Hawaii Fixed Rate Note, Installment Payments Secured by Personal Property Form

What is the Hawaii Fixed Rate Note, Installment Payments Secured By Personal Property

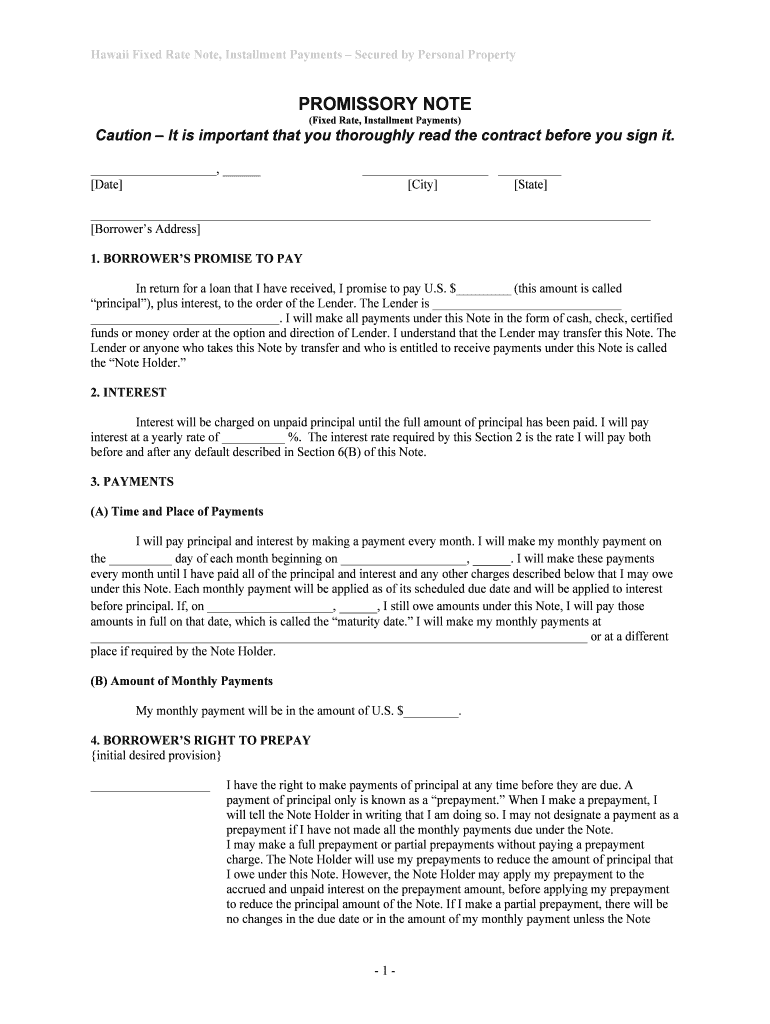

The Hawaii Fixed Rate Note, Installment Payments Secured By Personal Property is a legal document that outlines a borrower's promise to repay a loan at a fixed interest rate over a specified period. This note is secured by personal property, meaning that the borrower pledges specific assets as collateral. If the borrower defaults, the lender has the right to claim these assets. This type of note is commonly used in personal loans, auto loans, and other financing arrangements where collateral is required to mitigate risk for the lender.

Key Elements of the Hawaii Fixed Rate Note, Installment Payments Secured By Personal Property

Several key elements define the Hawaii Fixed Rate Note, Installment Payments Secured By Personal Property, making it a comprehensive financial instrument. These elements include:

- Principal Amount: The total amount borrowed by the borrower.

- Interest Rate: The fixed rate at which interest will accrue on the principal amount.

- Payment Schedule: A detailed outline of installment payment amounts and due dates.

- Collateral Description: Specific details about the personal property securing the loan.

- Default Terms: Conditions under which the lender can take possession of the collateral in case of default.

Steps to Complete the Hawaii Fixed Rate Note, Installment Payments Secured By Personal Property

Completing the Hawaii Fixed Rate Note involves several important steps to ensure accuracy and legality. Follow these steps:

- Gather Information: Collect all necessary details, including borrower and lender information, loan amount, interest rate, and collateral description.

- Fill Out the Form: Accurately complete the form, ensuring all sections are filled out correctly.

- Review Terms: Carefully review the terms of the note, including payment schedule and default conditions.

- Sign the Document: Both parties must sign the document, either in person or electronically, depending on the method used.

- Store the Document: Keep a copy of the signed note for your records and provide a copy to the lender.

Legal Use of the Hawaii Fixed Rate Note, Installment Payments Secured By Personal Property

The legal use of the Hawaii Fixed Rate Note is governed by state laws and regulations. It serves as a binding contract between the borrower and lender, ensuring that both parties understand their rights and obligations. For the note to be enforceable, it must meet specific legal requirements, including proper signatures and adherence to state laws regarding secured transactions. Additionally, compliance with federal regulations related to lending practices is essential to ensure the note's validity.

How to Obtain the Hawaii Fixed Rate Note, Installment Payments Secured By Personal Property

Obtaining the Hawaii Fixed Rate Note can be done through various means. Borrowers can access the form from legal document providers, financial institutions, or online platforms that specialize in legal forms. It is important to ensure that the version obtained is current and complies with Hawaii state laws. Additionally, consulting with a legal professional can provide guidance on the appropriate use and customization of the note to fit specific borrowing needs.

Examples of Using the Hawaii Fixed Rate Note, Installment Payments Secured By Personal Property

There are numerous scenarios in which the Hawaii Fixed Rate Note can be utilized effectively:

- Personal Loans: Individuals may use this note for personal loans where collateral, such as a vehicle, is provided.

- Business Financing: Small businesses can secure loans with equipment or inventory as collateral.

- Real Estate Transactions: While typically associated with real estate mortgages, it can also be adapted for personal property loans related to real estate investments.

Quick guide on how to complete hawaii fixed rate note installment payments secured by personal property

Execute Hawaii Fixed Rate Note, Installment Payments Secured By Personal Property effortlessly on any device

Managing documents online has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely keep it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly without interruptions. Handle Hawaii Fixed Rate Note, Installment Payments Secured By Personal Property on any device using airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to modify and electronically sign Hawaii Fixed Rate Note, Installment Payments Secured By Personal Property effortlessly

- Find Hawaii Fixed Rate Note, Installment Payments Secured By Personal Property and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Choose your preferred method of sending your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious document searches, or mistakes that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your device of choice. Modify and electronically sign Hawaii Fixed Rate Note, Installment Payments Secured By Personal Property and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Hawaii Fixed Rate Note, Installment Payments Secured By Personal Property?

A Hawaii Fixed Rate Note, Installment Payments Secured By Personal Property is a financial instrument that allows borrowers to repay loans through fixed monthly payments over a specified term. This note ensures security by tying the repayment obligation to personal property, making it a reliable option for both lenders and borrowers.

-

How does the Hawaii Fixed Rate Note benefit borrowers?

The Hawaii Fixed Rate Note provides borrowers with predictable monthly payments, allowing for better financial planning. Moreover, the security of personal property can potentially lead to better loan terms and lower interest rates.

-

Are there any upfront costs associated with a Hawaii Fixed Rate Note?

Yes, securing a Hawaii Fixed Rate Note may involve some upfront costs such as appraisal fees, closing costs, and possible legal fees. However, these costs are typically outweighed by the long-term benefits of fixed installment payments secured by personal property.

-

What features should I look for in a Hawaii Fixed Rate Note service?

When selecting a service for a Hawaii Fixed Rate Note, look for features such as easy document eSigning, integration capabilities with your existing systems, and clear communication of terms. A user-friendly platform like airSlate SignNow can streamline your documentation process for Hawaii Fixed Rate Notes.

-

How do I secure a Hawaii Fixed Rate Note?

To secure a Hawaii Fixed Rate Note, you typically need to submit an application with your financial details and the intended collateral. Once approved, the terms of the installment payments will be outlined, and you'll need to sign the necessary agreements.

-

Can I integrate Hawaii Fixed Rate Note services with other tools?

Yes, services offering a Hawaii Fixed Rate Note, like airSlate SignNow, often integrate with various CRM and financial management tools. This integration facilitates smooth data transfer and boosts overall efficiency in managing payments and documents.

-

What are the long-term benefits of a Hawaii Fixed Rate Note?

The long-term benefits of a Hawaii Fixed Rate Note include stable monthly payments, the potential for lower interest rates, and the ability to retain ownership of your personal property while fulfilling your loan obligations. This can lead to better financial stability over time.

Get more for Hawaii Fixed Rate Note, Installment Payments Secured By Personal Property

- E mail ghanacustomerservices stanlib form

- The world of vegetables rabobank form

- Incometaxreturnverificationform

- Medicare part d prescription drug premium ucm mtabsc form

- Truck transportation merit badge pamphlet form

- Land lease proposal letter form

- Declaration of owner occupancy form doc

- Consent to act form nevada

Find out other Hawaii Fixed Rate Note, Installment Payments Secured By Personal Property

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation