is it important?

A Notice To The EmployerGarnishee is a legal document that informs an employer of wage garnishments ordered by a court. It is crucial for ensuring compliance with court orders and protecting the rights of both employers and employees. Utilizing airSlate SignNow simplifies the process of sending and managing these notices efficiently.

-

How does airSlate SignNow help in creating a Notice To The EmployerGarnishee?

airSlate SignNow offers a user-friendly interface that allows you to quickly create a Notice To The EmployerGarnishee. With customizable templates and an easy drag-and-drop feature, you can tailor the notice to meet your specific requirements. This streamlines your documentation process signNowly.

-

What features does airSlate SignNow provide for handling Notice To The EmployerGarnishee?

airSlate SignNow provides features such as eSignature capabilities, document tracking, and secure storage, which are essential for managing Notice To The EmployerGarnishee efficiently. You can also integrate workflows that automate the approval and signing processes, making it easier for your team to stay organized.

-

Is airSlate SignNow a cost-effective solution for sending Notice To The EmployerGarnishee?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing legal documents like the Notice To The EmployerGarnishee. With affordable pricing plans and no hidden fees, businesses can save money while ensuring compliance and efficiency in their document workflows.

-

Can I integrate airSlate SignNow with other software to manage Notice To The EmployerGarnishee?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, enhancing your document management capabilities. By integrating with tools like CRM systems, HR software, and more, you can ensure that your Notice To The EmployerGarnishee workflow is both streamlined and efficient.

-

What are the benefits of using airSlate SignNow for legal documents like Notice To The EmployerGarnishee?

Using airSlate SignNow for legal documents such as the Notice To The EmployerGarnishee offers numerous benefits, including improved accuracy, faster processing times, and enhanced security. The digital signature feature ensures that your documents are legally binding and securely stored, allowing for easy access whenever needed.

-

How can I ensure the security of my Notice To The EmployerGarnishee with airSlate SignNow?

airSlate SignNow prioritizes the security of your documents, including the Notice To The EmployerGarnishee, through advanced encryption and secure data storage. User access controls and audit trails provide added layers of security, ensuring that your sensitive information remains protected throughout the document lifecycle.

Get more for Notice To The EmployerGarnishee

- Numerical index of approved probate court forms michigan

- Death registration form

- Meldungsblatt fr den bezirksweinbaukataster apps bgld gv form

- Mandatory overtime for nurses complaint form nys

- Tax exempt bonds a description of state and local form

- Supply vendor agreement template form

- Supply for goods agreement template form

- Supply and installation agreement template form

Find out other Notice To The EmployerGarnishee

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free