St 101 Form

What is the St 101 Form

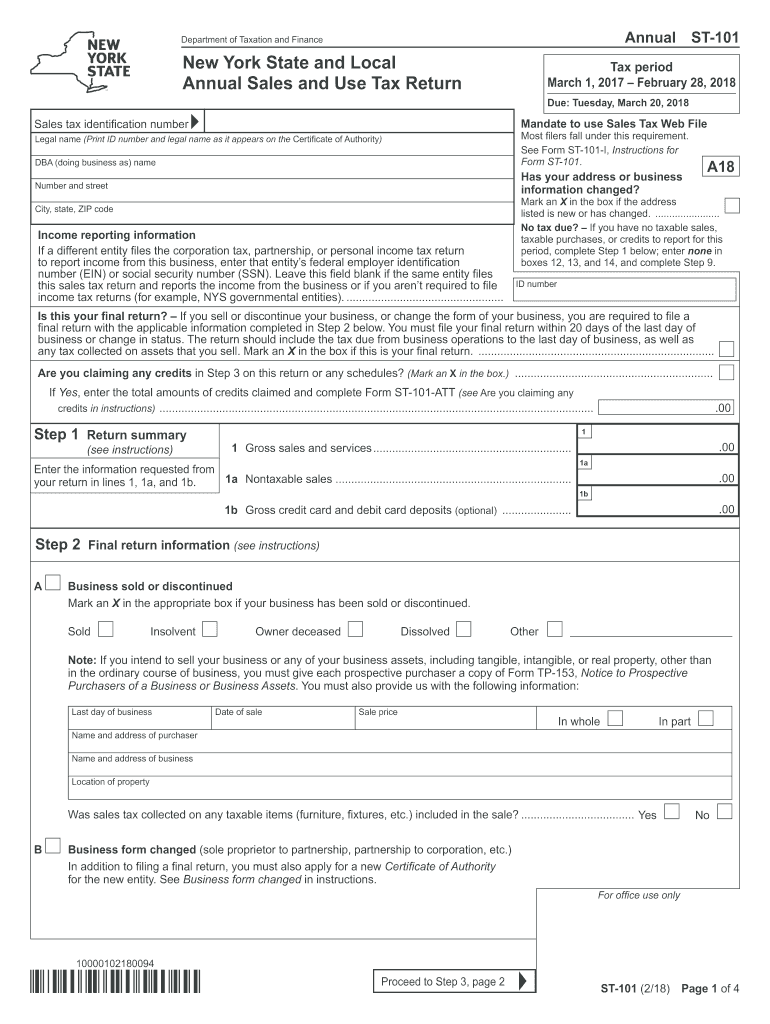

The New York State Annual Sales Tax Form ST-101 is a crucial document for businesses operating within New York. It is used to report sales and use tax collected during the year. The form is essential for ensuring compliance with state tax regulations and helps businesses accurately calculate their tax liabilities. By submitting the ST-101, businesses provide the New York State Department of Taxation and Finance with necessary information regarding their sales activities, which is vital for maintaining proper tax records.

How to use the St 101 Form

To effectively use the New York State Annual Sales Tax Form ST-101, businesses must first gather all relevant sales data for the reporting period. This includes total sales, exempt sales, and any sales tax collected. The form requires detailed entries that reflect these figures accurately. After completing the form, businesses must ensure that it is signed and dated before submission. Utilizing electronic signature solutions can streamline this process, making it easier to manage and submit the form securely.

Steps to complete the St 101 Form

Completing the New York State Annual Sales Tax Form ST-101 involves several key steps:

- Gather all sales records, including receipts and invoices, for the reporting period.

- Calculate total sales and any exempt sales to determine the taxable amount.

- Fill out the form with accurate figures, ensuring all required fields are completed.

- Review the form for any errors or omissions before finalizing it.

- Sign and date the form, confirming its accuracy.

- Submit the completed form either electronically or by mail, adhering to the specified deadlines.

Legal use of the St 101 Form

The New York State Annual Sales Tax Form ST-101 is legally binding when completed and submitted in accordance with state regulations. To ensure its legal validity, businesses must adhere to the guidelines set forth by the New York State Department of Taxation and Finance. This includes using the form for its intended purpose, providing accurate information, and maintaining compliance with all relevant tax laws. Electronic submissions are acceptable, provided that the eSignature meets legal standards.

Filing Deadlines / Important Dates

It is essential for businesses to be aware of filing deadlines associated with the New York State Annual Sales Tax Form ST-101. Typically, the form is due annually, with specific dates varying based on the business's fiscal year. Businesses should consult the New York State Department of Taxation and Finance for the most current deadlines to avoid penalties. Timely submission is crucial for maintaining compliance and preventing any potential legal issues.

Required Documents

When completing the New York State Annual Sales Tax Form ST-101, businesses should have several documents on hand. These include:

- Sales records, including invoices and receipts.

- Documentation for any exempt sales.

- Previous tax returns, if applicable.

- Any additional records that support the figures reported on the form.

Having these documents readily available will facilitate accurate completion of the form and support compliance with tax regulations.

Quick guide on how to complete st 101 formpdffillercom

Easily Prepare St 101 Form on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed materials, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents swiftly and without delays. Manage St 101 Form on any device using the airSlate SignNow Android or iOS applications and enhance your document-related processes today.

The Easiest Way to Edit and eSign St 101 Form Effortlessly

- Find St 101 Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to submit your form: via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign St 101 Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do you find out if a company is open to using a staffing agency to fill positions?

Get an introduction to the target company through a referral if possible. A lot of the companies that retain us even talk explicitly about "no agency referrals" on their website. There are times that going in through HR or their staffing org can be to your benefit but more often that not it helps to have a referral with a "VP" in their title to get you that introduction. You might still be a long way from getting a fee agreement signed (retained or contingent) but you'll be a lot close than being one of the hundreds of agency recruiters leaving voicemails for the VP HR or Staffing Manager.

-

How does one get invited to the Quora Partner Program? What criteria do they use, or is it completely random?

I live in Germany. I got an invite to the Quora partner program the day I landed in USA for a business trip. So from what I understand, irrespective of the number of views on your answers, there is some additional eligibility criteria for you to even get an email invite.If you read the terms of service, point 1 states:Eligibility. You must be located in the United States to participate in this Program. If you are a Quora employee, you are eligible to participate and earn up to a maximum of $200 USD a month. You also agree to be bound by the Platform Terms (https://www.quora.com/about/tos) as a condition of participation.Again, if you check the FAQ section:How can other people I know .participate?The program is invite-only at this time, but we intend to open it up to more people as time goes on.So my guess is that Quora is currently targeting people based out of USA, who are active on Quora, may or may not be answering questions frequently ( I have not answered questions frequently in the past year or so) and have a certain number of consistent answer views.Edit 1: Thanks to @Anita Scotch, I got to know that the Quora partner program is now available for other countries too. Copying Anuta’s comment here:If you reside in one of the Countries, The Quora Partner Program is active in, you are eligible to participate in the program.” ( I read more will be added, at some point, but here are the countries, currently eligible at this writing,) U.S., Japan, Germany, Spain, France, United Kingdom, Italy and Australia.11/14/2018Edit 2 : Here is the latest list of countries with 3 new additions eligible for the Quora Partner program:U.S., Japan, Germany, Spain, France, United Kingdom, Italy, Canada, Australia, Indonesia, India and Brazil.Thanks to Monoswita Rez for informing me about this update.

-

How can I get more people to fill out my survey?

Make it compellingQuickly and clearly make these points:Who you are and why you are doing thisHow long it takesWhats in it for me -- why should someone help you by completing the surveyExample: "Please spend 3 minutes helping me make it easier to learn Mathematics. Answer 8 short questions for my eternal gratitude and (optional) credit on my research findings. Thank you SO MUCH for helping."Make it convenientKeep it shortShow up at the right place and time -- when people have the time and inclination to help. For example, when students are planning their schedules. Reward participationOffer gift cards, eBooks, study tips, or some other incentive for helping.Test and refineTest out different offers and even different question wording and ordering to learn which has the best response rate, then send more invitations to the offer with the highest response rate.Reward referralsIf offering a reward, increase it for referrals. Include a custom invite link that tracks referrals.

-

How can I add my business location on instagram"s suggested locations?

Making a custom location on Instagram is actually quite easy and gives you an advantage to other businesses because it allows you to drive traffic via location.First off, Facebook owns Instagram; therefore, any location listed on Facebook also appears on Instagram. So you are going to need to create a business location on Facebook.So let’s dive into how to create a business location on Instagram.Make sure that you have enabled location services through the Facebook App or in your phone settings. If you are using an iPhone, select “Settings” → “Account Settings” → “Location” → “While Using The App”You need to create a Facebook check-in status. You do this by making a status and type the name of what you want your location to be called. For example “Growth Hustlers HQ”. Scroll to the bottom of the options and select “Add Custom Location” then tap on it!Now that you’ve created a custom location you need to describe it. It will ask you to choose which category describes your location, which you will answer “Business”.After choosing a category Facebook will ask you to choose a location. You can either choose “I’m currently here” or you can search for a location that you want to create for your business.Finally, publish your status. Congratulations! You have just created a custom location to be used on Facebook and Instagram.Now you are able to tag your business or a custom location on Instagram.If you have any questions about Social Media Marketing for businesses feel free to check out GrowthHustlers.com where you can find tons of resources about growing your Instagram following.

Create this form in 5 minutes!

How to create an eSignature for the st 101 formpdffillercom

How to make an electronic signature for your St 101 Formpdffillercom in the online mode

How to generate an electronic signature for your St 101 Formpdffillercom in Chrome

How to generate an electronic signature for signing the St 101 Formpdffillercom in Gmail

How to create an eSignature for the St 101 Formpdffillercom straight from your smartphone

How to make an eSignature for the St 101 Formpdffillercom on iOS

How to make an eSignature for the St 101 Formpdffillercom on Android

People also ask

-

What is the ST 101 Form and why is it important?

The ST 101 Form is a crucial document used for sales tax exemption in various states. It allows eligible organizations to purchase goods and services without paying sales tax. Understanding how to properly fill out and submit the ST 101 Form can save businesses signNow money on purchases.

-

How can airSlate SignNow help with the ST 101 Form?

airSlate SignNow streamlines the process of completing and eSigning the ST 101 Form. With our intuitive platform, users can quickly fill out the form, add necessary signatures, and send it to the relevant parties without hassle. This simplifies compliance and speeds up the purchasing process.

-

Is there a cost associated with using airSlate SignNow for the ST 101 Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective, ensuring that you can manage the ST 101 Form and other documents without breaking the bank. You can choose a plan that works best for your organization.

-

Can I integrate airSlate SignNow with other software to manage the ST 101 Form?

Absolutely! airSlate SignNow offers integrations with various software solutions, making it easier to manage your ST 101 Form alongside other business processes. Popular integrations include CRM systems, document management software, and cloud storage services, enhancing workflow efficiency.

-

What features does airSlate SignNow offer for managing the ST 101 Form?

airSlate SignNow provides a variety of features for managing the ST 101 Form, including customizable templates, secure eSigning, and real-time tracking. These features ensure that your documents are completed accurately and efficiently, meeting all necessary compliance requirements.

-

How secure is the information I submit on the ST 101 Form through airSlate SignNow?

The security of your information is a top priority at airSlate SignNow. When submitting the ST 101 Form, your data is protected with bank-level encryption and secure cloud storage. This ensures that sensitive information remains confidential and safe from unauthorized access.

-

What types of businesses can benefit from using the ST 101 Form with airSlate SignNow?

Any business that qualifies for sales tax exemption can benefit from using the ST 101 Form with airSlate SignNow. This includes non-profit organizations, educational institutions, and certain government entities. Our platform makes it easy for these organizations to manage their tax-exempt purchases effectively.

Get more for St 101 Form

Find out other St 101 Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors