Loan Form 2004-2026

What is the Loan Form

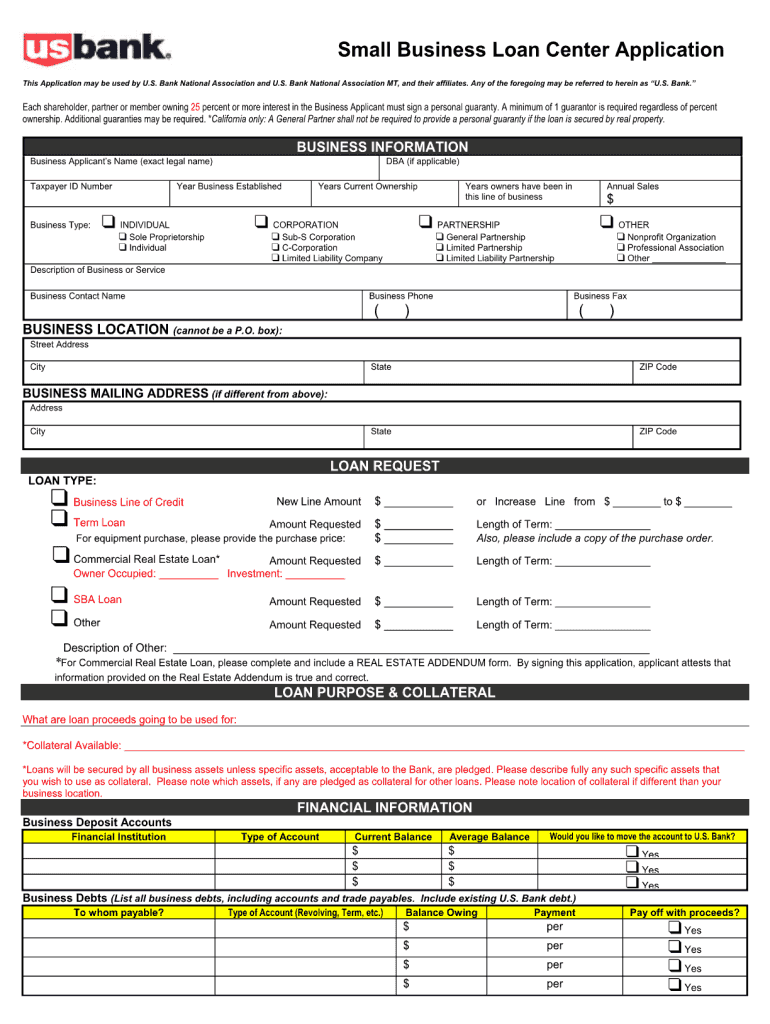

The SBA Form 2483 C is a crucial document for small business owners seeking financial assistance through the Paycheck Protection Program (PPP). This form is specifically designed for businesses that have already received a PPP loan and are applying for loan forgiveness. It helps the Small Business Administration (SBA) assess whether the funds were used appropriately according to the program's guidelines. Understanding the purpose and requirements of this form is essential for ensuring compliance and maximizing the potential for loan forgiveness.

How to use the Loan Form

Using the SBA Form 2483 C involves several steps to ensure that all required information is accurately provided. First, gather all necessary documentation, including payroll records, receipts, and any other relevant financial statements. Next, fill out the form with precise details about your business, the loan amount, and how the funds were utilized. It is important to provide supporting documentation to validate your claims. Once completed, the form can be submitted electronically or by mail, depending on your preference and the submission guidelines provided by the SBA.

Steps to complete the Loan Form

Completing the SBA Form 2483 C requires careful attention to detail. Follow these steps for a successful submission:

- Review eligibility criteria: Ensure your business qualifies for loan forgiveness under the PPP guidelines.

- Gather necessary documents: Collect payroll records, tax filings, and any other financial documents that demonstrate how the loan was used.

- Fill out the form: Provide accurate information about your business, the loan amount, and the expenses covered by the loan.

- Attach supporting documents: Include all required documentation to substantiate your claims for loan forgiveness.

- Submit the form: Choose your preferred submission method, either electronically or by mail, and ensure it is sent to the correct address.

Key elements of the Loan Form

The SBA Form 2483 C includes several key elements that must be addressed for a complete application. These elements typically consist of:

- Business information: Name, address, and contact details of the business applying for the loan.

- Loan details: The amount of the PPP loan and the date it was received.

- Use of funds: A detailed breakdown of how the loan proceeds were utilized, including payroll, rent, and utilities.

- Signature and certification: An affirmation that the information provided is accurate and that the funds were used according to the PPP guidelines.

Eligibility Criteria

To qualify for loan forgiveness using the SBA Form 2483 C, businesses must meet specific eligibility criteria. These criteria typically include:

- Business size: The business must meet the SBA’s size standards, generally defined as having fewer than five hundred employees.

- Loan usage: Funds must be used for eligible expenses, such as payroll, rent, and utilities, within the specified time frame.

- Documentation: Businesses must provide adequate documentation to support their claims for loan forgiveness.

Form Submission Methods

The SBA Form 2483 C can be submitted through various methods, allowing flexibility for businesses. The primary submission methods include:

- Online submission: Many businesses prefer to submit the form electronically through the SBA’s online portal, which can streamline the process.

- Mail submission: Alternatively, businesses can print the completed form and send it via postal mail to the designated SBA address.

- In-person submission: Some businesses may choose to deliver the form in person to their local SBA office, ensuring it is received directly.

Quick guide on how to complete u s loan form

The simplest method to locate and endorse Loan Form

On the scale of an entire organization, ineffective workflows surrounding document authorization can consume a signNow amount of work hours. Endorsing documents like Loan Form is a standard aspect of operations across all sectors, which is why the productivity of every agreement’s lifecycle has a substantial impact on the organization’s overall effectiveness. With airSlate SignNow, endorsing your Loan Form is as effortless and rapid as it can be. This platform provides you with the latest version of virtually any form. Even better, you can endorse it on the spot without needing to install any external software on your computer or printing anything as hard copies.

How to obtain and endorse your Loan Form

- Browse our collection by category or utilize the search bar to find the form you require.

- Check the form preview by clicking Learn more to confirm it’s the correct one.

- Hit Get form to begin editing immediately.

- Fill out your form and include any necessary information using the toolbar.

- Once completed, click the Sign tool to endorse your Loan Form.

- Select the signature method that is most suitable for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finish editing and move on to document-sharing options as needed.

With airSlate SignNow, you possess everything you need to manage your documentation efficiently. You can find, complete, edit, and even transmit your Loan Form within a single tab without any hassle. Enhance your workflows with one intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I reply to a U/S 143(1) notice from the Income Tax Department?

Under Section 143(1) the tax department completes the assessment without calling you to the department. Based on the return filed by you, the department checksThe arithmetical errors in the return orAny incorrect claim or deductions made.Incorrect brought forward Loss claimedMismatch of dis allowance of expenditure mentioned in audit report and income tax returnIncome appearing form 26AS, but not considering in return.[However, before making any such adjustments, an intimation of proposed adjustment u/s 143(1)(a) of Income Tax Act, 1961 shall be given to the assessee either in writing or through electronic mode requiring him to respond to such adjustments.The intimation u/s 143(1) will have two column, (a) the tax determined as per the return filed by you (b) the tax determined by the department after making any changes.Done by the computer –All intimations u/s 143(1) is processed by the computer without any human interface. The software is designed to detect arithmetical inaccuracies and inconsistencies in the return and such software is placed at Central Processing Centre (CPC)Stay cool –So, don’t get upset (and shout at your service provider!) if you get an intimation u/s 143(1) wherein as per the computation of Tax department, you are asked to pay any taxes. Generally, you will find that the Mismatch of taxes payable. We have to correct it by filing rectification.Intimation received under section143(1) of Income Tax ActIf the Intimation u/s 143(1) doesn’t show any difference (or mismatch), keep this document along with a copy of Income tax return filed by you as proof of completion of assessment.What should I do if no intimation is received?The intimation shall be sent within one year from the end of the financial year in which the return is made. (Means for the Financial Year ending March 2014, you will get intimation on or before March 2016). If you haven’t received any intimation within this period, consider ITR– V (acknowledgment) of the return as deemed intimation.What should be done in the case of mismatch?Intimation received under section 143(1) of Income Tax Act showing demand or refundFirst ascertain whether refund due to you computed or arrived as per your claim. If no refund is claimed by you, ensure that “Net Amount Payable” is Zero .If refund claimed by you matched with the income tax return filed by you or net amount payable is zero, no further action is required.You can follow the steps mentioned below if you found discrepancies–Step 1: compare two column, (a) As provided by Tax Payer in Return of Income (b) As computed under section 143(1) and check the difference, find out the reason for the difference.Step 2: File online rectification application u/s 154(1) correcting the mistake appearing in the intimation received u/s 143(1).Step 3: After filing rectification u/s 154(1) login to ePortal of the income tax department and file online response.Step 4: File online grievances if you are not satisfied with processing of your return/rectification return by Central Processing Center (CPC).I would be glad to know your doubts or queries. In case you need our assistance in relation to Intimation under section 143(1) of Income Tax Act 1961 , please feel free to post your query at anuraguppal9@gmail.com.

-

How can I apply for an education loan from SBI online?

Step 1: Go to GyanDhan’s website. Check your loan eligibility here.Step 2: Apply for loan with collateral at GyanDhanStep3: Fill the Complete Application form.Done ! You will get a mail from SBI that they have received your application along with a mail from GyanDhan which will contain the details of the branch manger and the documents required.GyanDhan is in partnership with SBI for education loan abroad. GyanDhan team has technically integrated their systems so that customer can fill the GyanDhan’s form and it automatically get applied to SBI. The idea is to make education loan process so simple via GyanDhan that students don’t have to worry finances when they think of higher education abroad.GyanDhan is a marketplace for an education loan abroad and are in partnership with banks like SBI, BOB, Axis and many more.PS: I work at GyanDhan

-

How do I fill out the application form for an educational loan online?

Depending on which country you are in and what kind of lender you are going for. There are bank loans and licensed money lenders. If you are taking a large amount, banks are recommended. If you are working, need a small amount for your tuition and in need of it fast, you can try a licensed moneylender.

-

How to fill the apple U.S tax form (W8BEN iTunes Connect) for indie developers?

This article was most helpful: Itunes Connect Tax Information

-

When I fill out a loan application form at a bank, how does the bank know if I am lying about my total assets and liabilities?

Your credit report has more than the score, because part of what makes up you score is the amount of liabilities and how they are handled. Liabilities that will show areCar payments and balanceCredit cardsDepartment store cardsStudent loansChild support/alimony Judgements And many more.For assetsBank statementsBrokerage accounts401k statements etc.If an applicant is sufficiently strong (20% down-payment and a few months mortgage payments reserved) then all assets are usually not verified.But as a mortgage broker I've even used a car and boat title to boost an otherwise shaky application.

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

Create this form in 5 minutes!

How to create an eSignature for the u s loan form

How to create an electronic signature for your U S Loan Form online

How to make an eSignature for your U S Loan Form in Google Chrome

How to make an electronic signature for signing the U S Loan Form in Gmail

How to generate an eSignature for the U S Loan Form straight from your mobile device

How to make an eSignature for the U S Loan Form on iOS devices

How to create an eSignature for the U S Loan Form on Android

People also ask

-

What is a Loan Form and how does it work with airSlate SignNow?

A Loan Form is a document used to apply for a loan, detailing the borrower's information and loan requirements. With airSlate SignNow, you can easily create, send, and eSign your Loan Form, streamlining the application process for both lenders and borrowers. Our intuitive platform simplifies document management for efficient loan approvals.

-

How can I create a Loan Form using airSlate SignNow?

Creating a Loan Form with airSlate SignNow is straightforward. Simply use our template library to find a pre-designed Loan Form, customize it to fit your needs, and add eSignature fields for easy signing. This user-friendly process ensures that you can have your Loan Form ready in minutes.

-

What are the benefits of using airSlate SignNow for my Loan Form?

Using airSlate SignNow for your Loan Form offers numerous benefits, including faster processing times, reduced paperwork, and improved accuracy. The platform allows for real-time collaboration, making it easy for all parties to review and sign the Loan Form. Plus, our advanced security features keep your sensitive data safe.

-

Is airSlate SignNow affordable for creating Loan Forms?

Yes, airSlate SignNow offers competitive pricing plans that are designed to be budget-friendly for businesses of all sizes. You can create and manage as many Loan Forms as you need without worrying about high costs. Plus, the time saved in processing your Loan Forms can lead to signNow cost savings.

-

Can I integrate airSlate SignNow with other software for my Loan Form?

Absolutely! airSlate SignNow seamlessly integrates with various CRM and document management systems. Whether you're using Salesforce, Google Drive, or other platforms, integrating your Loan Form process with airSlate SignNow enhances efficiency and keeps your workflow organized.

-

What security measures are in place for my Loan Form documents?

airSlate SignNow prioritizes the security of your Loan Form documents with robust encryption and compliance with industry standards. We ensure that your data is protected during transmission and storage. Additionally, our platform includes features like audit trails and user authentication for added peace of mind.

-

Can I track the status of my Loan Form in airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for your Loan Form. You can easily monitor who has viewed, signed, or completed the document at any time. This feature helps you stay updated on the progress of your Loan Form and ensures timely follow-ups.

Get more for Loan Form

Find out other Loan Form

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed